Students with less debt default more often

One would assume that graduating with a high level of student debt would put a borrower at greater risk of falling behind on their payments and defaulting on their student loans.

But a new report from the Federal Reserve Bank of New York found the exact opposite to be true.

More student debt, less default

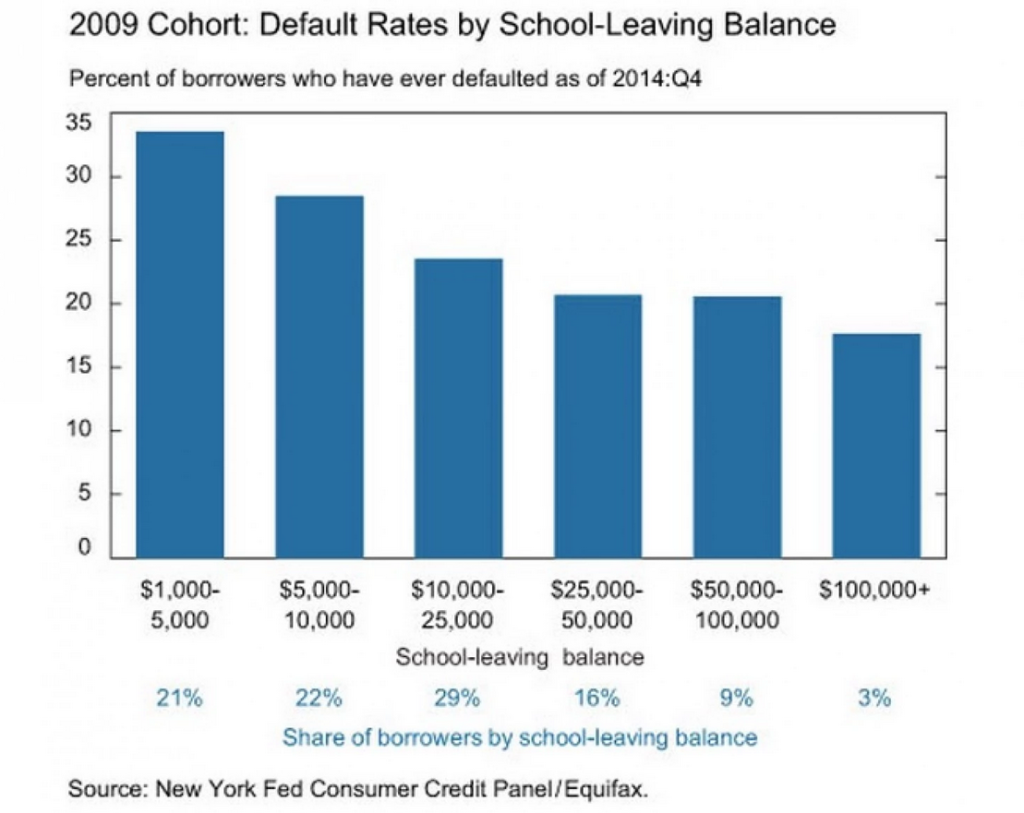

According to the study of students leaving college in 2009, 34% of borrowers with less than $5,000 in student loans defaulted by the end of 2014, compared to just 18% of those with more than $100,000 in student loans.

Students who left college in 2009 with more student loan debt were less likely to default on their loans than those with the least amount of debt.

These low-debt borrowers also make up a fifth of all students, compared with the $100,000+ debt group, which represents just 3% of the students leaving college in 2009.

Not graduating could be to blame

Why could this be the case? Are borrowers with higher debt levels more likely to get on repayment plans that help them avoid default, or is there another factor at play?

One important thing to note is that the study included all students who left college in 2009–not just those who graduated and received a 4-year degree.

According to the Washington Post, it’s possible that borrowers with lower debt levels never graduated, leaving them without a degree that would help them get a higher-paying job that allowed them to repay their student loans.

It’s also possible that these borrowers graduated from a cheaper alternative program, such as a community college, rather than finishing a 4-year degree, and thus had less earning power (and less money to repay their student loans) than those who borrowed more.

Avoid student loan debt when possible

Despite these surprising statistics, we don’t advocate taking on more debt in the hopes of avoiding default.

In general, the less debt you can take on for college, the better off you’ll be.

As we’ve reported, student loan debt can have dire consequences, including higher levels of stress and unhappiness. And since there are no guarantees of landing a high-paying job to pay it off, we recommend trying to make college as affordable as possible.

If you need help figuring out how to avoid loans and pay for college, or if you’re already struggling to repay your student loans or have defaulted, we can help. Give us a call at 1-888-234-3907 or contact us using this form and we’ll get back to you within 24 hours.

college debt, college loans, student debt, student loan default, student loans