The history of the college tuition scam

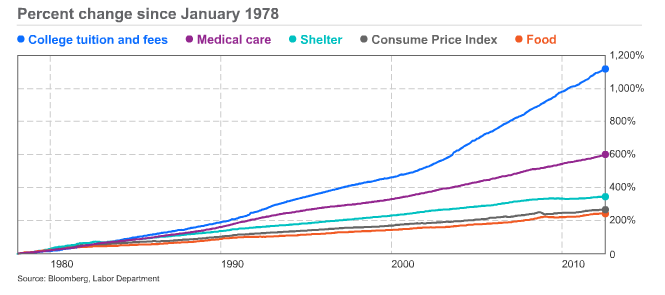

According to Bloomberg, the cost of college has risen 1,200 percent over the last 30 years, far faster than the price of any other good the government tracks, including food, housing, cars, gasoline, and TVs.

In a fantastic article recently published in Salon, Thomas Frank explains what led the country to a point where the price of college has become out of reach for many Americans.

Colleges avoid blame for rising college tuition

According to Frank, journalists and government officials have neglected to hold colleges accountable for their high costs for three decades, allowing colleges to raise their prices without justification.

For one thing, journalists haven’t asked for hard data from colleges showing where their money goes, or dared imply that colleges may be putting their own greed ahead of students’ well-being.

And politicians have just increased financial aid, which includes student loans–leaving us a in a situation where the average graduate leaves college with nearly $30,000 in debt and gives colleges no reason to bring costs down.

Meanwhile, university administrators have skirted responsibility, blaming everything from professor salaries to utilities and students ‘demanding’ campus luxuries.

Because of this, and a media that treats expensive, exclusive colleges as status symbols, parents and students feel the pressure to attend ‘brand-name’ schools, despite evidence that attending a prestigious, expensive college doesn’t improve one’s chances of happiness or success.

Affording college in an out-of-control marketplace

Since a college degree has become necessary for succeeding in today’s marketplace, many families feel they have no choice but to pay these outrageous prices.

But this doesn’t have to be the case. We work with parents and students make college more affordable, so that they’re not burdened by debt down the line. We help them find the best value college for their money, while giving them strategies to reduce their overall costs.

And for young adults who already have student loans, we work with them to make the repayment process as easy as possible–while also reducing their debt.

If you’re interested in learning more, give Rick & Andy a call at 1-888-234-3907 or fill out this form and we’ll get back to you within 24 hours.