How to transfer your tax information into the FAFSA

The FAFSA is available now at fafsa.gov for students attending college in 2017-18.

Because of its earlier availability (it usually isn’t available until January 1), the Department of Federal Student Aid is allowing families to use tax information from 2015 to complete the form.

It will not be necessary to update your FAFSA next year with 2016 information.

Use the IRS DRT to complete the FAFSA

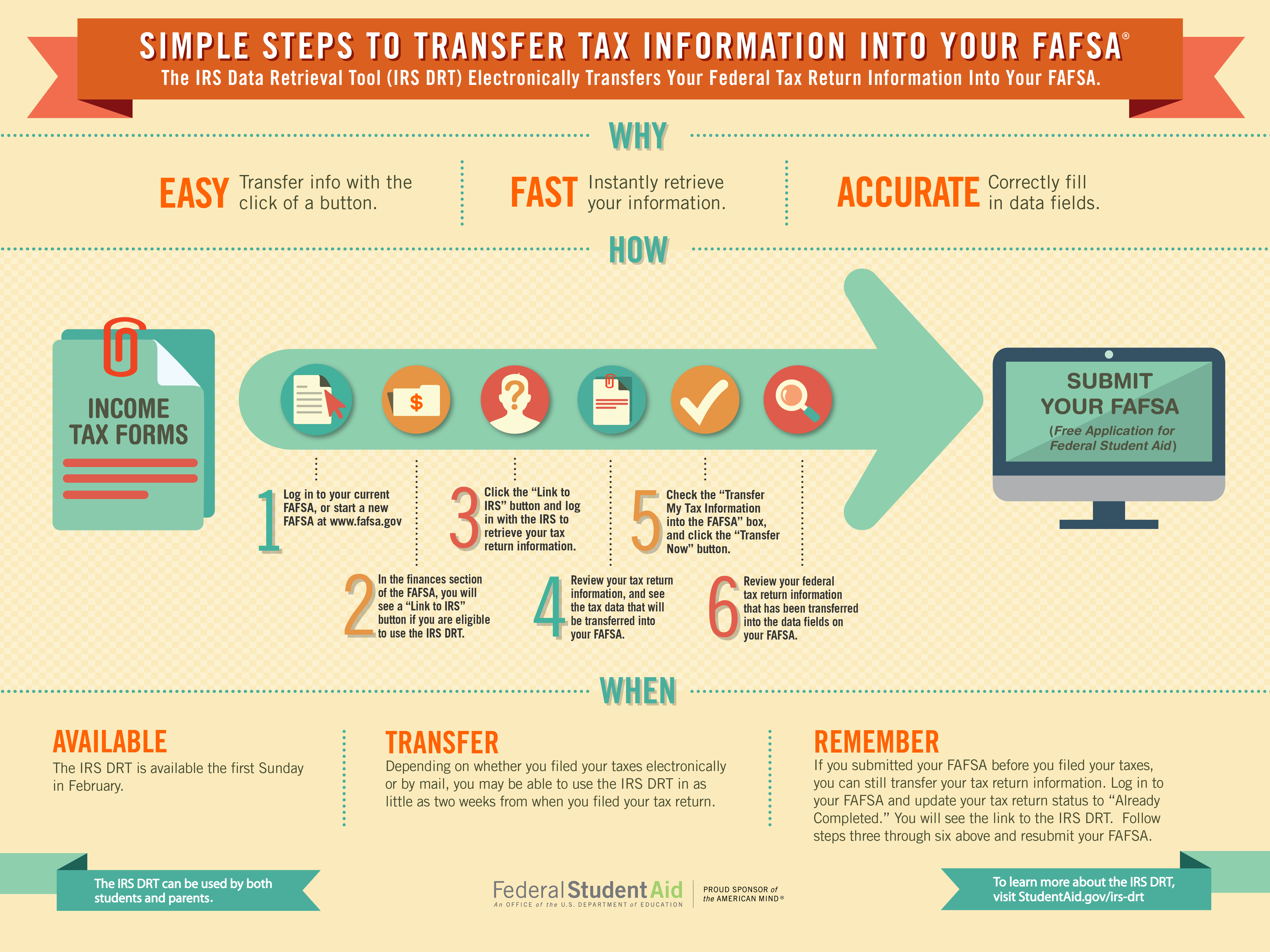

To make it easier for families to complete the form, the Department of Education has put together the infographic below outlining the steps you should take to transfer information directly into the FAFSA using the IRS Data Retrieval Tool (DRT).

