When the Excelsior Scholarship Program was announced, many believed it meant that the majority of students in New York state would now be able to attend college for free.

That’s not entirely the case, as we explain in our recent post about the program. And more details have emerged that should give pause to students and families depending on this program.

Many of our clients have been asking about the new Excelsior Scholarship program, which will provide free tuition at in-state public colleges for New York state students if their family meets certain income requirements.

While it may sound too good to be true, there are a lot of important details and things you need to keep in mind when considering the program. Read these important FAQs about the program, and contact us if you want personalized help figuring out whether it is a good option for your family.

When you have multiple kids in college, filling out the FAFSA can be tricky. Luckily, the Department of Education put together a guide to answer your most pressing questions.

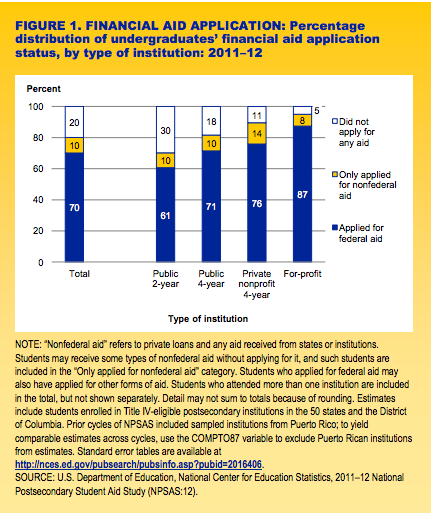

We write often about the importance of applying for financial aid, even if you don’t think you’re qualified to receive it.

But a new study from the National Center for Education Statistics (NCES) found that 1 in 5 students don’t apply for financial aid at all.

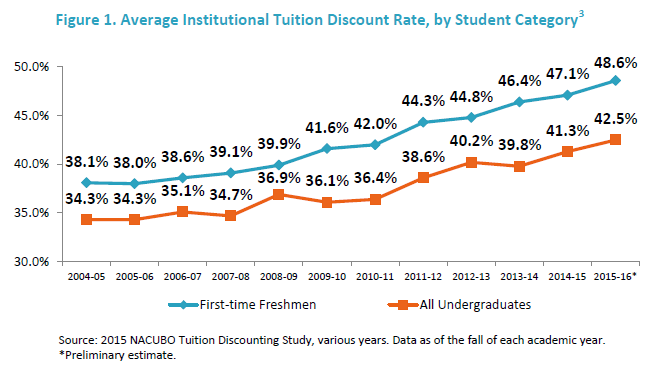

While it’s no secret that college costs are rising, financial aid has been increasing too, providing more opportunities for students to take advantage of discounts at expensive private colleges, MONEY reports. According to The National Association of College and University Business Officers’ annual survey of tuition discount rates, the average freshman student at a private college only […]

We write often about the necessity of making college more affordable in order to minimize student debt. One of the best ways to reduce your college costs is through private scholarships. They can be time-consuming to apply for, but winning free money for college is definitely worth it. With scholarships, you’ll have to take out less in […]

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

With college costs higher than ever before, and families taking on more debt to pay for college, some students have sought alternative routes to finance their education.

Some students are now using income-share agreements, or ISAs, to help pay for college. With an ISA, students get money from investors and they agree to pay a percentage of their future income to those investors over a set period of time.

We reported earlier this year how students and parents were required to create an FSA ID in order to fill out the Free Application for Federal Student Aid (FAFSA) this year and explained how to do it in this post. But the new FSA ID requirement is causing confusion and problems for parents and students trying to submit […]

There are many factors that determine financial aid eligibility, and it can be difficult to know how much aid you’ll get before you apply.

With college being such a large investment, it’s important to do research and understand how financial aid is determined before applying to colleges in order to maximize your financial aid package.

In a recent segment on Time Money, Lynnette Khalfani-Cox, author of College Secrets: How to Save Money, Cut College Costs and Graduate Debt Free, explains how to maximize your financial aid, the difference between merit and need-based aid, and why you should fill out the FAFSA even if you don’t think you’ll qualify for aid.