Most people understand that student loans come with interest — which can add several thousand dollars onto the life of the loan, especially if you extend out your payments.

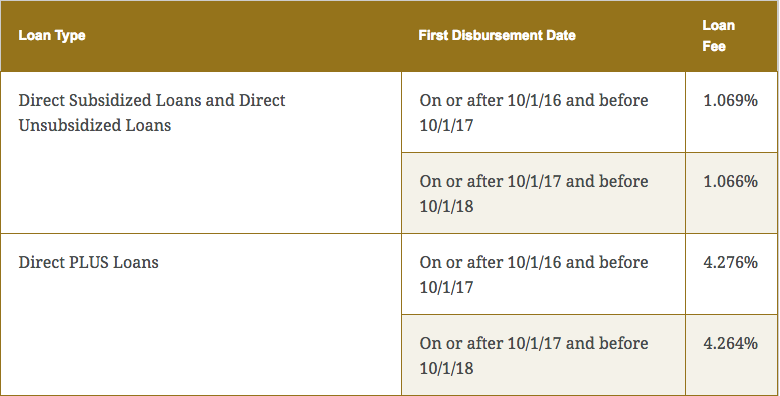

But many people don’t realize that federal student loans also come with origination fees, much like mortgages or car loans, which can add significantly to student debt totals.

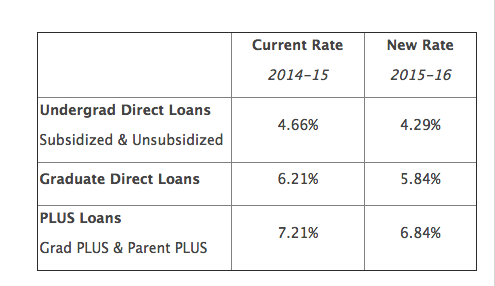

While college costs continue to rise, there’s some good news for students who will be enrolled in college this fall: lower student loan interest rates.

Interest rates on federal student loans for the 2015-16 school year will drop by more than one-third of a percentage point, according to Inside Higher Ed.

Before borrowing money to pay for college, it’s important to know what your loan’s interest rate will be to figure out how much you’ll pay over the life of the loan.

Unfortunately, students and parents will pay more this year than last to borrow for college. Federal student loans remain, however, one of the most affordable options when borrowing for college.

Read on to find out the new student loan interest rates for the 2014-15 academic year.

Sen. Elizabeth Warren (D-MA) says student loan interest rates are ‘crushing’ former students, and something needs to be done. She introduced a plan in March that would let student loan borrowers refinance their loans at lower interest rates. And last week, she filed the bill with the support of 27 co-sponsors. Plan would let borrowers refinance […]

Jennifer Lawrence might be America’s BFF, but Senator Elizabeth Warren (D-Massachusetts) is the modern college student’s best ally. Her latest student loan proposal aims put a large dent in the nation’s current $1.2 trillion student loan debt and provide relief for struggling borrowers. Student loan plan could save borrowers $1,000/year As part of the plan, current student loan borrowers […]

Compared to private student loans, whose interest rates vary depending on the borrower’s credit history, federal student loans are a steal. But according to USA Today, a large percentage of private loan borrowers don’t maximize their borrowing of federal student loans.

In fact, the newspaper found that more than half of private loan borrowers failed to max out on federal student loans, and a quarter didn’t take out any federal loans.

This is quite alarming and demonstrates the need for education about the differences between federal and private student loans. Unlike federal student loans, private student loans can have variable interest rates, some greater than 18%. This substantially increase the total amount you repay.

If you have good credit, you can refinance your mortgage or car loan. Why not your student loans? A new bill called “Higher Ed-Lower Debt” has been introduced in Wisconsin as a way of helping people with student debt reduce their interest rates so they can pay off their debt faster. If approved, it would the […]

Repaying your student loans shouldn’t be scary.

Unfortunately, the shady practices of some student loan servicers have got us spooked.

How do I find out how much I owe in student loans? How do I consolidate my loans? Can I lower my student loan interest rate?

This video featuring Money Magazine reporter Carolyn Bigda answers those questions and more. Watch to find out when to start repaying your student loans, what repayment options you have, and how to set up a student loan repayment schedule.

This summer, college students and their parents narrowly avoided a student loan interest rate hike that would have raised interest rates on new subsidized Stafford loans from 3.4 percent to 6.8 percent. The deal set Federal Stafford Loans for undergraduates at 3.85%, Graduate PLUS loans at 5.4%, and Parent PLUS loans at 6.4%.

While college-bound students and their families breathed a collective sigh of relief, the deal came with a catch: student loan interest rates would be tied to the health of the economy. If the economy improves as economists predict, rates would increase in coming years. In fact, rates would likely climb higher than they were this past spring.

For families who have saved for college with a 529 plan, the new deal presents an interesting conundrum. Should you use the funds in your account now to pay for your student’s education or save them for the future, when it might be more expensive to borrow?