Room and board is the “untold story” of rising college costs

There’s been plenty of discussion about the astronomical growth of college tuition costs over the past few decades.

But rarely do you hear about another culprit for rising college costs: room and board.

Room and board costs rising as fast as tuition

According to the College Board as reported by Hechinger Report, public four-year universities have raised their room and board costs by 9% above inflation since 2009. At private colleges, these costs have risen by 6% above inflation during this time.

Overall, without adjusting for inflation, room and board fees are up 20% at public colleges and 17% at private colleges since 2009.

How does this compare to increases in tuition costs?

At public universities, it’s about the same. Tuition costs at public colleges increased 21% over that same period.

But at private colleges, the increase in room and board costs almost makes the increase in tuition costs (13%) look small.

The hidden costs of college

Despite these huge increases, the media usually only talk about the rise in college tuition when discussing how much college costs have increased.

As Richard Vedder, director of the Center for College Affordability and Productivity, tells Hechinger Report,

This is the untold story.

We focus on tuition but we should look at other costs, too.

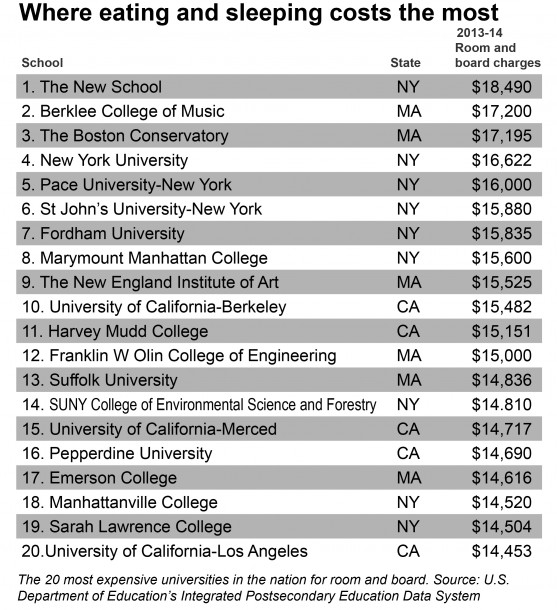

Room and board costs $18,490 at The New School in New York, making it the most expensive room and board cost among all colleges in 2013-14.

That’s more than the cost of tuition at many public colleges.

Multiplied over 4 years, that’s $73,960–a pretty hefty price to pay just to live and eat for four years (and for only part of the year).

In addition to tuition, college food and housing prices are rising significantly faster than inflation. (Graphic: Sarah Butrymowicz)

It’s followed by many other colleges located in the New York city area, as well as Boston and California.

But even students in smaller cities aren’t immune to high room and board costs.

SUNY College of Environmental Science and Forestry, for example, is located in the smaller (and significantly more affordable) city of Syracuse, NY, yet has a room and board price tag of nearly $15,000.

Students have limited food and living options

At many of these colleges with high room and board costs, students have no choice but to purchase meal plans and live on campus for at least a year, if not longer.

Not to mention, many local landlords have a monopoly on student housing and charge just as much as the colleges do, knowing that students have few options.

Thus, students are forced into buying expensive meal plans and living in overpriced, often cramped quarters in order to attend the college of their choice.

Even on the cheapest meal plan at the University of Massachusetts-Amherst, for example, students pay $10,957 for room and board.

This breaks down to about $24 a day for food twice what the U.S. Department of Agriculture says the average American spends per day on food—and $786 a month to share a room, only slightly lower than median monthly rent for an entire apartment or house in America, according to the Census Bureau.

Reducing college costs

While many colleges say costs have risen due to a demand for gourmet food and luxury accommodations, most students would agree it’s not worth the cost–especially when they have to take out huge loans that gain interest over time to pay for it.

A few colleges, including Purdue, in Indiana, have chosen not to raise room-and-board charges in the past three years, but unfortunately these schools are the exception rather than the rule.

In general, moving off-campus and getting off the meal plan as early as your college allows is a smart financial move.

While there is little students can do about being forced to live on campus or purchase a meal plan, there are ways to make college more affordable overall so that room and board costs are less of a burden.

We work with families to help them reduce their college costs and make the most out of their college investment. If you’d like to learn how we can help you pay for college, give us a call toll-free at 1-888-234-3907 or contact us using this form.