Pell Grant payouts not keeping up with college costs

The Federal Pell Grant program was established to help make it possible for low-income students who may have not otherwise been able to afford a college education to do so. Unlike loans, the grant does not have to be repaid, which helps reduce the burden for students who receive the grant.

As college costs have risen, the maximum federal Pell Grant has risen as well–but not nearly enough to cover the huge increase, Inside Higher Education reports.

According to a new report from the Education Trust, New America Foundation, and Young Invincibles, the Pell Grant program is failing to keep up in providing low-income students with access to a college education.

Pell grant purchasing power plummets

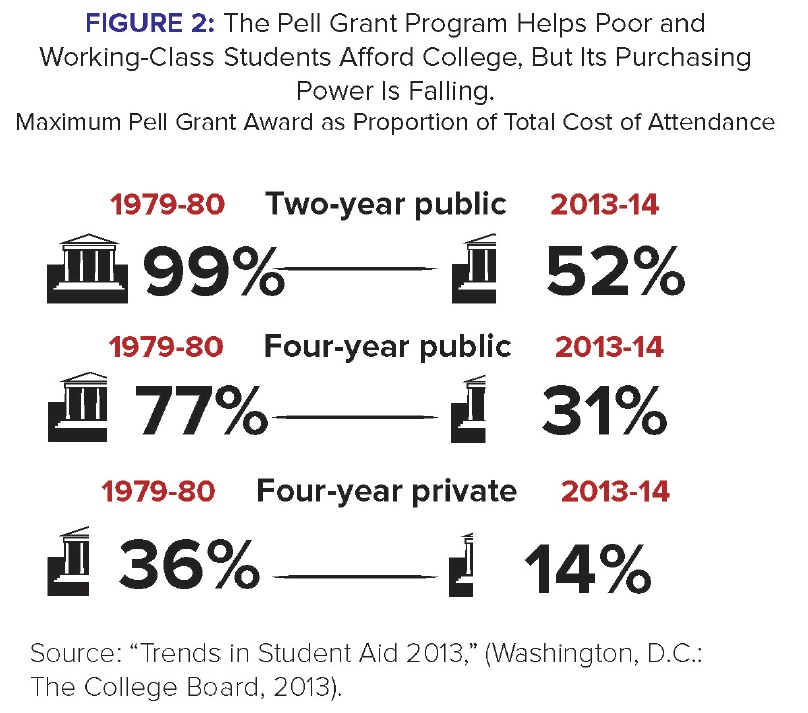

In 1980, the maximum Pell award covered more than three-quarters of what it cost students to attend a four-year public university in the student’s home state. Last year, the maximum grant amount, $5,645, only covered 31% of the cost of the same–a huge decline in just a few decades.

Similarly, two-year community college students used to have almost their entire cost of attendance covered by the grant, but the amount now covers just half.

Over the past three decades, the Pell Grant has covered a decreasing percentage of the overall cost of a college education, forcing students to make up the difference.

Low-income students forced to take on more debt

With grants, scholarships and other sources of free money for college covering a smaller percentage of college costs, low-income students and families are forced to make up the difference–usually by taking out student loans.

It’s no surprise, then, that over that same time period, the percentage of low-income students (and students overall) with student loans, and the amounts borrowed, have increased significantly.

As a way to prevent low-income students from taking on significant debt to pay for college, the report calls on the government to provide an “affordability guarantee” for low-income families that mandates they should not have to pay out of pocket or borrow more than 10 percent of their discretionary income to finance their student’s college education each year.

To make this happen, however, the group says states must be willing to spend more per student on higher education.

Be prudent when borrowing for college

We believe additional steps must be taken to make sure federal and state financial aid is keeping up with the rising cost of education and prevent low-income students from being denied access to an affordable college education.

While no such affordability guarantee exists yet, the 10% rule is a good measure for all families to use when deciding whether they can afford to send their student to an expensive college. Costs must be seriously considered, and both students and parents need to understand the implications and long-term costs of borrowing money for college.

For help figuring out how to pay for college and make a college education affordable for your family, call us toll-free at 1-888-234-3907 or contact us here.

federal financial aid, financial aid, grants, pell grant, scholarships, student loans