Student Loan Repayment: What are my options?

As this year’s class of college seniors prepares to graduate, they may (and should) be wondering about repaying their student loans.

The video below from the office of Federal Student Aid provides a good breakdown of your options for repaying student loans, including consolidation and alternative repayment plans.

Differences between student loan repayment plans

The video outlines some of the differences between Standard Repayment, Graduated Repayment, and income-driven repayment plans.

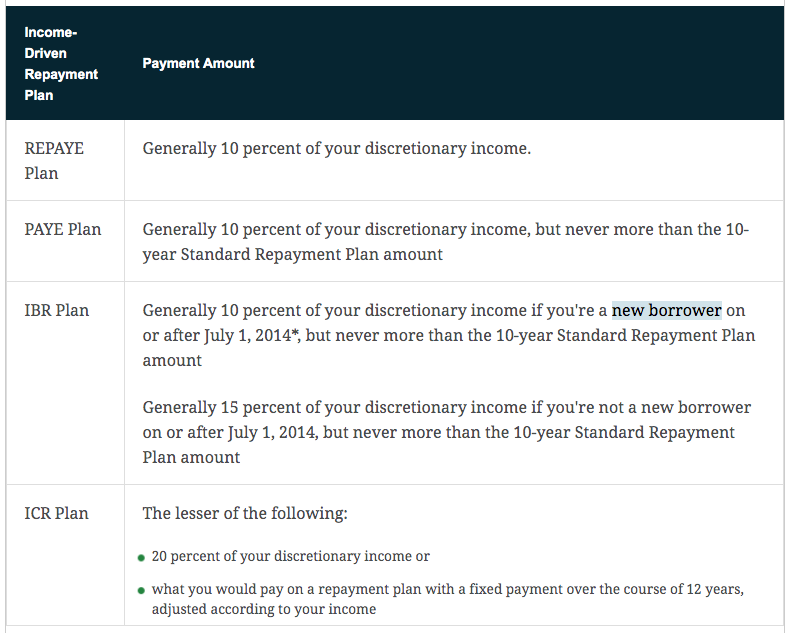

Income-driven plans, however, generally result in lower payments, which leads to a longer repayment period. After 25 years of payments on these plans, your remaining loan balance is forgiven. These plans include:

- Revised Pay As You Earn (REPAYE)

- Pay As Your Earn Plan (PAYE)

- Income Based Repayment (IBR)

- Income Contingent Repayment (ICR)

You can learn about the differences between the income-driven repayment plans in the chart below as well as on the Federal Student Aid website.

This chart outlines the differences between the different income-driven student loan repayment plans. [Image: Federal Student Aid]

How to choose a repayment plan

Finally, the video addresses other important topics on repaying student loans, including:

- How to use the Federal Student Aid repayment estimator to figure out how much you’ll pay under each plan

- How to make monthly payments toward your student loans

- How to enroll in auto debt for student loan payments

In addition to the options outlined in the video, some borrowers may be eligible to refinance their student loans at a lower interest rate through LendKey.

If you need specialized assistance choosing a repayment plan and repaying your student loans, our repayment experts can help. Send us a message or give us a call at 1-888-234-3907.