Student debt is at over $1.6 trillion. That’s a lot of money that needs to be paid back to the federal government, lenders and college.

But what if it didn’t have to be paid back? Where would it go?

According to economists, it would go toward spending, like purchasing homes, cars and other necessities. All of this would help boost the economy, they say.

As new college graduates look for jobs and prepare to start the next phase of their lives, many consider moving for career or financial reasons.

With most graduates carrying student debt, finding a place to live where they can build a career and repay their loans is extremely important.

Students in the U.S. pay more for college than in any other country. It’s no secret that the cost of college has risen astronomically and continues to increase each year.

But why is this the case? And what can be done to prevent costs from rising even further?

In a recent podcast from the University of Pennsylvania’s Knowledge@Wharton High School, Wharton management professor Peter Cappelli and PricewaterhouseCoopers Partner Michael Deniszczuk discuss why costs have risen, how financial aid can affect the cost of college and how student loans have affected borrowers and the economy as a whole.

We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

Before going to college, many students don’t really think about maximizing the return on their college investment. In their mind, just getting into college and attending is enough. But in today’s world, it’s not enough to just have a college degree. You have to be armed with other skills that demonstrate you can add value […]

While college does more than prepare you for a job, it’s a reality that career preparation is part of a college education.

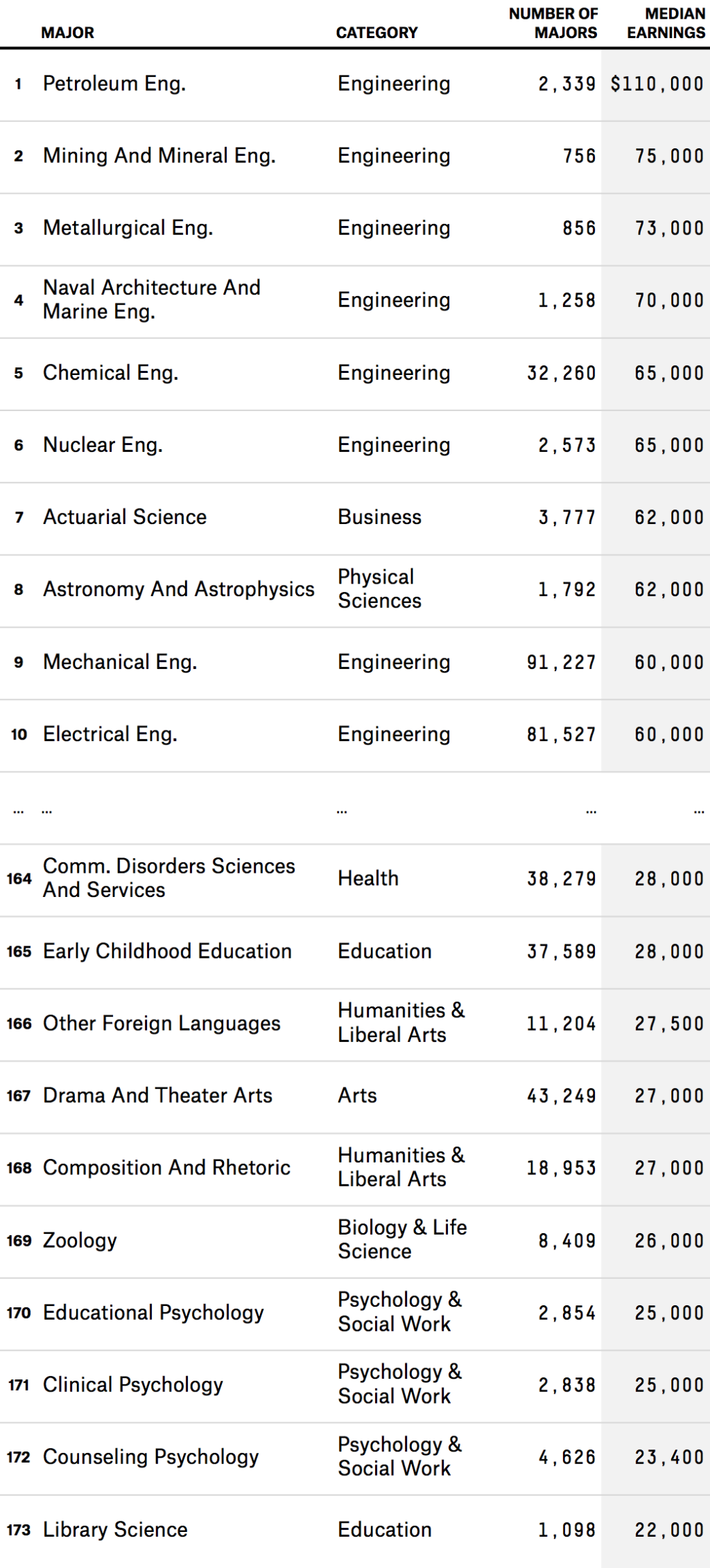

With the average cost of college rising rapidly each year and student debt topping $1.2 trillion, it’s crucial for today’s college students to research what types of jobs they’ll be able to get after college and figure out how much they can expect to make, particularly if they have student loans to pay.

Most parents look forward to their children graduating from college, as it marks the time in their lives when they can start becoming real adults and taking care of themselves–moving out, finding a full time job, and potentially getting married, having kids, or buying a home.

But a recent study from the University of Arizona, as reported by CNN Money, has found that that’s not the case for more than half of recent college graduates, who report they still depend on their parents for money.

As parents of college-bound students know, applying to college is more than a financial decision–it’s an emotional one as well. Our founders Rick Ross and Andy Leardini recently appeared on Winging it! Buffalo Style to discuss the challenges families and students face when choosing a college and figuring out how to pay for it. Taking the emotion […]

While the return on value of a college degree is at an all-time high, according to a recent analysis by FiveThirtyEight, not all degrees are created equal. As we’ve written, the return on investment of a college degree depends on many factors, including the field of study, student’s debt level, and what the graduate does with […]

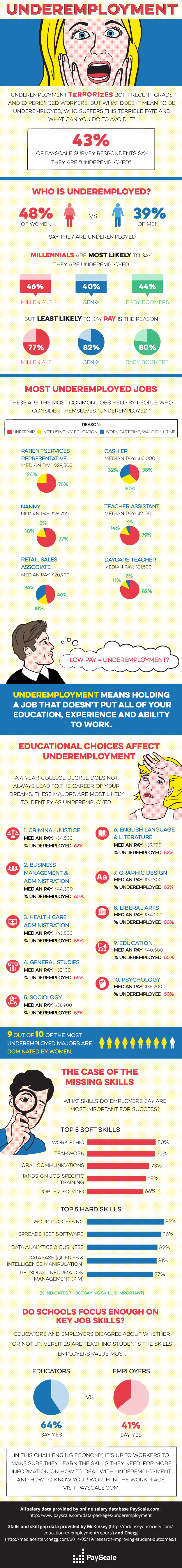

According to a recent PayScale survey, of 68,000 workers, 43% of Americans feel underemployed in their jobs.

As we recently reported, the worker’s choice of college major is a factor in feeling underemployed. Healthcare and Business majors were among the top majors listed by underemployed workers.

This infographic from PayScale presents a broader look at underemployment in America–including the jobs in which workers feel most underemployed and the ‘hard’ and ‘soft’ job skills employers most value.