As we’ve written before, there’s more to rising college expenses than just increasing tuition costs–off-campus housing costs are also skyrocketing, adding to students’ financial burdens even more and forcing them to take on more student debt. And unfortunately, attending a higher-ranked college often means paying more for housing, a new study has found. Elite colleges […]

While most of the focus on rising college costs has been related to tuition, there’s another factor that’s driving college students into debt: high off-campus housing costs.

A recent article from USA Today outlined the impact rising off-campus housing costs are having on students.

Millennials may hear their parents reminisce about putting themselves through college by working a summer job and part-time during the school year, but those days are long gone, NPR reports.

NPR broke down the costs of attending college in 1981-82 and how much students would have to work in order to cover their expenses that year. They then compared this to how much students would need to work to pay for college today with a minimum wage part-time or summer job, and the results are striking.

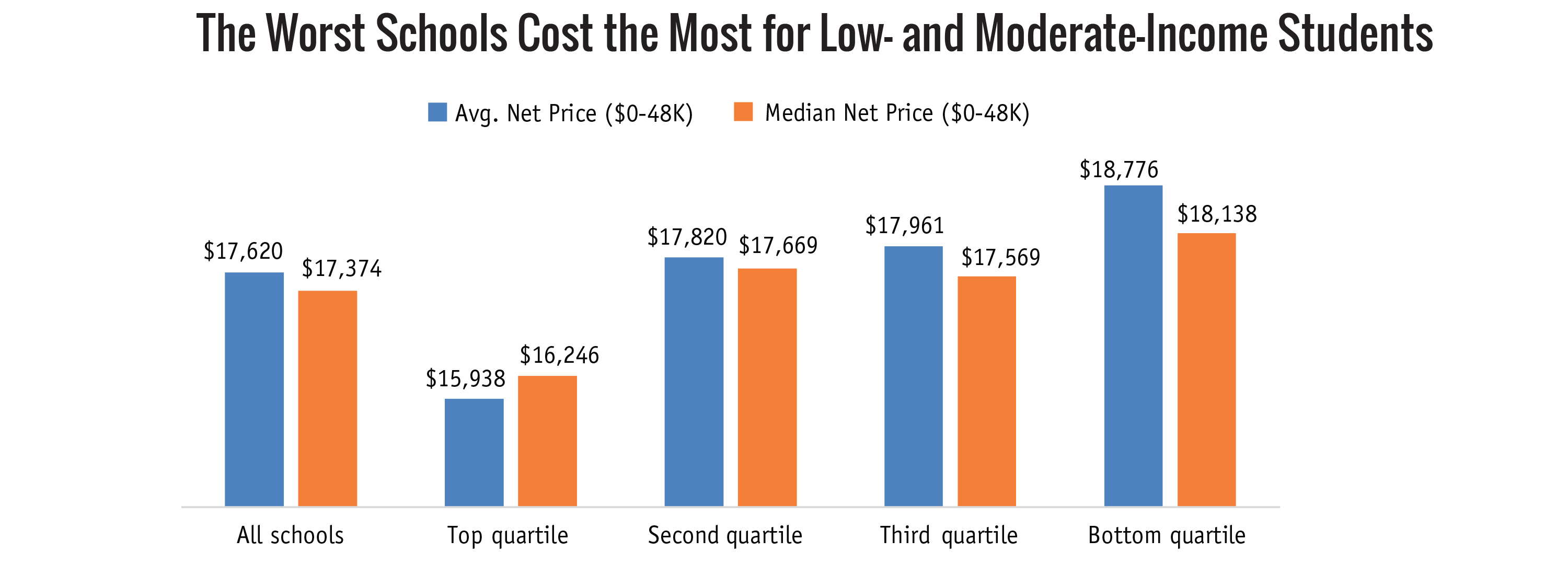

Many students and families assume that the more expensive a college is, the more prestigious and the higher its quality.

This leads some families to overpay for college under the assumption that there is a positive correlation between price and education quality.

But a recent report from Third Way found that that’s not the case.

In fact, they found the lowest-ranked colleges charged low- and moderate-income students more than higher-ranked schools.

