College fees rising faster than tuition

It’s not just tuition and room and board that are causing college costs to skyrocket: college fees are as well, according to The Hechinger Report.

In fact, fees have been increasing far faster than tuition, nearly doubling at four-year public universities and more than doubling at community colleges since 1999-2000, according to a recent study.

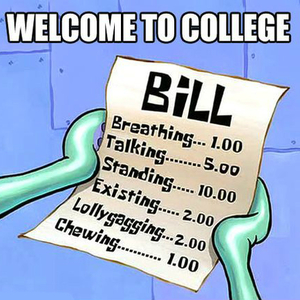

Hidden fees add on to college students’ bills

Colleges are charging fees for all sorts of different things, from athletics to building maintenance, while blindsiding students and parents.

The study found that student fees at four-year public universities averaged $1,719 in the 2012-2013 school year, the most recent for which the figure is available, adding another 27 percent to student charges on top of the typical cost of tuition.

These extra charges are often added to students’ bills as an afterthought to cover charges for things like student activities, athletics, building maintenance, libraries or even graduation.

Families often don’t plan for these extra fees, which may not be covered by financial aid. When combined with other high college costs, this can lead to students and their families feeling nickel-and-dimed by the college process.

As Ann Roach, a parent of a student who attended the University of Dayton, put it,

It’s like buying a car. You think you have a price, and then they tell you, ‘Here’s a conveyance fee, or here’s a fee for $200 to put the license plates on.’ Nobody told us about these.

Colleges use fees to raise costs without oversight

The increase in fees has allowed college costs to climb even while schools claim tuition hikes are slowing — even though fees may cover some of the things that would usually be covered by tuition, such as program fees.

As Jennifer Delaney, an associate professor at the University of Illinois at Urbana-Champaign, explains,

Tuition gets all of the media attention, while fees are hidden to students and also to public knowledge and oversight.

This lack of transparency by colleges has led to a backlash from former students. Luckily, some colleges, like Dayton University, are listening.

The college has stopped charging fees and has instead rolled them into tuition, while promising not to raise tuition for the four years a student is in school.

We’re happy to see colleges taking notice of how their students feel about these extra fees, which are difficult for families to plan for and predict.

By including them in tuition costs, students can get a better handle on how much they will owe after financial aid.

For fees that are not mandatory, it can be helpful for students to be able to opt out in order to reduce their college costs. Optional fees may include health insurance or specific activity fees.

Don’t overpay for college

College fees are on the rise, but that doesn’t mean you have to pay more.

It’s crucial to study your college bill carefully to ensure you’re not being charged for things you don’t use. And don’t be afraid to question colleges about fees you don’t understand.

We can also help you understand your college bill and financial aid award to help you determine your total expenses and make college more affordable.

To learn how we can help you, call us at 1-888-234-3907 or send us a message.