Public Service Loan Forgiveness (PSLF) is a fantastic program is you can qualify for it. PSLF forgives the remaining balance on your federal student loans if you meet certain requirements, which include working full-time in a public service position while repaying your student loans.

The program is in danger of being cut in President Trump’s latest budget. However, this change would only apply to student loans taken out on or after July 1, 2021. Therefore, if you’ve been making payments under this program up to this point, you are still eligible.

Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

With private student loan interest rates on the rise, and the high cost of college forcing many students and parents to take on debt to pay for college, student loan refinancing has emerged as an option for borrowers to reduce their interest rates (depending on their credit score) and save money on repayment.

Find out why you should consider refinancing your student loans, and learn about SoFi, one of the best-known student loan refinancing companies.

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

Good news for student loan borrowers burdened with debt: the U.S. is on pace to forgive at least $108 billion in student debt over the next 10-20 years, according to a report from the Government Accountability Office.

While 401(K) contributions have traditionally been a benefit companies used to lure talented employees, innovative companies are beginning to offer a new benefit that their millennial employees need even more: help paying their student loans. A recent article in The Hechinger Report discussed the rise of employee benefit programs aimed at helping employees pay student debt. […]

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

We’ve written about the consequences of not paying your student loans, such as having your wages garnished and your credit damaged.

But it turns out the repercussions could be much higher. According to the NY Daily News, a man in Houston was recently arrested by seven U.S. Marshals armed with automatic weapons for not paying a $1,500 student loan from 1987.

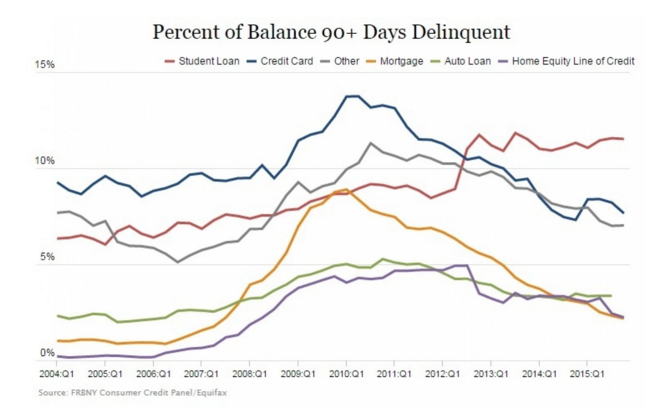

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

With the national student debt now at $1.3 trillion, and thousands of borrowers in default, some borrowers are going to great lengths to avoid paying back their debt–including moving to a whole other country. Hiding from student debt collectors abroad An interesting new article from VICE takes a look at the many Americans who have moved […]