Sen. Elizabeth Warren (D-MA) says student loan interest rates are ‘crushing’ former students, and something needs to be done. She introduced a plan in March that would let student loan borrowers refinance their loans at lower interest rates. And last week, she filed the bill with the support of 27 co-sponsors. Plan would let borrowers refinance […]

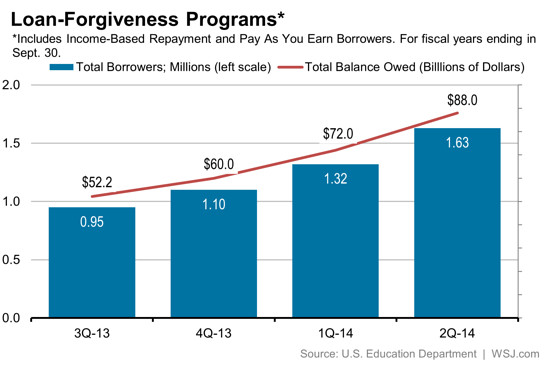

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.

What’s keeping millennials up at night? It’s not just Netflix–it’s student debt.

NPR’s Morning Edition recently asked young adults, members of the millennial generation, what their biggest concerns were.

The results were telling: almost two-thirds responded that college debt was their biggest worry.

Good news (finally!) for young college graduates.

According to a survey released on April 16, employers said they plan to increase the number of college graduates they hire this year by nearly 9 percent.

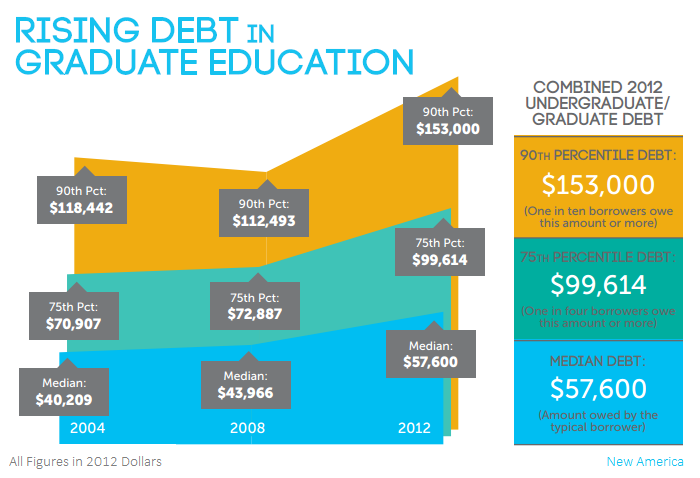

And you thought undergraduate student loan debt was bad.

According to a new report by the New America Foundation, the median debt load for borrowers leaving school with a master’s, medical, law or doctoral degree was $57,600 in 2012–about twice the average amount today’s typical undergrad leaves college with.

This represents a 43% increase from 2004 to 2012 when adjusted for inflation.

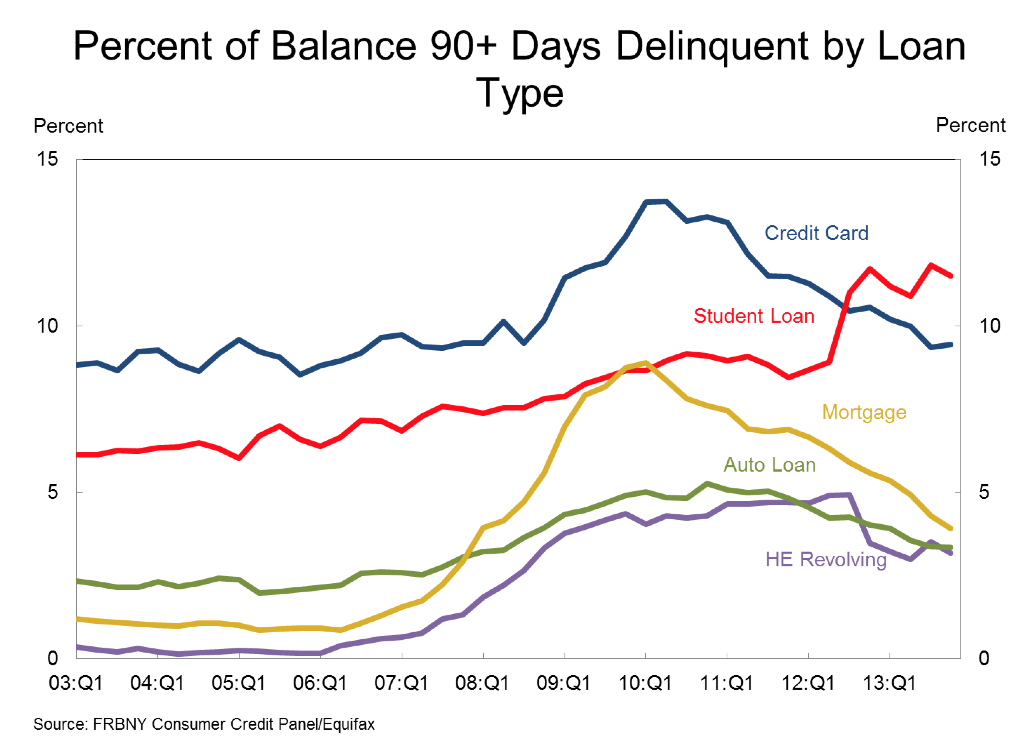

More bad news for student loan borrowers: student loan debt is growing faster than any other type of debt–and more and more borrowers are falling behind on their payments.

According to the most recent consumer debt report by the Federal Reserve Bank of New York released on February 18, 2014, student loan debt is outpacing debt from credit cards, mortgages, auto loans, and HE Revolving loans.

And that’s not all–the percentage of student loans that are 90+ days delinquent is growing fastest as well.

Jennifer Lawrence might be America’s BFF, but Senator Elizabeth Warren (D-Massachusetts) is the modern college student’s best ally. Her latest student loan proposal aims put a large dent in the nation’s current $1.2 trillion student loan debt and provide relief for struggling borrowers. Student loan plan could save borrowers $1,000/year As part of the plan, current student loan borrowers […]

Imagine if you took out $30,000 for college and that’s all you had to pay back. For most student loan borrowers, that’s not the case. Due to compound interest, that $30,000 can easily turn into $40, $45, $50,000 or more by the time the graduate has paid it off. The burden of student loan interest […]

Compared to private student loans, whose interest rates vary depending on the borrower’s credit history, federal student loans are a steal. But according to USA Today, a large percentage of private loan borrowers don’t maximize their borrowing of federal student loans.

In fact, the newspaper found that more than half of private loan borrowers failed to max out on federal student loans, and a quarter didn’t take out any federal loans.

This is quite alarming and demonstrates the need for education about the differences between federal and private student loans. Unlike federal student loans, private student loans can have variable interest rates, some greater than 18%. This substantially increase the total amount you repay.

For college graduates and adults struggling with student loan repayment, the holiday season can be difficult. So many gifts to give, so little money in the bank account.

But a new service from Tuition.io lets family and friends ease the burden of student loan borrowers during the holidays.