And you thought undergraduate student loan debt was bad.

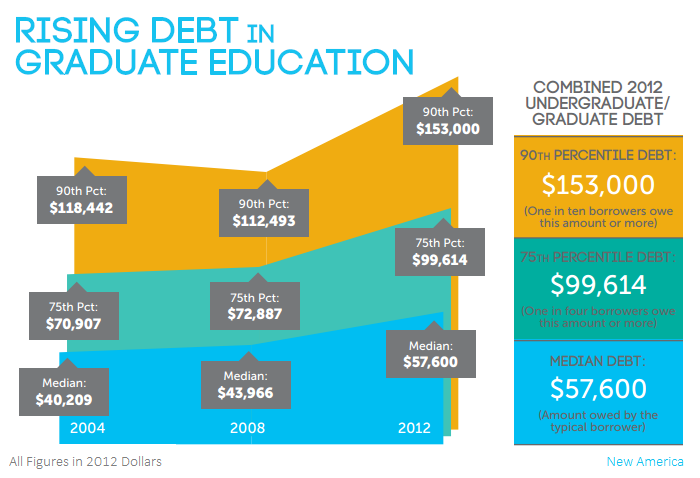

According to a new report by the New America Foundation, the median debt load for borrowers leaving school with a master’s, medical, law or doctoral degree was $57,600 in 2012–about twice the average amount today’s typical undergrad leaves college with.

This represents a 43% increase from 2004 to 2012 when adjusted for inflation.

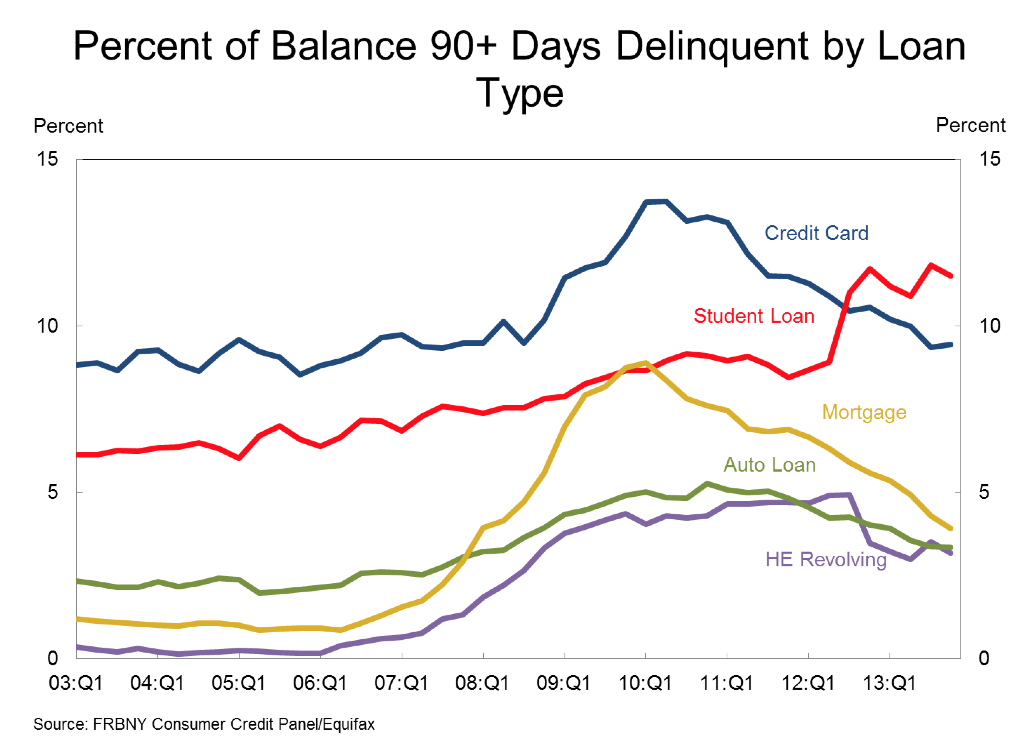

More bad news for student loan borrowers: student loan debt is growing faster than any other type of debt–and more and more borrowers are falling behind on their payments.

According to the most recent consumer debt report by the Federal Reserve Bank of New York released on February 18, 2014, student loan debt is outpacing debt from credit cards, mortgages, auto loans, and HE Revolving loans.

And that’s not all–the percentage of student loans that are 90+ days delinquent is growing fastest as well.

Jennifer Lawrence might be America’s BFF, but Senator Elizabeth Warren (D-Massachusetts) is the modern college student’s best ally. Her latest student loan proposal aims put a large dent in the nation’s current $1.2 trillion student loan debt and provide relief for struggling borrowers. Student loan plan could save borrowers $1,000/year As part of the plan, current student loan borrowers […]

In a press release issued February 25, student loan servicer Sallie Mae announced that it will separate into two distinct companies—Navient and Sallie Mae—in fall 2014.

If you have a loan through Sallie Mae, there may be some changes, but the federal government assures borrowers the changes will be minimal, and no changes will occur until later this year.

Here are the 6 things you need to know if you have a student loan serviced by Sallie Mae.

What is student loan consolidation and how does it work?

We love this video from StudentLoanConsolidator.com, which explains the process in a unique way–by using Play-Doh to represent student loan consolidation.

For college graduates and adults struggling with student loan repayment, the holiday season can be difficult. So many gifts to give, so little money in the bank account.

But a new service from Tuition.io lets family and friends ease the burden of student loan borrowers during the holidays.

According to a report released Wednesday, the average student loan debt for a member of the class of 2012 was $29,000, up from $26,600 in 2011.

This increase follows recent trends, with student loan balances for new graduates rising at an average rate of 6% per year from 2008 to 2012.

In a recent Guardian article, millennials were asked what they wish their parents had taught them about choosing a college, student loans, and managing their finances. Millennials regret taking on student loan debt Many millennials expressed regret that they had spent so much on their college degree and wished they had looked into less expensive […]

After graduating college, many former students have difficulty finding jobs that allow them to afford their monthly student loan payments.

If you graduate into a low-paying field, you may find yourself barely scraping by–even before you pay your student loans. The lowest-paying major for 2013, Child and Family Studies, has an average starting salary of just $29,300.

Houghton College knows the economy is tough, and it can take new graduates several years to make enough money to pay back their loans, especially in smaller cities, job markets, and careers.

That’s why the small liberal arts college in Houghton, NY has decided to launch an innovative new student loan repayment plan for graduates.

If you have good credit, you can refinance your mortgage or car loan. Why not your student loans? A new bill called “Higher Ed-Lower Debt” has been introduced in Wisconsin as a way of helping people with student debt reduce their interest rates so they can pay off their debt faster. If approved, it would the […]