The FAFSA is available now at fafsa.gov for students attending college in 2017-18. Because of its earlier availability (it usually isn’t available until January 1), the Department of Federal Student Aid is allowing families to use tax information from 2015 to complete the form.

To make it easier to complete the FAFSA, you can use the IRS Data Retrieval Tool to automatically fill in all of your tax information. This will allow you to submit the form sooner and maximize your chances of receiving financial aid for college.

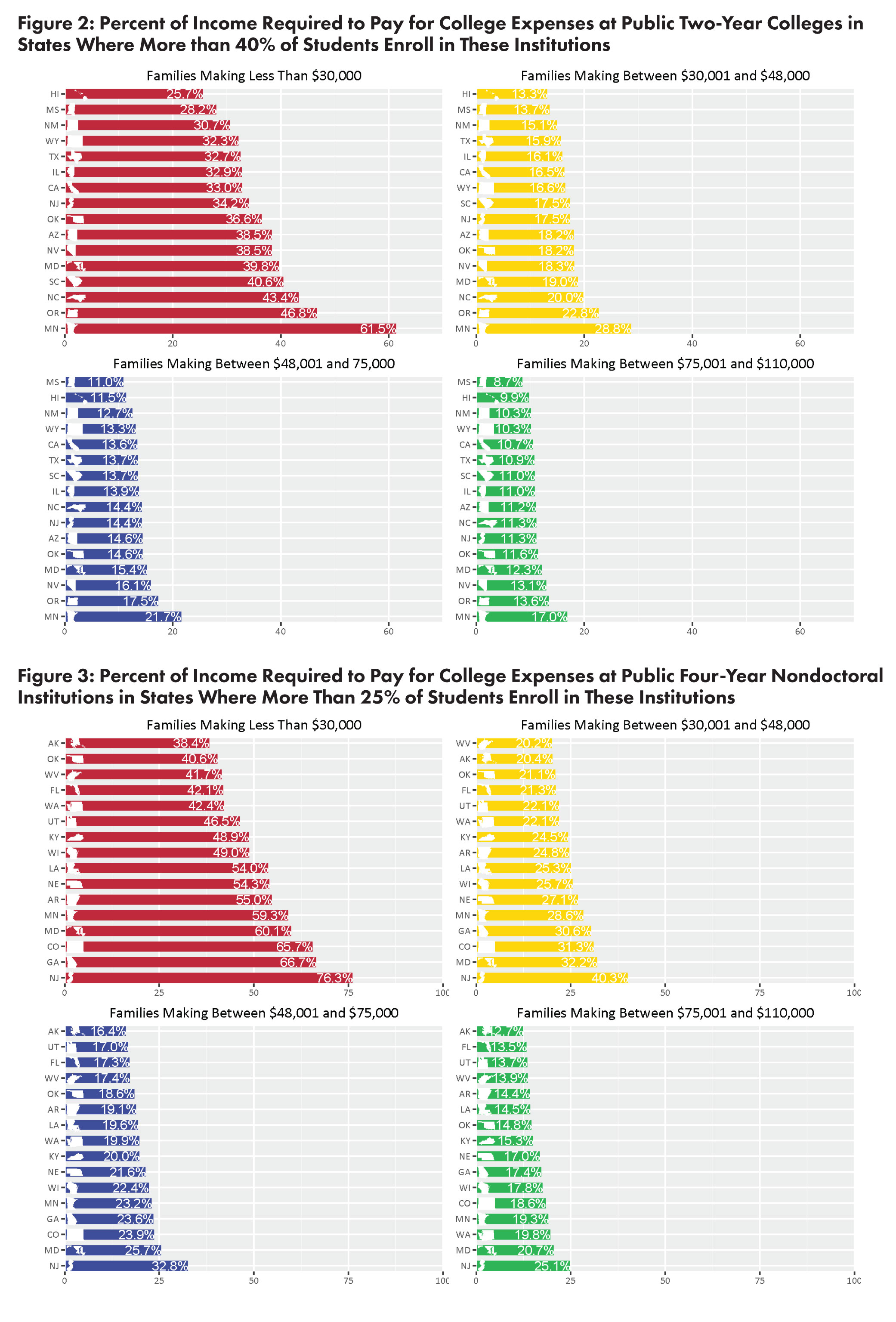

We’ve written previously about how college overall has gotten more expensive, and even though financial aid has reached record levels, it still hasn’t been enough to make up the difference for most families, particularly low-income ones. And a new study from the Institute for Research on Higher Education at the University of Pennsylvania confirms that college […]