We often discuss the dangers of taking on more student debt than you’ll be able to repay. A recent Boston Globe article highlights the difficulty many students, particularly those who are low-income, have with repaying their student loans after graduation. Comparing college net price to graduate salaries In the interactive graphic below, you can see […]

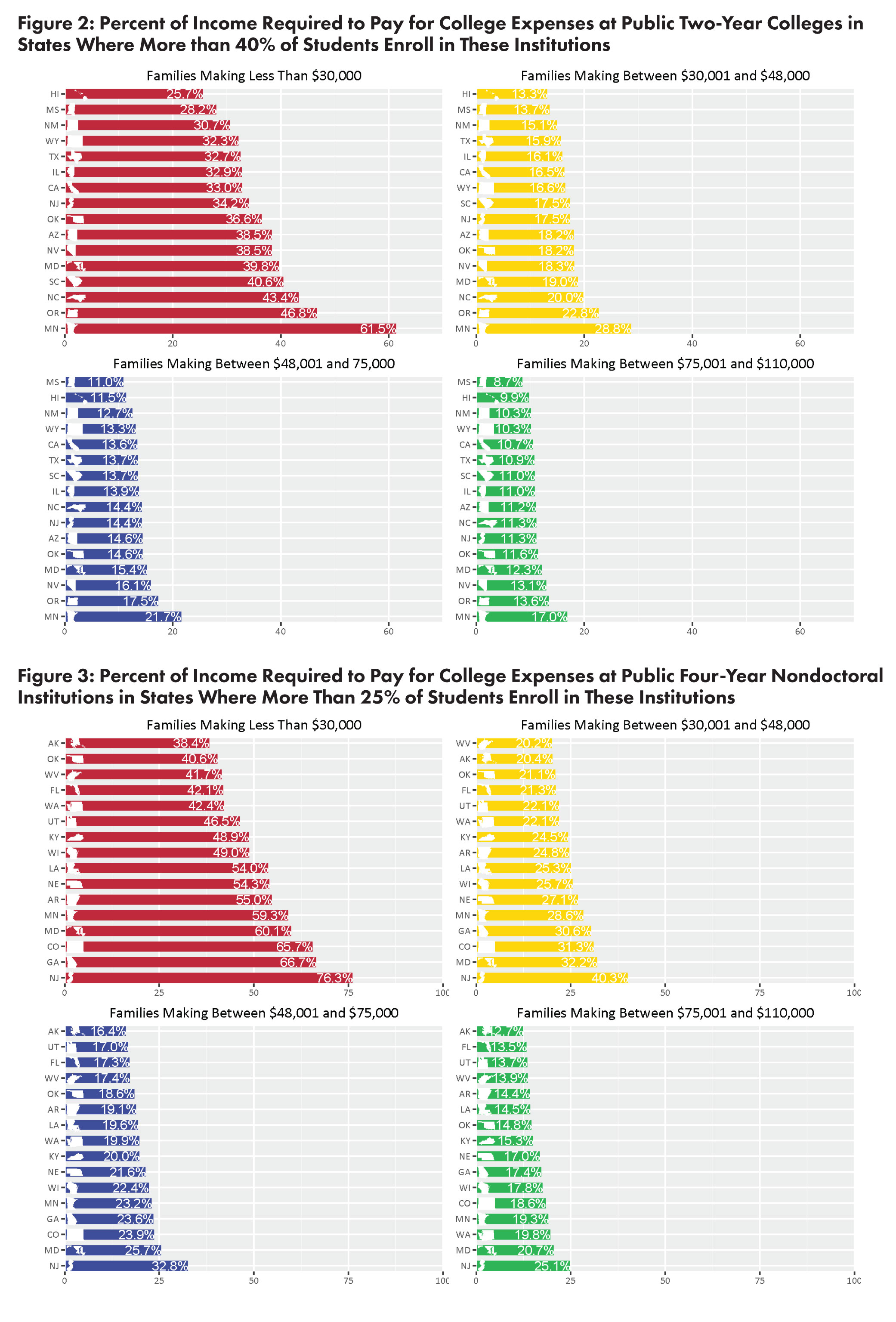

We’ve written previously about how college overall has gotten more expensive, and even though financial aid has reached record levels, it still hasn’t been enough to make up the difference for most families, particularly low-income ones. And a new study from the Institute for Research on Higher Education at the University of Pennsylvania confirms that college […]

