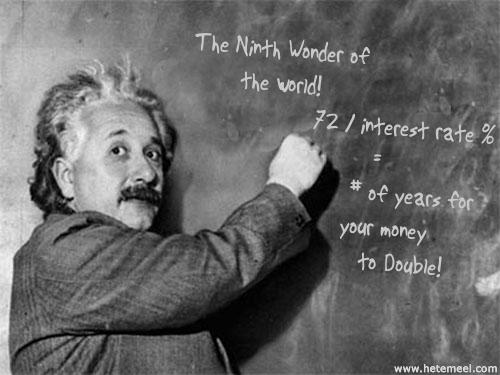

The most powerful force in the universe

What’s the most powerful force in the universe, according to Albert Einstein?

It’s not gravity. It’s not even love.

It’s compound interest.

What exactly is compound interest?

Compound interest is any interest accrued on a loan that is added to the outstanding principal amount borrowed.

So if you borrow $20,000 in unsubsidized loans for school at a 6% interest rate, you’ll pay $21,200 with interest added, right?

Not so fast. Because the interest is compounded, you’ll pay interest on a higher amount as time goes on–not just on the original $20,000.

Subsidized vs. unsubsidized loans and interest

For subsidized federal loans, interest begins accruing on the loan after you leave school and your grace period ends. Once interest begins accruing, it was be added to the original amount you borrowed.

If you pay off your subsidized loans before your grace period is over, you’ll pay no compound interest. But if you don’t, the interest that accrues on the loan will be compounded, and you’ll pay more over time.

Interest starts accruing on unsubsidized loans the moment you take them out, and the amount added to the principal begins to accrue interest immediately. So if you have unsubsidized loans, you’ll leave school with a debt total higher than the original amount you borrowed if you’re not paying the interest that accrues on your loans each month.

Pay off student loans as fast as you can

This post from CU Student Loans does a good job explaining how compound interest works and why it’s important to pay off your loans as soon as you can in order to avoid paying thousands of dollars in interest.

By getting pro-active with repayment, a borrower can mitigate the expansion of debt to an unmanageable amount. If a student chooses not to make payments while in school, they should recognize that compound interest will force that debt to increase and cost much for repayment later. The wise move is to counter the impact of compounding interest by beginning loan repayment immediately, and adding additional accelerating payments if possible.

How much should I be paying each month?

Of course, it’s not always possible for students to pay off their student loans quickly, particularly if they’re suffering from economic hardship, are unemployed, or have large debt balances. In that case, it’s necessary to choose a repayment plan with monthly payments you can afford, since falling behind on your student loans can have significant repercussions as well.

If you’re having trouble making your monthly payments on your student loans, or if you’re not sure how much you should be paying each month to avoid paying extra interest over time, we can help. Just give us a call at 1-888-234-3907, tweet us at @CFGCollege, or send us a message.

college costs, college debt, college loans, compound interest, loan repayment, repayment, student loan interest, student loan repayment, student loans