Many colleges underestimate their true cost

We all know that college is expensive, but what’s most alarming is that many colleges who list their total cost of attendance are actually underestimating the price.

That’s because many colleges (one-third, in fact) are underestimating the cost of living in the city where students reside.

Inaccurate cost estimates impact financial aid

According to recent research from the Association for Institutional Research, as reported by The Hechinger Report, one-third of all colleges are making this crucial mistake, many by large amounts.

This is a major issue because this cost is taken into account when listing prices for students and awarding financial aid.

If a college underestimates its true cost, then it may award students less money than they actually need to attend, leaving students with nothing to make up the difference.

A smaller percentage, 11 percent, are actually overestimating their costs–which has the potential to scare off students worried they can’t afford to attend.

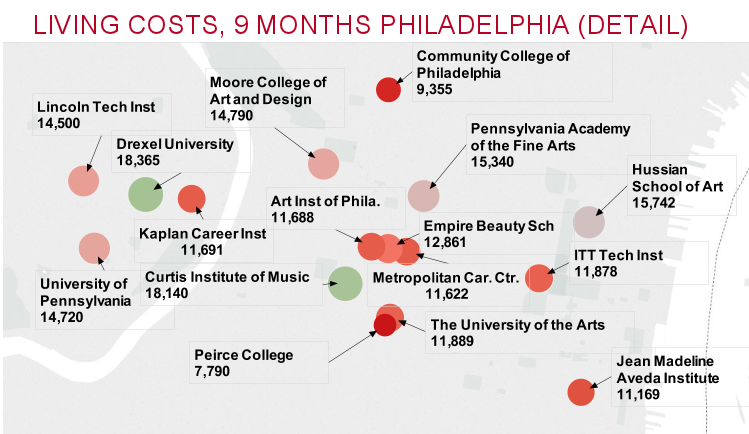

The association released this useful interactive map to show the differences between what the average college estimates for living costs vs. what the federal government says it costs to live there.

Cost of living estimates vary within same city

There’s even inconsistency among schools within the same city.

For example, Drexel University in Philadelphia, PA estimates living expenses for students living off-campus at $18,365.

Peirce College, meanwhile, says it costs only $7,790 for housing, food, transportation, healthcare and other personal expenses for off-campus students to live in the same city. That’s a $10,575 difference per year.

College cost data can vary widely

The federal government doesn’t specify how colleges should estimate off-campus living expenses, so many use surveys of students to come up with an estimate, which can vary widely depending on the student bodies’ spending habits.

And this estimate is also used to come up with a college’s net price, which is supposed to be its “true cost” after financial aid. Unfortunately, this “true cost” might actually be far off from reality if a college is using an inaccurate cost-of-living figure.

Minimize college costs to avoid surprises

While federal estimates can help students figure out the cost of living in the city of their chosen college, it can be difficult to assess how much you’ll actually spend until you get there.

And since colleges aren’t much help, it’s best to be on the safe side and overestimate your cost of living so that you budget enough to cover expenses.

Since listed costs for living expenses can be inaccurate, it’s crucial to minimize other costs as much as you can. We help families and students make college more affordable so that there aren’t big disparities in cost when the student actually attends college.

By maximizing financial aid and helping families find low-cost, high quality colleges, we can help families avoid taking out big student loans to pay for college. If you’d like to learn how we can help make college more affordable, give us a call toll-free at 1-888-234-3907 for a free consultation or contact us using this form and we’ll get back to you right away.

affording college, college costs, cost of living, financial aid, net price