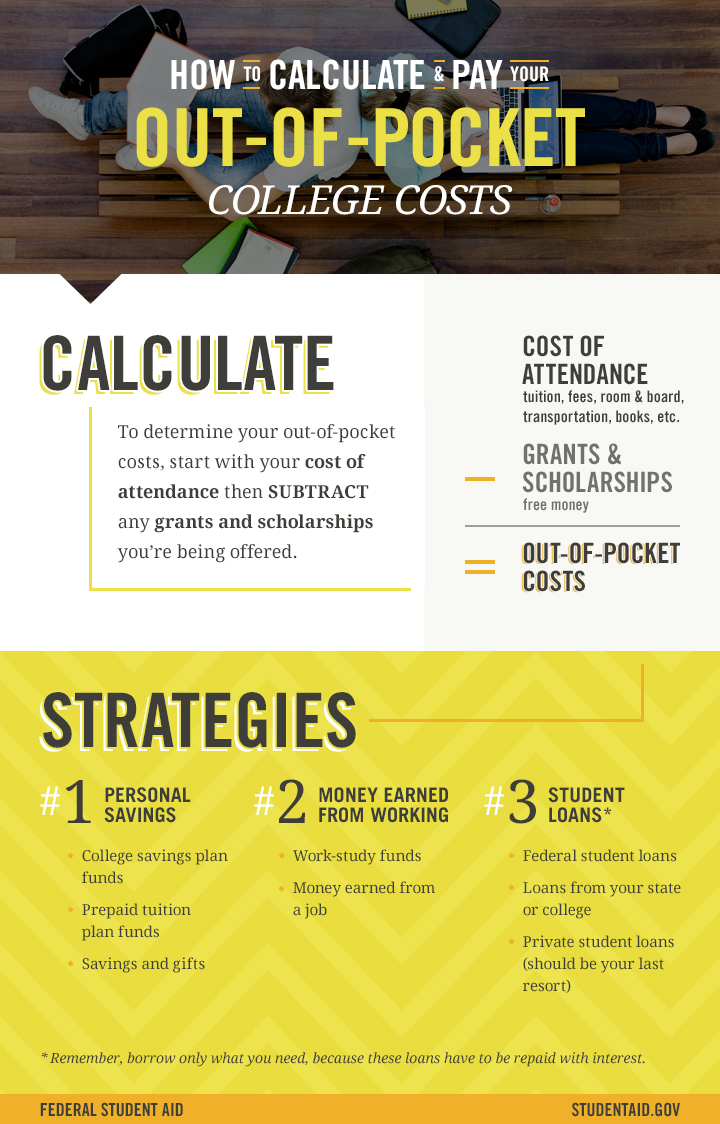

In order to compare financial aid awards from different colleges, you need to be able to understand the different out-of-pocket costs for each college–the total cost you’ll have to pay after grants and scholarships are applied.

With the price of college continuing to rise, some students, particularly those from low-income families, have found themselves struggling to make ends meet. That’s why some colleges in Texas have taken a step to help, by setting up food pantries for students to pick up free groceries, according to The Texas Tribune. There’s a stereotype that most college […]

With college costs higher than ever before, and families taking on more debt to pay for college, some students have sought alternative routes to finance their education.

Some students are now using income-share agreements, or ISAs, to help pay for college. With an ISA, students get money from investors and they agree to pay a percentage of their future income to those investors over a set period of time.

Students in the U.S. pay more for college than in any other country. It’s no secret that the cost of college has risen astronomically and continues to increase each year.

But why is this the case? And what can be done to prevent costs from rising even further?

In a recent podcast from the University of Pennsylvania’s Knowledge@Wharton High School, Wharton management professor Peter Cappelli and PricewaterhouseCoopers Partner Michael Deniszczuk discuss why costs have risen, how financial aid can affect the cost of college and how student loans have affected borrowers and the economy as a whole.