Don’t make these 6 common FAFSA mistakes

If you have a child in college this coming year, it’s time to start filling out the Free Application for Federal Student Aid (FAFSA) at fafsa.gov.

When completing the FAFSA, it’s important to make sure you’re not making any major mistakes that could jeopardize your chances of receiving financial aid.

Get the most financial aid for college

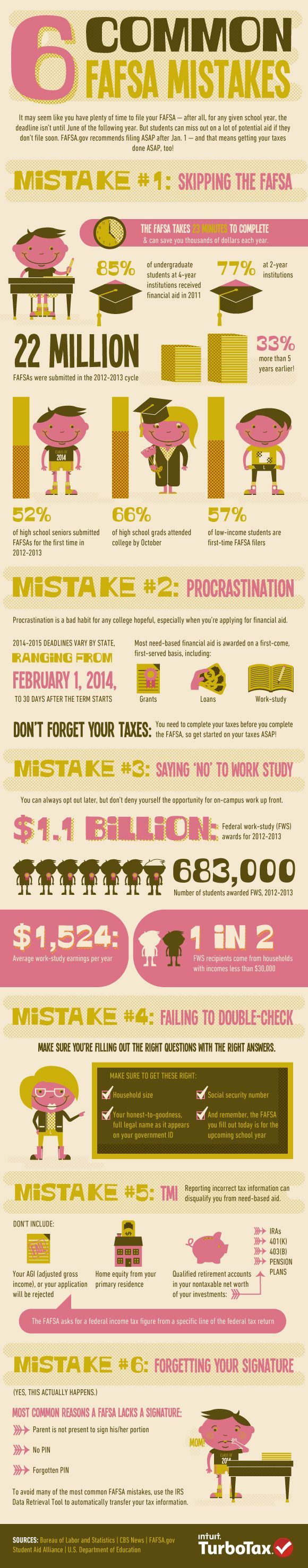

The most common mistakes including not filling it out at all, filling it out too late (some college’s deadlines are as early as February 1), reporting incorrect tax information, and saying ‘no’ to work-study. And don’t forget to read it over and sign your form to avoid delays in processing.

Check out the infographic below from TurboTax to find out 6 most common mistakes people make on the FAFSA so that you can maximize your chance of receiving grants, work-study, and other forms of financial aid to help pay for college.

affording college, applying to college, fafsa, financial aid, financial aid counseling, paying for college