Public Service Loan Forgiveness (PSLF) is a fantastic program is you can qualify for it. PSLF forgives the remaining balance on your federal student loans if you meet certain requirements, which include working full-time in a public service position while repaying your student loans.

The program is in danger of being cut in President Trump’s latest budget. However, this change would only apply to student loans taken out on or after July 1, 2021. Therefore, if you’ve been making payments under this program up to this point, you are still eligible.

Student debt is at over $1.6 trillion. That’s a lot of money that needs to be paid back to the federal government, lenders and college.

But what if it didn’t have to be paid back? Where would it go?

According to economists, it would go toward spending, like purchasing homes, cars and other necessities. All of this would help boost the economy, they say.

College-bound students will be receiving their financial aid packages within the next couple of months — and many of them will come with student loans.

But many students — even those already attending college — don’t really understand how student loans work. That’s despite nearly 70% of students graduating with student debt.

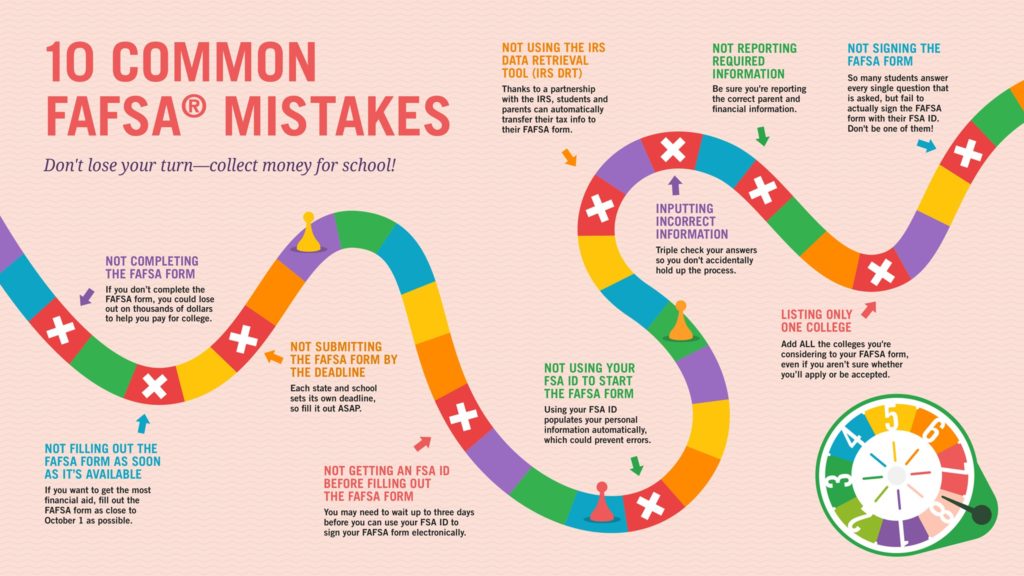

Now that the FAFSA is available in October, it’s important to make sure you’re filling it out as early as possible.

But filling it out correctly is even more important. If you make a mistake on your FAFSA, you could miss out on financial aid.

Check out the top 10 common FAFSA mistakes from the Federal Office of Student Aid to make sure you don’t miss out on free money for college.

As a Western New York-based business, we love seeing Upstate New York colleges making positive changes — especially when it results in lower student debt.

Colgate University, a prestigious college located in Hamilton, NY, recently announced a new no-loan initiative for students with a total family income up to $125,000.

We’ve written before about how public colleges aren’t necessarily the most affordable choice in the long run. In some cases, private colleges may offer more financial aid than public schools and can sometimes end up being even less expensive.

Not only can attending a private college sometimes save you money upfront, in many cases it can pay off long after graduation.

As this year’s class of college seniors prepares to graduate, they may (and should) be wondering about repaying their student loans.

This video from the office of Federal Student Aid provides a good breakdown of your options for repaying student loans, including consolidation and alternative repayment plans.

In the wake of the recent college admissions scandal, many people are wondering whether it actually matters what college you go to.

For these parents, it was extremely important that their child got into a prestigious school at all costs. Clearly, they didn’t go about it the right way, but the pressure to have their child attend an “elite” college was great enough to motivate them to take drastic measures.

But does your school even matter? Does attending an elite college actually lead to better outcomes after graduating?

While the general trend is for college costs to rise each year, some private colleges have decided to buck the trend by significantly lowering tuition costs, according to a recent CBSNews article.

Two dozen private colleges have cut tuition since 2016, according to the National Association of Independent Colleges and Universities.

The Free Application for Federal Student Aid (FAFSA) is now available for the 2019-20 school year.

All students attending college in fall 2019 and/or spring 2020 should use this application to apply for financial aid. Watch this video for step-by-step instructions on how to complete the form.