Without a doubt, college is one of the most expensive investments a student will ever make. Even for families who have saved since their child was born, the cost of higher education can be crippling. Even respected journalists say the cost of college has gotten out of control. In the video below from CNNMoney, Stephen […]

According to a report released Wednesday, the average student loan debt for a member of the class of 2012 was $29,000, up from $26,600 in 2011.

This increase follows recent trends, with student loan balances for new graduates rising at an average rate of 6% per year from 2008 to 2012.

If you have good credit, you can refinance your mortgage or car loan. Why not your student loans? A new bill called “Higher Ed-Lower Debt” has been introduced in Wisconsin as a way of helping people with student debt reduce their interest rates so they can pay off their debt faster. If approved, it would the […]

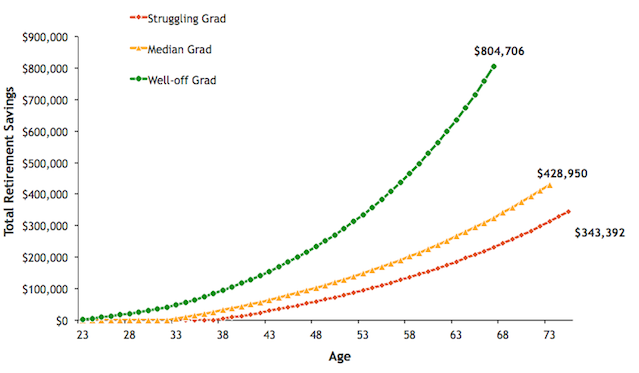

Millennials: have the stresses of work life got you looking forward to retiring on a beach somewhere? You’re going to be waiting a while. How student loans affect retirement A new report from financial website NerdWallet says student loan debt could push the average retirement age to 73. That’s 12 years later than the current […]

Repaying your student loans shouldn’t be scary.

Unfortunately, the shady practices of some student loan servicers have got us spooked.

How do I find out how much I owe in student loans? How do I consolidate my loans? Can I lower my student loan interest rate?

This video featuring Money Magazine reporter Carolyn Bigda answers those questions and more. Watch to find out when to start repaying your student loans, what repayment options you have, and how to set up a student loan repayment schedule.

Depending how you look at it, repaying your student loans can be a positive or a negative experience. Once Julia of SaltMoney.Org took a positive outlook and accepted her student debt as a part of her life, it became much easier to pay it off. In the video below, Julia explains how she built her student loan repayment […]

Do you ever feel like your student loan servicer is out to get you? You’re not being paranoid.

A new report has found that student loan servicers aren’t doing much to help borrowers repay their student loans. In fact, they seem to be actively trying to prevent borrowers from paying off their student debt as quickly as possible.

Cinderella never had to worry about student loans. And she got to live in a castle and had her own room. She might have had to work for her room and board, but her situation sounds pretty great compared to the typical college student’s cramped living quarters.

And even if Cinderella had gone to college, she had a fairy godmother to step in and wipe away her student loans.

Are you planning on taking out student loans to pay for college? It’s important to have a plan in place before taking on too much student debt. Remember, unlike other forms of debt, student loans can’t be discharged if you declare bankruptcy.

When choosing a college, it’s important to keep future student debt in mind. Forbes advises that students should keep college debt below their expected first year’s salary. While this may seem impossible given the rising cost of college, it demonstrates the need to be diligent in your college search to find a school that offers significant financial aid while providing a quality education.