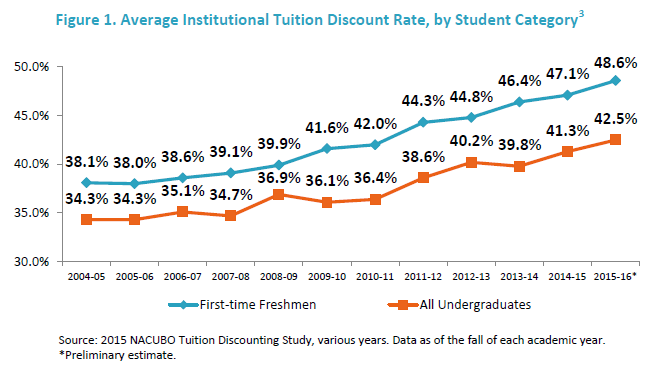

While it’s no secret that college costs are rising, financial aid has been increasing too, providing more opportunities for students to take advantage of discounts at expensive private colleges, MONEY reports. According to The National Association of College and University Business Officers’ annual survey of tuition discount rates, the average freshman student at a private college only […]

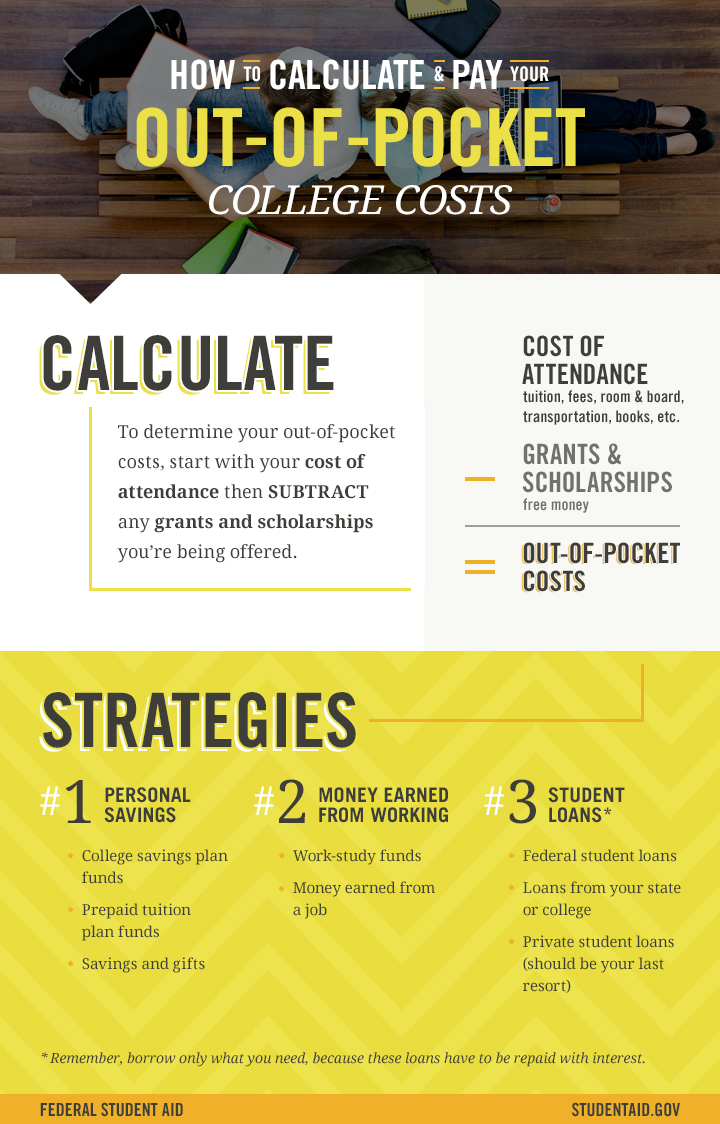

In order to compare financial aid awards from different colleges, you need to be able to understand the different out-of-pocket costs for each college–the total cost you’ll have to pay after grants and scholarships are applied.

In an era of sky-high college costs, it’s extremely important to consider a college’s ROI before committing to potentially take out tens–or even hundreds–of thousands of dollars in student loans to go there.

But it can be difficult for students and families to assess the value of a college before deciding whether or not to attend. Many factors, including the student’s major, will play a role in the long-term value of the degree.

So you’ve been accepted to your dream school. The only problem is, there’s no way you’ll be able to afford to attend based on the financial aid package you have received. Is all hope lost? Not necessarily. Can you negotiate for a better deal? While some schools refuse to negotiate financial aid packages with students, […]