This tool allows you to instantly transfer your tax information directly into your FAFSA. It can be used by both students and parents and is the best way to ensure all of your information is accurate.

This infographic explains how to transfer your tax information into the FAFSA using the IRS Data Retrieval Tool. Note that the tool can be used ASAP, not starting February 1 as the graphic says (click to expand the image and get a closer look).

You can find the IRS DRT in the “Financial Information” section of the FAFSA. To use the tool, be sure to indicate that you already completed your tax return.

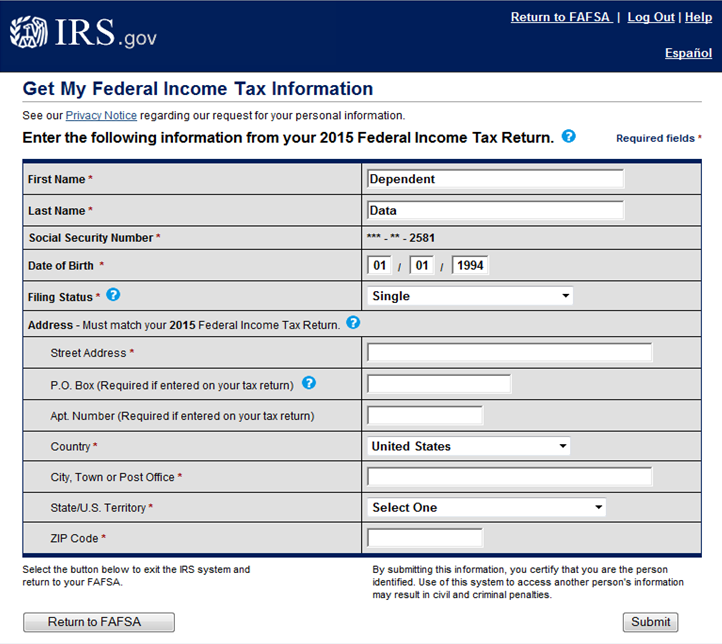

Answer all of the questions and log in using your FSA ID. If you are eligible to use the tool, you will immediately be transferred to it.

Make sure to provide your information exactly as you provided it on your tax return. You will have the opportunity to check over all of the information before submitting it.

When you return to the FAFSA, you’ll see all of your information from the tax returns automatically filled in.

Complete the FAFSA ASAP

If your student is attending college in 2017-18, it’s important to fill out your FAFSA as soon as possible to maximize their eligibility for financial aid. Since you can use older tax information, there’s no reason not to get it out of the way now.

When filling out the form, list any colleges your student is considering, even if they haven’t submitted an application yet. You can also go back later and update it later if you want to add other colleges.

If you haven’t filled out the FAFSA before, be sure to create an FSA ID first. This will allow you to confirm your identity and legally sign your FAFSA. One parent and the student must each create their own FSA ID.

Get the most financial aid

Completing the FAFSA is the most crucial step in applying for financial aid. The best way to get the most money for college is to fill it out as soon as possible after it becomes available. If you need help completing the form, follow this FAFSA guide.

We help families and students navigate the financial aid process, including comparing financial aid packages and figuring out the best way to pay for college.

If you’d like to learn how we can help you, call our financial aid experts at 1-888-234-3907 or send us a message and we’ll get back to you as soon as we can.

fafsa, financial aid, financial aid consulting, IRS Data Retrieval Tool, taxes