Before borrowing money to pay for college, it’s important to know what your loan’s interest rate will be to figure out how much you’ll pay over the life of the loan.

Unfortunately, students and parents will pay more this year than last to borrow for college. Federal student loans remain, however, one of the most affordable options when borrowing for college.

Read on to find out the new student loan interest rates for the 2014-15 academic year.

Applying for scholarships, grants and other forms of financial aid to help pay for college can be overwhelming for many students and families. And with the cost of college rising rapidly, there’s no shortage of students applying. The internet has made this a lot easier, but not all financial aid websites are created equal. Tess Clarke, a guidance […]

Hechinger Report recently published a great opinion piece from Karen Gross on the ‘flawed conversation’ regarding the cost of higher education. She says that too much public focus is placed on the hard costs of college, and not enough on the repercussions of taking out student debt and alternative repayment options for students. We couldn’t agree more with her claims. […]

Even as college costs rise, millions of students are missing out on the opportunity to get free money for college.

According to an analysis of federal data by Mark Kantrowitz, senior vice president at Edvisors Network, about 2 million students could have qualified for the need-based Federal Pell Grant during the 2011-12 academic year.

Of that group, 1.3 million would have qualified for a full Pell Grant of $5,645 for the 2013-14 academic year. That’s a free $22,580 over 4 years. If these students had instead borrowed loans to cover that amount, they’d have to pay it all back, plus interest.

So why didn’t these student receive this free money for college?

They didn’t file the Free Application for Federal Student Aid (FAFSA).

How do colleges decide which students should receive financial aid and how much they should receive? Despite the increase in colleges using net price calculators and other reforms to make the process more transparent, financial aid remains a mystery to parents and students–it’s still a “apply, wait and see” type of game. Now, colleges are […]

It’s no secret that college is a huge investment in your future, and costs are rising at most colleges and universities. With the price so high and student loan debt increasing, it’s never been more important to be careful how you spend your college dollars. But which colleges pay off? Are 96% of U.S. colleges […]

Whether you or your child is preparing for college or already enrolled, your family can benefit from working with a financial aid consultant to save time and money on college.

Here are 9 reasons you should consider working with a financial aid consultant.

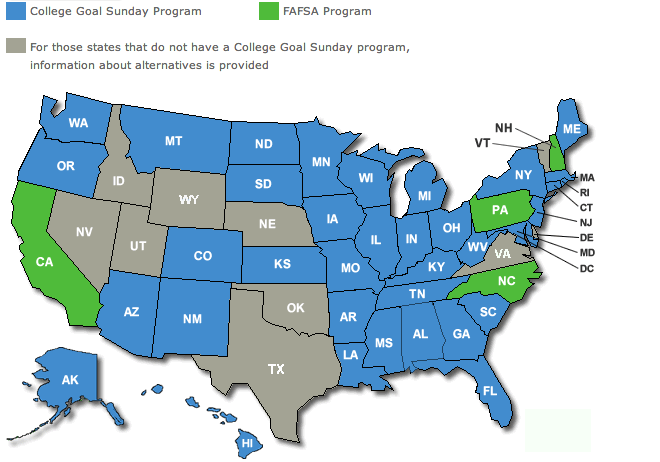

Need help filling out your FAFSA? There’s likely a FAFSA filing event happening near you in the next couple of months.

Check out this map and click on your state for a list of locations, dates, and times for events happening in your state.

Compared to private student loans, whose interest rates vary depending on the borrower’s credit history, federal student loans are a steal. But according to USA Today, a large percentage of private loan borrowers don’t maximize their borrowing of federal student loans.

In fact, the newspaper found that more than half of private loan borrowers failed to max out on federal student loans, and a quarter didn’t take out any federal loans.

This is quite alarming and demonstrates the need for education about the differences between federal and private student loans. Unlike federal student loans, private student loans can have variable interest rates, some greater than 18%. This substantially increase the total amount you repay.

During the college admissions process, the cost of standardized testing, test prep services, college applications, and college visits can really add up.

And that’s before you even start thinking about paying for major expenses like college tuition, fees, textbooks, room, and board.

With college such an expensive investment, you may be wondering why anyone would pay someone just to help them figure out how to pay for it.