When giving advice to students and families about choosing a college and determining how to pay for it, we tell them to look at the return on investment (ROI) of the degree.

The College Considerator is a new tool makes that even easier, by measuring the value of the student’s potential degree. This can help families and students figure out whether it’s worth paying for the college of their choice.

Applying to and getting into college puts enormous pressure on students and families. Many students believe they need to get into the “best” (highest-ranked) college possible in order to have a chance at getting a good job after college.

Particularly among the wealthy, there’s often competition between parents as their children apply to the same prestigious colleges, Robert Reich writes in a recent piece for Slate.

With the cost of college topping $60,000 at some schools, it may seem impossible for regular families to afford higher education.

But there are still plenty of quality colleges for half the cost. Kiplinger recently released a list of the best value colleges that still cost under $30,000 per year, all of which provide a great bang for your tuition buck.

While we believe you should major in a subject you enjoy because you’ll do better if you’re interested in the material, there’s no denying that some college majors pay better than others–usually because students in these positions gain more specialized, in-demand knowledge.

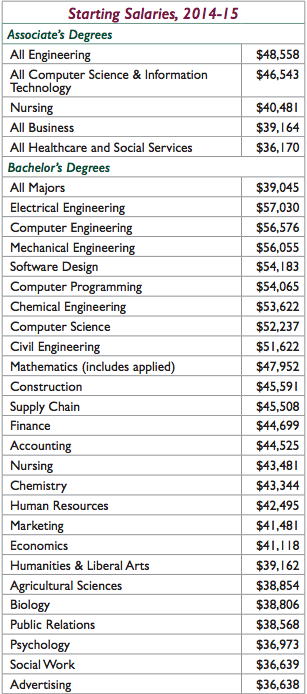

According to a new study from Michigan State University, electrical engineering majors have the highest starting salaries out of college, with the average graduate making $57,030 in the first year.

We’ve expressed that the value of your college degree is influenced heavily by several factors, including choice of major and how much debt you take on to pay for it.

And now a new calculator from The Hamilton Project makes it easier for college-bound students to understand how much their degrees will cost them over time depending on major, student loan debt, interest rates, and term of the loan.

When most people talk about student debt, they talk about it in terms of undergraduates. Indeed, undergraduate student debt remains a real issue, with the average graduate leaving college with $29,000 in student loans. But according to Time Magazine, there’s an even bigger problem that’s not frequently talked about in the media: graduate student debt. […]

With the cost of college rising, more parents are beginning to look at the return on investment of where they send their children to college and evaluating whether schools are worth their high costs. As College Financing Group co-founder Andy Leardini told Buffalo Business First in a recent article, the college decision has become like […]

As parents of college-bound students know, applying to college is more than a financial decision–it’s an emotional one as well. Our founders Rick Ross and Andy Leardini recently appeared on Winging it! Buffalo Style to discuss the challenges families and students face when choosing a college and figuring out how to pay for it. Taking the emotion […]

