Parent PLUS loan reform reduces number of black college students

A few years ago, the government reformed its Parent PLUS loan program and tightened credit standards for issuing loans to parents to help pay for college.

While this reform may have reduced predatory lending, it may have had an unintended negative consequence as well: reducing the number of black students in college, according to a new report from Hechinger Report.

Black student college enrollment falls

In 2012-13, a year after the reform, the number of black students enrolled at four-year universities and colleges across the United States declined at a greater rate than students of other races and ethnicities.

The decline was particularly noticeable at historically black colleges and universities, where black students make up more than 80 percent of the student body.

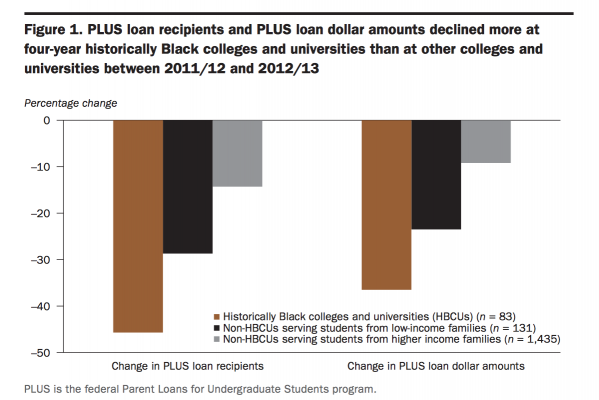

At these colleges, the number of recipients of federal parent loans fell 46 percent, compared to 29 percent at other colleges that educate students from low-income families (meaning that at least 64% of the student body would qualify for a Pell Grant).

Source: Changes in financial aid and student enrollment at historically Black colleges and universities after the tightening of PLUS credit standards, U.S. Department of Education

At the same time parent loans declined, so did the number of students enrolled at historically black schools. They lost 3.4% of their student bodies, nearly 100 students per college on average.

This troubling trend was also apparent at other colleges throughout the country.

Among colleges that serve low-income students, there was a 1.5 percent drop in black students, on average, or about 12 fewer black students per institution. In addition, the percentage of black students at universities and colleges that serve higher-income students declined 0.6 percent, an average loss of about three students per school.

Skipping college is costly for low-income students

While we’re glad that families are no longer being saddled with student debt they can’t repay, it is extremely concerning that low-income students are apparently becoming less likely to go to college as a result of the changes.

Since the federal government caps students’ borrowing each year, students whose families have not saved for college may find themselves with few options and decide to skip college since their parents cannot borrow the money.

As we’ve reported, a college degree pays off, and students who graduate from college have much better outcomes than those who don’t.

Skipping college is a costly mistake, and all students who want to go to college should have access to affordable options.

Alternatives to Parent PLUS loans

When working with families and students, we try to help them keep college costs down so that parent PLUS loans are not a necessity. While many families use these loans since parents are allowed to borrow up to the full cost of attendance (assuming their credit is good enough to get a loan), they can leave families saddled with large debt loads at high interest rates.

Our goal is to help families pay for college while avoiding unnecessary debt. We can help you explore alternatives and make college more affordable.

If you’d like to learn how we can help you pay for college, call us toll-free at 1-888-234-3907 or contact us using this form.