Young college grads struggle to accumulate wealth due to student loans

A new study from the Urban Institute shows that millennials have accumulated less wealth since entering the workforce than their parents did at the same age, even as the economy has grown and the average wealth of Americans has doubled.

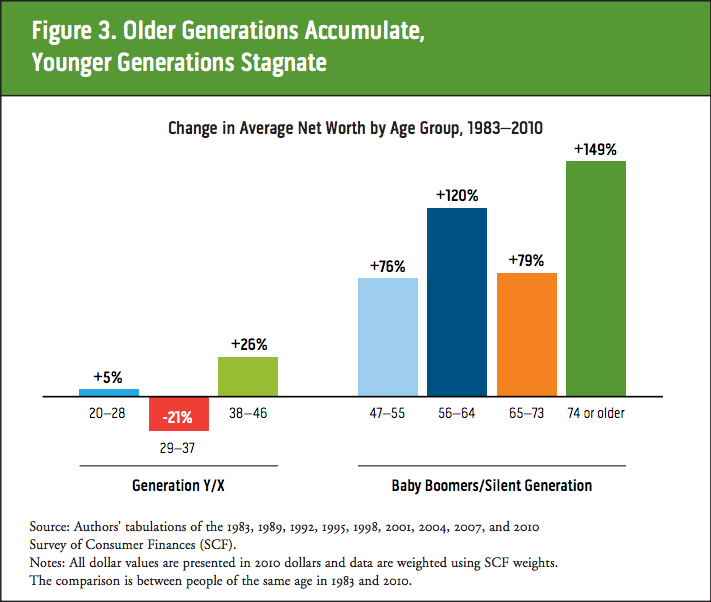

The chart below shows the change in average net worth by age group from 1983 to 2010.

In response to the study, AlterNet published a fascinating look at the struggles of real young college graduates to repay their loans and enter the middle class. It’s certainly worth a read for parents and students considering taking on debt for college and students already in the process of repaying their loans.

Young adults are in a period when they should be investing in their futures to build the kind of middle class stability that their parents’ generation enjoyed.

Instead they are paying down tens of thousands of dollars in college debt, putting those critical investments in their future farther out of reach.”

— Catherine Ruetschlin, policy analyst at Demos

While the findings are troubling, student loans can be a necessary evil when paying for college. However, it’s critical to avoid taking out more loans than you need to prevent hurting your post-college credit and economic status.

If you’re struggling with figuring out how to pay for college without drowning in debt, give us a call toll-free at 1-888-234-3907 or contact us.

generation x, generation y, loan repayment, student debt, student loans