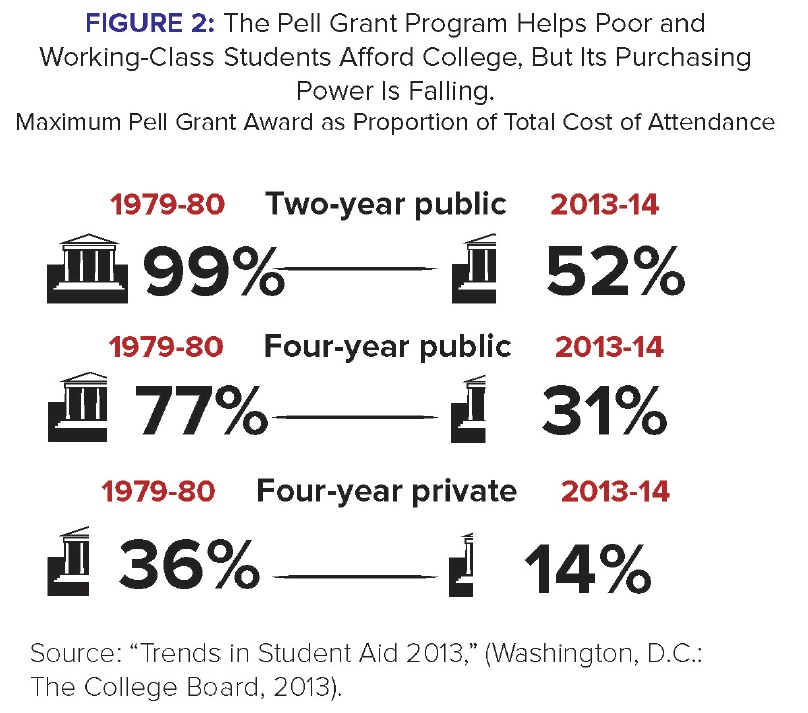

The Federal Pell Grant program was established to help make it possible for low-income students who may have not otherwise been able to afford a college education to do so. Unlike loans, the grant does not have to be repaid, which helps reduce the burden for students who receive the grant.

As college costs have risen, the maximum federal Pell Grant has risen as well–but not nearly enough to cover the huge increase, Inside Higher Education reports.

According to a new report from the Education Trust, New America Foundation, and Young Invincibles, the Pell Grant program is failing to keep up in providing low-income students with access to a college education.

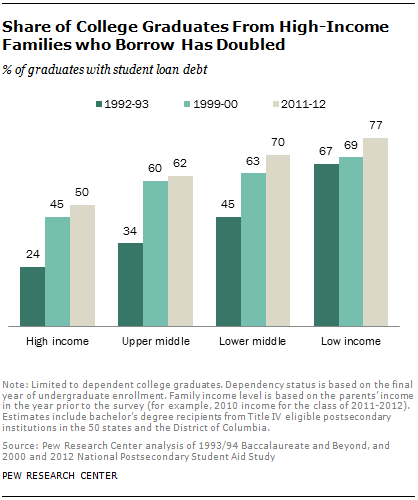

Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.

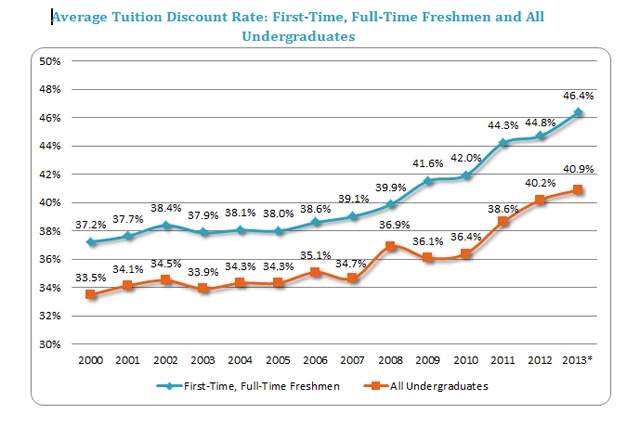

While college costs have increased rapidly over the past few decades, financial aid, grants and scholarships have increased significantly as well. In fact, at some colleges, these tuition “discounts” have been so large that colleges are struggling financially, Jon Marcus reported in a recent Hechinger Report article. College costs are up, but so is financial aid According […]

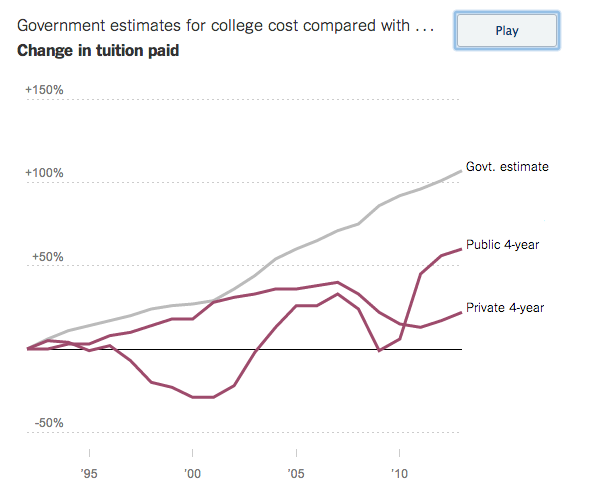

The general consensus among the public is that the cost of college has risen dramatically over the past few decades. We’ve reported how much the rise in college tuition has outpaced gas, cars and any other household item that the government tracks. According to the government, college tuition and fees have risen a shocking 107 percent since […]

With college costs reaching record levels and still rising, the idea of free college might sound like a pipe dream. Some colleges offer free tuition to the very top students, but these scholarships are extremely competitive. And even with financial aid, most students usually end up paying large amounts for college and taking out student loans. […]

Many of the nation’s top universities, such as Harvard, Stanford and Duke, are lauded for having need-blind admissions policies, meaning they don’t take into account a student’s ability to pay for college when making admissions decisions. These schools say the policy a way to make sure the best students are accepted because of their merit, […]

Before borrowing money to pay for college, it’s important to know what your loan’s interest rate will be to figure out how much you’ll pay over the life of the loan.

Unfortunately, students and parents will pay more this year than last to borrow for college. Federal student loans remain, however, one of the most affordable options when borrowing for college.

Read on to find out the new student loan interest rates for the 2014-15 academic year.

Applying for scholarships, grants and other forms of financial aid to help pay for college can be overwhelming for many students and families. And with the cost of college rising rapidly, there’s no shortage of students applying. The internet has made this a lot easier, but not all financial aid websites are created equal. Tess Clarke, a guidance […]

Hechinger Report recently published a great opinion piece from Karen Gross on the ‘flawed conversation’ regarding the cost of higher education. She says that too much public focus is placed on the hard costs of college, and not enough on the repercussions of taking out student debt and alternative repayment options for students. We couldn’t agree more with her claims. […]

Even as college costs rise, millions of students are missing out on the opportunity to get free money for college.

According to an analysis of federal data by Mark Kantrowitz, senior vice president at Edvisors Network, about 2 million students could have qualified for the need-based Federal Pell Grant during the 2011-12 academic year.

Of that group, 1.3 million would have qualified for a full Pell Grant of $5,645 for the 2013-14 academic year. That’s a free $22,580 over 4 years. If these students had instead borrowed loans to cover that amount, they’d have to pay it all back, plus interest.

So why didn’t these student receive this free money for college?

They didn’t file the Free Application for Federal Student Aid (FAFSA).