Even as college costs rise, millions of students are missing out on the opportunity to get free money for college.

According to an analysis of federal data by Mark Kantrowitz, senior vice president at Edvisors Network, about 2 million students could have qualified for the need-based Federal Pell Grant during the 2011-12 academic year.

Of that group, 1.3 million would have qualified for a full Pell Grant of $5,645 for the 2013-14 academic year. That’s a free $22,580 over 4 years. If these students had instead borrowed loans to cover that amount, they’d have to pay it all back, plus interest.

So why didn’t these student receive this free money for college?

They didn’t file the Free Application for Federal Student Aid (FAFSA).

Jennifer Lawrence might be America’s BFF, but Senator Elizabeth Warren (D-Massachusetts) is the modern college student’s best ally. Her latest student loan proposal aims put a large dent in the nation’s current $1.2 trillion student loan debt and provide relief for struggling borrowers. Student loan plan could save borrowers $1,000/year As part of the plan, current student loan borrowers […]

In a press release issued February 25, student loan servicer Sallie Mae announced that it will separate into two distinct companies—Navient and Sallie Mae—in fall 2014.

If you have a loan through Sallie Mae, there may be some changes, but the federal government assures borrowers the changes will be minimal, and no changes will occur until later this year.

Here are the 6 things you need to know if you have a student loan serviced by Sallie Mae.

What is student loan consolidation and how does it work?

We love this video from StudentLoanConsolidator.com, which explains the process in a unique way–by using Play-Doh to represent student loan consolidation.

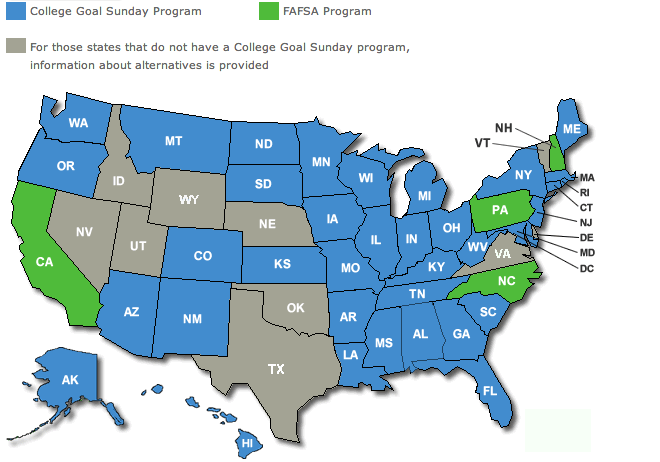

Need help filling out your FAFSA? There’s likely a FAFSA filing event happening near you in the next couple of months.

Check out this map and click on your state for a list of locations, dates, and times for events happening in your state.

Compared to private student loans, whose interest rates vary depending on the borrower’s credit history, federal student loans are a steal. But according to USA Today, a large percentage of private loan borrowers don’t maximize their borrowing of federal student loans.

In fact, the newspaper found that more than half of private loan borrowers failed to max out on federal student loans, and a quarter didn’t take out any federal loans.

This is quite alarming and demonstrates the need for education about the differences between federal and private student loans. Unlike federal student loans, private student loans can have variable interest rates, some greater than 18%. This substantially increase the total amount you repay.

With the cost of college reaching as much as $63,200 at the nation’s most expensive college, Sarah Lawrence, getting financial aid has become a necessity for most families and students.

There are several steps families can take to maximize their financial aid package in order to make college more affordable.

According to U.S. News Education, here’s how to get colleges to show you the money.

Getting ready to go to college or have a child who is? It’s time to fill out the Free Application for Federal Student Aid (FAFSA).

Many parents and students have misconceptions about what the FAFSA is and who should fill it out. Some families don’t bother because they assume they make too much money to qualify for federal aid.

But confusion about the FAFSA can cost you–you may lose out on financial aid, including grants, scholarships, and student loans.

If you have good credit, you can refinance your mortgage or car loan. Why not your student loans? A new bill called “Higher Ed-Lower Debt” has been introduced in Wisconsin as a way of helping people with student debt reduce their interest rates so they can pay off their debt faster. If approved, it would the […]

If you graduated in May, November means the end of your six-month grace period on your subsidized Direct Subsidized and Unsubsidized student loans.

Watch the video below to find out to expect during repayment, and check out the top 4 things to know about repaying your student loans.