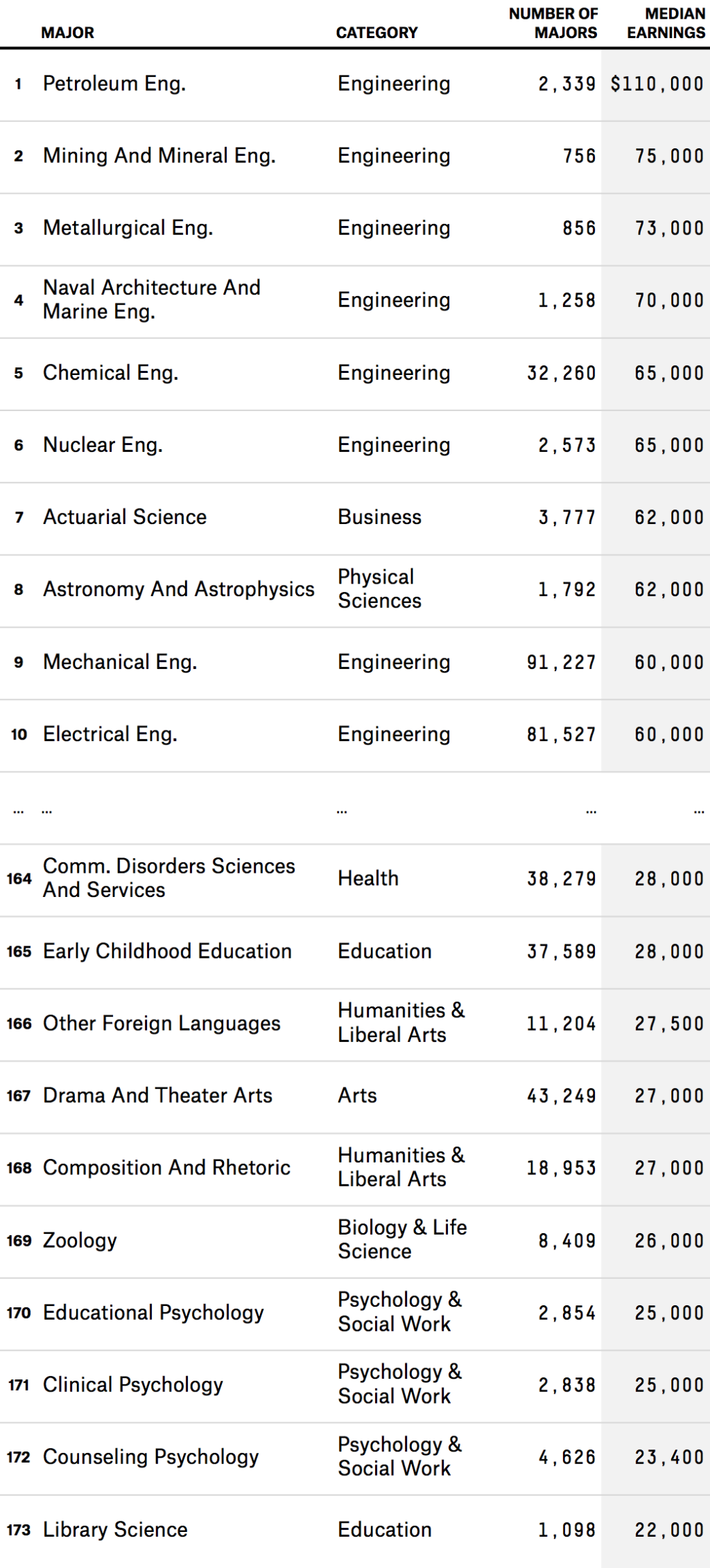

While the return on value of a college degree is at an all-time high, according to a recent analysis by FiveThirtyEight, not all degrees are created equal. As we’ve written, the return on investment of a college degree depends on many factors, including the field of study, student’s debt level, and what the graduate does with […]

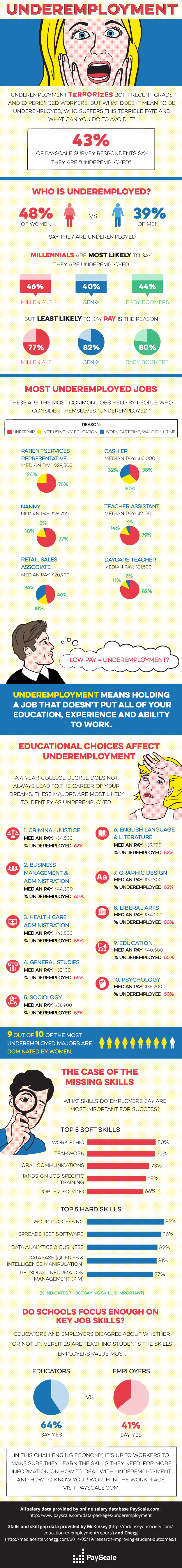

According to a recent PayScale survey, of 68,000 workers, 43% of Americans feel underemployed in their jobs.

As we recently reported, the worker’s choice of college major is a factor in feeling underemployed. Healthcare and Business majors were among the top majors listed by underemployed workers.

This infographic from PayScale presents a broader look at underemployment in America–including the jobs in which workers feel most underemployed and the ‘hard’ and ‘soft’ job skills employers most value.