Affluent students borrowing for college at higher rates

Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

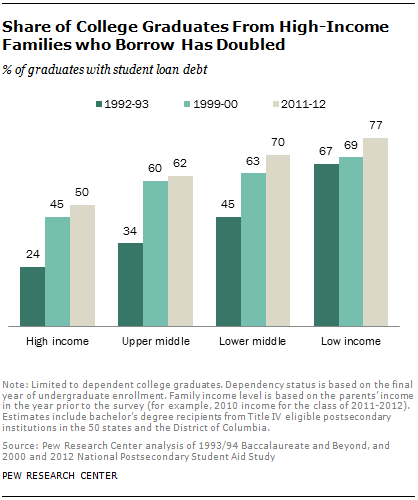

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.

Student loan borrowing increasing faster for high-income students

Pew’s recent analysis of new government data found that the increase in the rate of student loan borrowing over the past two decades has been much greater among graduates from more affluent families than among those from low-income families.

In fact, half of 2012 college graduates from high-income families borrowed money for college, double the percentage that borrowed in 1992-93.

Additionally, upper-middle-income college students are borrowing at much higher rates, with 62% of 2012 graduates holding debt, compared with 34% two decades ago.

The increase has been much slower for low-income students since they’ve always had to borrow more–67% were taking out loans for college in 1992-93.

Students from all economic backgrounds have more student debt

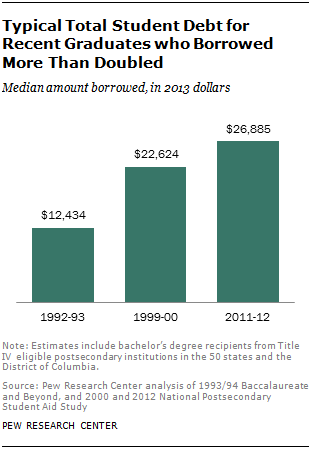

And the rate of borrowing hasn’t been the only thing that’s increased among all income groups–the amounts borrowed have increased drastically as well.

For recent college graduates with student loans, the average debt rose from $12,434 for the class of 1992-93 to $26,885 for the class of 2011-12 when adjusted for inflation.

While the amounts varied by family income, the average amount owed at graduation doubled over this time period for all groups.

Paying for college without student loans

While it’s not surprising that students and families are borrowing at higher rates, the substantial increase among higher-income groups indicates that more families are struggling to pay for college, regardless of income.

Many families believe that high student debt is inevitable, but it doesn’t have to be. Families and students need to understand that paying extra for a fancy name college isn’t worth the substantial investment most of the time.

There are plenty of affordable colleges that can help students of all economic backgrounds avoid the plague of student debt. If you need help paying for college or finding ways to make college more affordable, give us a call at 1-888-234-3907 or contact us here.

affording college, college costs, college loans, college value, financial aid, financial aid counseling, student debt, student loans