More parents take on more debt for college

Students aren’t the only ones feeling the brunt of the student debt crisis.

Now, their parents are too.

A new study shows that more parents are taking out loans to pay for their kids’ college–and they’re taking out more money overall.

PLUS Loans on the rise

The latest figures from the National Center for Education Statistics showed that in 2011, 21% of parents took out PLUS Loans to pay for their children’s college education. PLUS Loans are direct loans given out to parents of college-bound students by the federal government.

That’s a 60% jump from 1999, when just 13% of parents took out PLUS Loans.

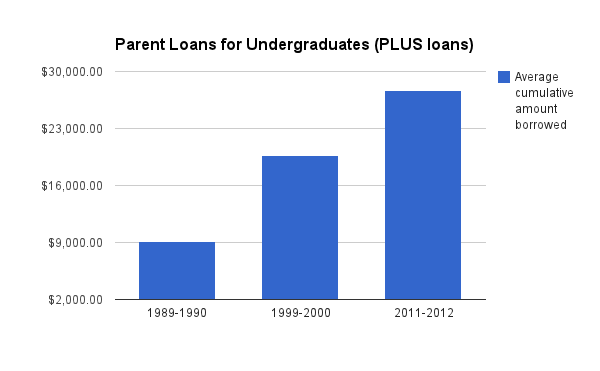

And it’s not just that more parents are taking out loans for college: they’re taking out much larger loans as well.

In 2011, PLUS Loan carried an average balance of $27,700 in inflation-adjusted dollars, up 40% from 1999, when the average balance was $19,700.

Students and parents share student debt burden

While some may blame the increase on an “entitlement mentality” causing parents to take out loans to avoid burdening their children, this ignores the fact that the percentage of students taking out loans and the balances they’ve borrowed have risen dramatically as well.

Rather than being a result of parents spoiling their children, it’s become necessary for many parents to take on loans, even with the student contributing as much as possible.

Do I look entitled to you? (Photo credit: CollegeParents.Org)

At many colleges, even after grants, scholarships, and maxing out on federal student loans, students are left with a hefty balance to pay.

If they can’t do so with just their savings, job, or another source of money, they have to take out private student loans, which can have high, variable interest rates and less favorable terms than federal loans.

For some parents, PLUS loans are a good way to pay for college when other funds aren’t available. But when families borrow beyond their means, they have the potential to wreak havoc on a family’s financial future.

Rising college costs to blame for increased parent debt

Again, the issue comes down to rising college costs.

You can’t blame parents for wanting to lend their kids a hand–especially if it means preventing their 18-year-old from taking out money from a shady student loan lender. If college costs were kept under control, parents (and students) wouldn’t have to take on so much debt to pay for college.

Unfortunately, the sticker price of college remains too high for most families to afford without student loans and other financial aid.

But this doesn’t have to mean excessive debt is inevitable when you have a child in college.

How to avoid taking out loans for college

Even in an era of high college costs, it’s still possible for students to avoid taking out loans and graduate college debt free.

It’s not easy, but students and parents have to be willing to open their minds to colleges they may have never considered.

It’s becoming more clear that college prestige is not worth paying a premium for, so there’s no reason not to consider a college just because it lacks a sexy name. There are over 3500 colleges in the U.S., and there might just be a hidden gem that offers everything you want–including a student debt-free (or nearly debt-free) future.

Whether you’re a student or a parent, if you want to learn ways to make college more affordable, give Rick & Andy a call at 1-888-234-3907 or submit this form for a free consultation.