Federal student loans are now easier to repay

The government recently dropped some huge news for those with federal student loans.

As of December 16, 2015, all federal student loan borrowers are eligible for an alternative repayment plan called Revised Pay As You Earn (REPAYE), MONEY reports.

Revised Pay As You Earn repayment plan

Here’s what you need to know about the new plan:

- All borrowers with federal student loans will be able to cap their payments at 10% of their disposable income–an option that was previously only available to borrowers who applied for and qualified for an Income-Based Repayment plan.

- The plan will provide more flexible student loan repayment options to more than 6 million Americans–and applies to borrowers with older student loans as well.

- All borrowers who took out federal student loans for undergraduate or graduate study will be eligible for REPAYE. Unfortunately, it is not open to parents who have taken out federal parent Plus loans and does not apply to private student loans.

- Borrowers who sign up for REPAYE and work in a government or nonprofit job for 10 years (and make 120 on-time payments) can have the rest of their loan forgiven. All other borrowers who took out loans for undergraduate study can have their loans forgiven after 20 years of payments, and those paying graduate school debt will it forgiven after 25 years of repayment.

Alternative student loan repayment plans

While this plan adds to the government’s already long list of student loan repayment plans, it is the most inclusive because all federal student loan borrowers are automatically eligible for lower payments and forgiveness.

However, this doesn’t mean it’s right for everyone. Student loan borrowers should be sure to consider all of their options before choosing a repayment plan.

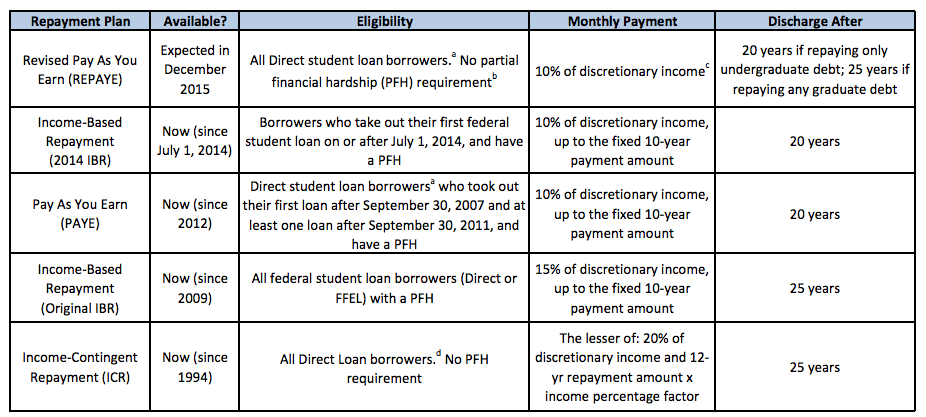

Check out the table below from The Institute for College Access & Success to see how the new REPAYE plan compares to other federal student loan repayment plans.

Which repayment plan is right for you?

Borrowers with graduate school debt may want to consider the original Pay As You Earn (PAYE) plan, which makes borrowers eligible for forgiveness after 20 years as opposed to 25, according to MONEY.

And parents with parent PLUS loans who are not eligible for REPAYE should consider student loan refinancing through LendKey, a network of credit unions that offers refinancing rates ranging from 1.90% APR to 6.92% APR–lower than most Parent PLUS loan rates.

In addition, many borrowers with Stafford, Perkins, private and/or Graduate PLUS loans may find that LendKey’s student loan refinancing option is better than their current plan.

Help choosing a student loan repayment plan

Sorting through all of the student loan repayment plans can definitely be tricky.

That’s why we work with borrowers to help them reduce their student debt and get them on the best repayment plan for their situation.

If you’d like to learn how we can help you repay your student loans, give us a call at or send us a message and we’ll get back to you within 24 hours.

IBR, ICR, income based repayment, pay as you earn, PAYE, repayment, repayment options, repayment plans, revised pay as you earn, student debt, student loan repayment, student loans