While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

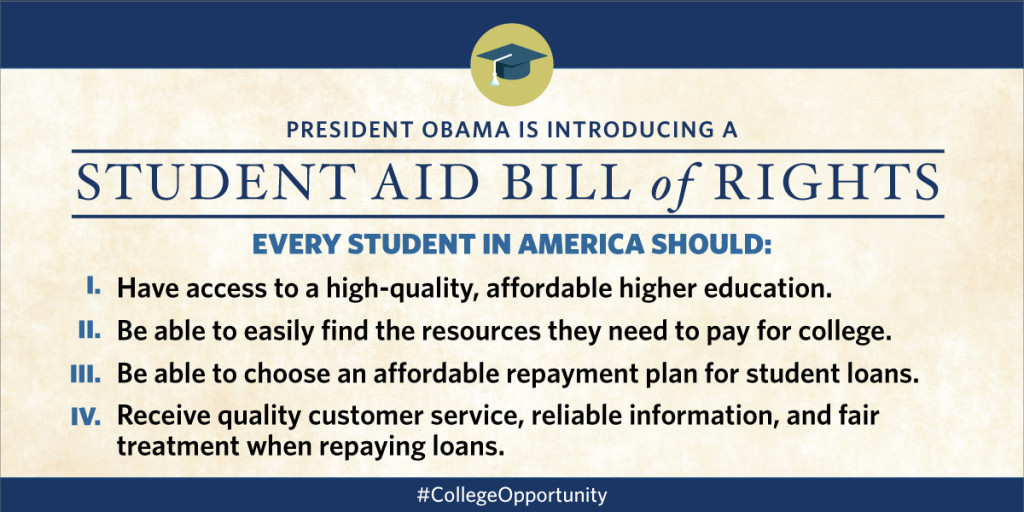

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.

In a press release issued February 25, student loan servicer Sallie Mae announced that it will separate into two distinct companies—Navient and Sallie Mae—in fall 2014.

If you have a loan through Sallie Mae, there may be some changes, but the federal government assures borrowers the changes will be minimal, and no changes will occur until later this year.

Here are the 6 things you need to know if you have a student loan serviced by Sallie Mae.

Do you ever feel like your student loan servicer is out to get you? You’re not being paranoid.

A new report has found that student loan servicers aren’t doing much to help borrowers repay their student loans. In fact, they seem to be actively trying to prevent borrowers from paying off their student debt as quickly as possible.

With outstanding student debt now topping $1.2 trillion, it’s extremely important for students to understand their repayment options and take advantage of relief programs to avoid defaulting on their student loans and hurting their credit. But according to ThinkProgress, students aren’t taking advantage of these programs. While one in eight student debtholders is in default, just three percent are enrolled in the income-based plans offered by the […]