Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.

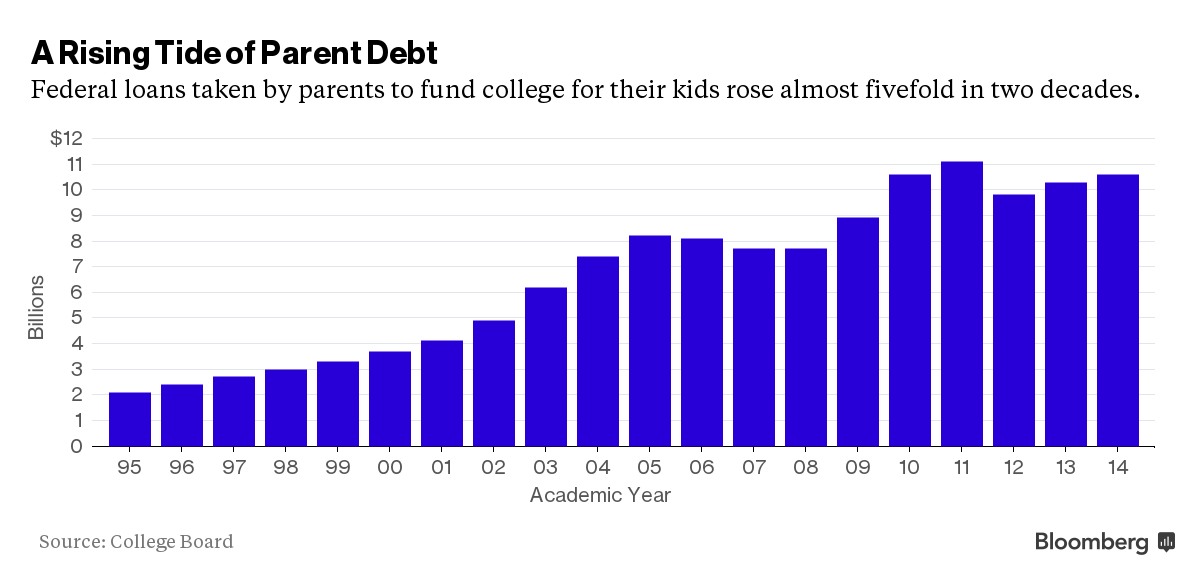

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

The government recently dropped some huge news for those with federal student loans.

Starting Dec. 16, all federal student loan borrowers will be eligible for an alternative repayment plan called Revised Pay As You Earn (or REPAYE), MONEY reports.

Not paying your student loans can have some serious consequences, including a lowered credit score and having your wages garnished.

But what if there was a way to avoid paying your student loans with no repercussions?

Actually, there is–if you quality for a student loan forgiveness program.

As we’ve explained, defaulting on your student loans has several consequences and could severely damage your credit score.

Of course, it’s best to avoid default by getting on the right student loan repayment plan for your situation and paying your loans on time. But if you’ve already defaulted on your loans, there is a way out.

This helpful video from Centsible Student explains what to do if you’ve defaulted on your loans and what options you have, including repayment plans and student loan consolidation.

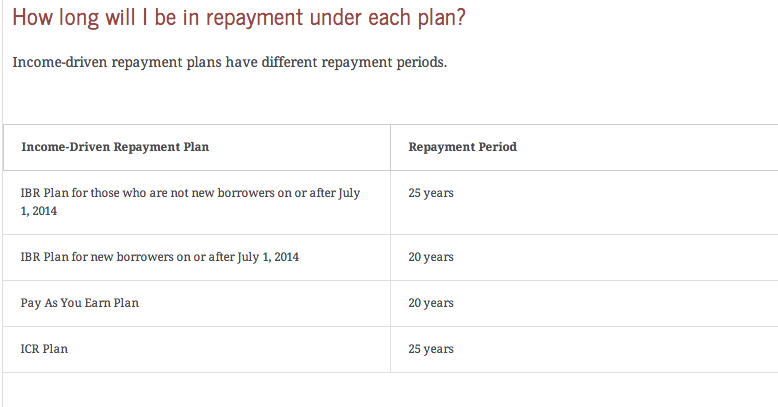

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

When we say we are financial aid and student loan repayment consultants, many people assume we work for a college financial aid office, bank, or other outside organization.

But our work is completely independent. As student loan repayment consultants, we work one-on-one with student loan borrowers to set up a repayment schedule that allows them to manage their debt.

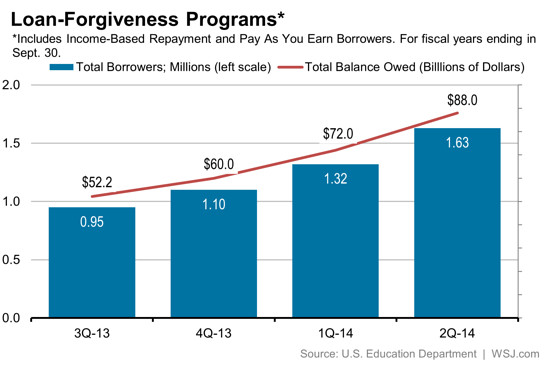

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.