Most college freshmen underestimate student debt

When most students enter college, student debt is a far thing from their minds. They’re more likely to be concerned with classes, making friends, and adjusting to a new place.

Since most students enter college as young adults, it’s difficult for many to grasp how student loans work and the consequences of taking them out.

But not only are new students not understanding how loans work; they’re grossly underestimating how much debt they’ve taken out for college.

And in many cases, they’re under the false impression that they have no student loans at all.

Students don’t realize they have college debt

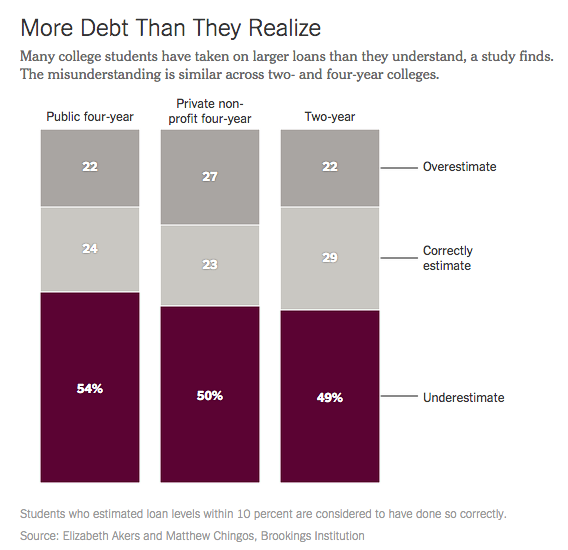

A recent study of college freshmen from the Brookings Institute, as reported by Business Insider, found that about half of all first-year students in the U.S. seriously underestimate how much student debt they have.

Image source: New York Times

In addition, 28% of students with federal student loans reported having no federal debt, while another 14% with federal loans said they had no student debt at all.

Ignorance about college debt hurts students

Given that many students may not even realize they have loans (or assume they have much less), it’s no wonder that the national student debt stands at $1.2 trillion and counting and student loan default rates are on the rise.

As the study’s authors, Elizabeth Akers and Matthew Chingos, write,

College students do not have a firm grasp on their financial positions, including both the price they are paying for matriculation and the debt they are accruing.

Without this information, it’s unlikely that students will be able to make savvy decisions regarding enrollment, major selection, persistence and employment.

Understanding the impact of student debt

So what can be done to make students more aware of the effects of student debt, as well as their actual amounts borrowed?

Many people believe classes on basic financial information should be taught in high schools, so that students have a better grip on how debt accumulates through compound interest.

In addition, parents and college counselors play a role in helping students understand the impact of their decision to take out student loans to pay for college.

As financial aid counselors, we work with students and families to help break down costs and avoid student debt. We also help show them whether the return on their college investment is worth it, so that they can fully understand the total costs and evaluate whether or not taking on loans is a good idea.

We never want to see a student or family uninformed about how they’re paying for college, so we do everything we can to make the cost and financial aid process as transparent as possible.

In addition, for students who may already have left college and have student loans, we help them find the best repayment plan for their situation so they can avoid falling behind on payments and get rid of their student debt.

If you’d like to learn how we can help your family pay for college or manage your student debt, give us a call at 1-888-234-3907 or contact us using this form.

affording college, college debt, paying for college, student debt, student loans