Parents now have $71 billion in federal student loan debt

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

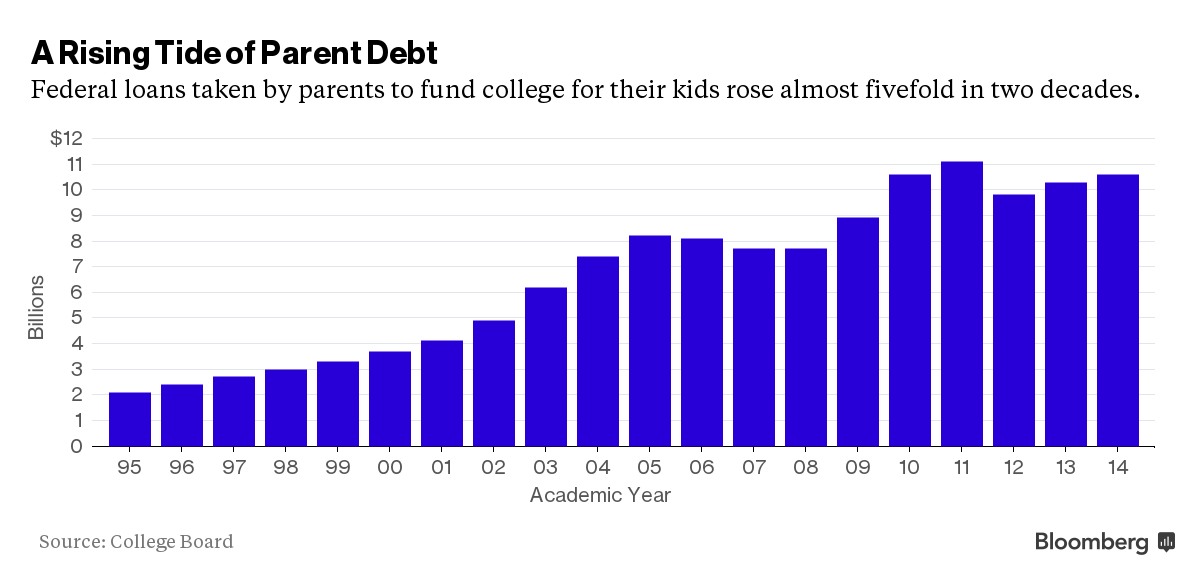

Parent student loan debt on the rise

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

This is in part due to the rising cost of college, which has forced parents to take out larger loans each year. In 1995, parents borrowed a little over $2 billion in student loans, while in 2014, they borrowed nearly 5 times as much.

About 3 million parents have $71 billion in parent PLUS loans, contributing to more than $1.2 trillion in federal student loan debt.

Parent PLUS debt not being paid back

And not only is the amount of parent student debt high–it’s not being paid back, causing the balance to continue to rise due to accumulating interest.

As of May 2014, half of the balance was in deferment, with annual interest rates as high as 7.9 percent.

Even after financial aid, many families find that they can’t afford a college’s cost of attendance for their child, which is why many take out federal PLUS loans and use the funds to cover the gap and pay for tuition, room, board, fees and books.

But due to their higher interest rates (currently 6.8 percent, down from almost 8 percent from July 2006 to June 2013) and origination fees (currently 4.3%) many parents find themselves crushed by debt if they can’t pay the loan back right away.

And even when they defer the loan, interest continues to accrue, and their balance continues to rise.

Alternatives to parent PLUS loans

Luckily, there are alternatives to parent PLUS loans for families who find themselves with a larger bill than they can pay for their children’s college.

LendKey offers private student loans at rates as low as 2.99%, much lower than the rate on new parent PLUS loans and even federal Stafford loans. And unlike the government with parent PLUS loans, most of their credit union lenders don’t charge an origination fee when you take out the loan.

If you quality for a low interest rate, it’s definitely a good option to consider before taking out parent PLUS loans.

Making college more affordable for families

Unfortunately, for most parents with PLUS loans, refinancing isn’t an option. They can, however, work with their lender to get on a repayment plan that can help them afford their monthly payments.

We help borrowers already struggling with student loan debt get on the right repayment plan for their situation so they can afford their monthly payments and avoid falling behind.

It’s also crucial to apply for financial aid and scholarships and make college as affordable as possible when your children apply to college in order to help you avoid taking out loans in the first place.

We help families find ways to reduce the cost of college and find ways to pay for it. If you’d like to learn how we can help you, call us toll-free at 1-888-234-3907 or contact us using this form.

federal student loans, parent debt, parent plus loans, paying for college, plus loans, repayment, repayment options, student debt, student loan debt, student loan delinquency, student loans