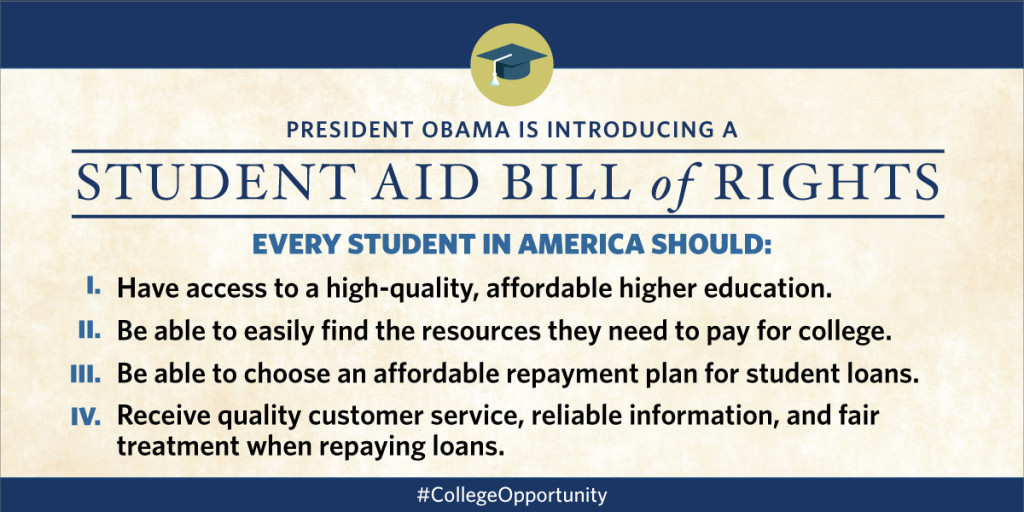

President Obama introduces Student Aid Bill of Rights

While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.

New protections for student loan borrowers

The new Student Aid Bill of Rights includes:

- the right to have access to a quality, affordable college education;

- the right to access the resources needed to pay for college,

- the right to an affordable student loan repayment plan; and

- the right to quality customer service, reliable information, and fair treatment from student loan lenders and servicers, even if they struggle to repay their loans.

Making student loan repayment more affordable

But the government isn’t just outlining these rights–it’s taking action. Their initiatives to promote affordable federal student loan payments include:

- The development of a simplified, centralized website for borrowers to view their student loan information, provide feedback and file complaints about lenders who engage in inappropriate or illegal behavior (such as harassment, making it difficult for the student to repay loans, or not giving the student helpful and accurate information);

- Increased consumer protections on federal loans, such as making sure that any prepayments apply first to loans with the highest interest rates unless the borrower specifies otherwise;

- Forcing lenders to provide greater disclosure during the student loan process, including letting borrowers know when federal student loans are transferred from one servicer to another, when borrowers fall behind in their payments, and when borrowers begin but do not complete applications to change repayment plans

- Clearer information for borrowers who become disabled or declare bankruptcy;

- A simpler process for helping students enroll in and stay on income-based repayment plans, which offer more affordable monthly payments for qualifying borrowers;

- Raising standards for student loan debt collectors to ensure that they charge borrowers reasonable fees and help them return to good standing; and

- Working with experts to continually utilize the best technology for communicating with borrowers, monitor student loan trends, and improve service for borrowers.

These provisions are aimed at making student loan repayment simpler and more affordable for student loan borrowers.

Helping student loan borrowers repay debt

We’re extremely supportive of this new initiative and believe in all of the rights the President has outlined.

We’re big believers in making college affordable and helping students and families find ways to reduce their college costs.

We also help student loan borrowers repay their debt and find the best student loan repayment plan for their situation.

We’re also glad to see the government taking a stand against shady practices by student loan servicers like Sallie Mae / Navient.

By default, many student loan servicers don’t always apply payments in the most advantageous way for the student, such as applying early payments to lower-interest loans first. These new protections, however, will help put borrowers in a better position to pay off their loans as soon as possible.

Reduce student loan debt

We’re hopeful that these new initiatives make it easier for borrowers to enroll in repayment plans that make it easier to repay their loans and reduce student loan default.

Remember, these provisions don’t apply to private student loans, so it’s important to be sure you’re borrowing from a reputable lender if you choose to go that route.

Of course, the best way to prevent the struggles that come with student loan debt is to make college affordable before you ever step foot in the classroom.

If you need help figuring out how to pay for college or reduce your student loan debt, give us a call at 1-888-234-3907 or contact us using this form.

college debt, college loans, federal student loans, sallie mae, student debt, student loan delinquency, student loan lenders, student loan repayment, student loan servicers, student loans