The college majors with the highest & lowest starting salaries [Infographic]

With college being such a large investment, it’s important to have a good idea of how much money you’ll likely be making once you graduate.

Knowing the starting salary of your college major can help you determine your future ability to repay student loans and help you make smart decisions about paying for college.

The highest and lowest paying college majors

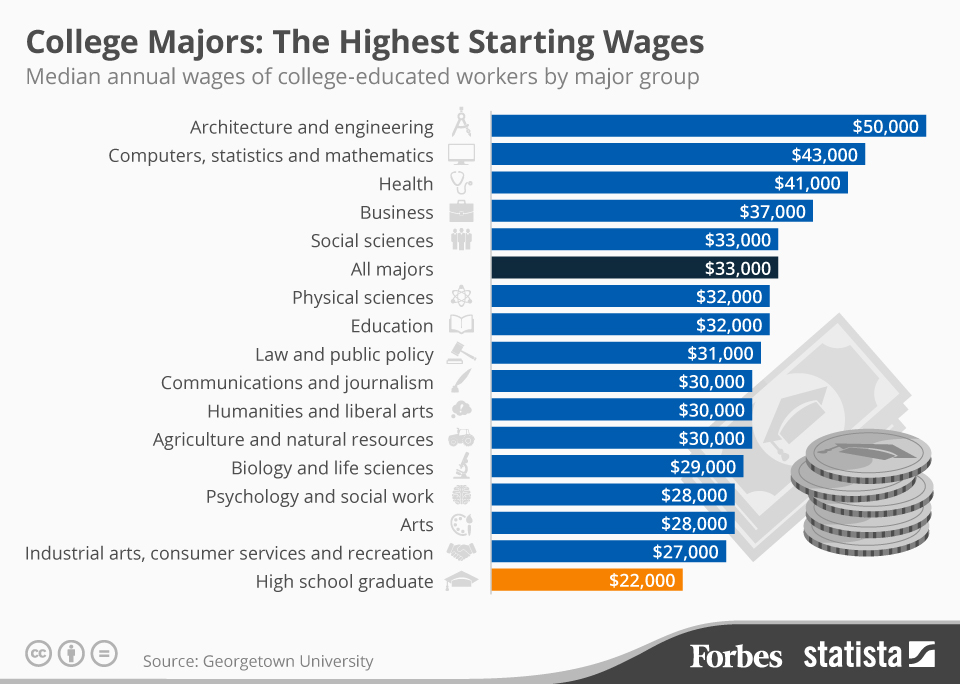

The infographic below from Forbes shows which college majors pay the most–and the least–right out of college.

Architecture and engineering majors make, on average, significantly more money than those in other fields right out of college, particularly majors in the arts.

Architecture and engineering majors come out on top, with a starting salary of $50,000. That’s $7,000 per year more than the second-highest paying field (computers, statistics and mathematics).

It’s also $17,000 more than the average college graduate, who makes $33,000 per year out of college.

And it’s almost twice what college graduates who studied industrial arts, consumer services and recreation make–just $27,000 per year.

Graduating from college pays off

Of course, salaries generally go up during the course of your career, so even for some majors that start off with low salaries (such as those studying psychology or biology), additional schooling and experience can lead to much higher pay in the future.

And students in all majors can take comfort in the fact that they’re making more than a high school graduate, who makes just $22,000.

The potential for salary increases is also much greater for college graduates, proving that graduating from college pays off, despite its high cost.

Making the most of your college investment

In general, it’s usually best to choose a major that you’ll enjoy and succeed in, rather than picking one based on salary alone.

But it’s definitely good to know what you’re getting yourself into so you don’t take out $200,000 in student loans for a college degree that will earn you less than $30,000 per year out of college.

If you’re in the process of choosing a college or figuring out how to pay for it, we can help you reduce your college costs and maximize the return on your college investment.

And if you’re in a lower-paying field and struggling to repay the student loans you took out, we can help you reduce your payments and manage your student debt.

Give us a call at 1-888-234-3907 or contact us here to tell us about your situation and find out how we can help.