The states with the most & least student debt

Students are graduating college with more debt than ever before, with the average college graduate leaving school with $28,400 in student loans.

But in some states, students are graduating with debt levels much higher than that, with debt in 6 states topping $30,000.

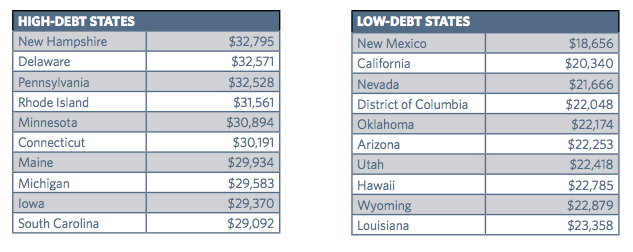

A new report from The Institute for College Access & Success’ Project on Student Debt shows that average student debt varies widely by state, ranging from $18,656 to as much as $32,795 per student.

Average student debt varies widely by state

The report found that high-debt states are located mainly in the Northeast and Midwest, while low-debt states are in the West and South.

Students in New Hampshire, Delaware, and Pennsylvania graduate with an average of over $32,000 in debt, while those lucky students in New Mexico, California, and Nevada all leave college with at least $10,000 less in debt.

Due to compounding interest, debt totals can often grow quickly, leaving borrowers in high-debt states to pay back even more in loans.

Check out the charts below to see where student debt is highest and lowest.

College graduates in New Hampshire, Delaware and Pennsylvania average over $32,000 in student loans, while students in New Mexico leave college with about $13,000 less debt.

Consider attending college in a low-debt state

Why such a difference?

TICAS says state policy has a big effect on student debt. Other factors like the availability of need-based state grant aid, cost of living, the ratio of private to public schools in a state and the amount of students paying out-of-state tuition can all play a factor, according to the Washington Post.

When choosing a college, it would be wise to consider these lists to expand your college search. Some public colleges have low tuition even for out-of-state students and may offer scholarships that could decrease your college bill and help you avoid debt.

And if you live in a low-debt state, staying close to home for college might be a smart financial plan.

Making college affordable is key to minimize loans

Of course, you don’t know how much you’ll pay for college until you apply and receive your financial aid package. It’s important to keep your options open when choosing a college and figuring out how to pay for it.

And if you’re already dealing with student debt, it’s important to make sure you’re on track and avoid default, no matter what state you’re in.

If you need help with finding affordable colleges or paying your student loans, feel free to call us at 1-888-234-3907 or contact us using this form.

affording college, choosing a college, college debt, student debt, student loans