Dealing with the death of a child is difficult enough. But the financial stress of having to repay the child’s student loans can make such a tragic event that much more difficult to bear.

This is a heartbreaking reality for the Mason family, and many others who face the terrible tragedy of losing a child with student loans, according to a recent CNN Money story.

Student debt remains an enormous societal and economic problem, with the average college graduate leaving school with $29,400 in loans, according to College Access and Success. It would be one thing if these graduates were entering an economy with many high-paying jobs available, but that simply isn’t the case, Charles Stevens writes in a fantastic […]

We’re proud to be based in Western New York, and we’re always glad to see the area get national recognition.

That’s why we were so excited to hear that Buffalo, the largest city in the region, was recently named the top medium-sized city for new college graduates by CreditDonkey.com.

The city’s low rents, low job competition and great nightlife make it an attractive destination for young college grads hungry for employment and fun while still affording their student loan payments.

It’s well-documented that student debt has grown rapidly over the past decade. The class of 2014 graduated with an average $33,000 in student loans per student, and the numbers will likely be event greater for next year’s class.

Given that student loan debt is increasing while salaries are declining, it’s not surprising that many young adults are struggling to accumulate wealth.

According to a new report from the Pew Research Center, it’s become increasingly difficult for young adults with student debt to save up enough money to buy a house, get married or start building their ‘nest egg.’

It’s official: the class of 2014 is the most indebted college class ever.

According to an analysis by Mark Kantrowitz published in the Wall Street Journal, the average 2014 college graduate has $33,000 in student loans, the most by any previous class.

Just a year ago, we were talking about how the class of 2013 was the most indebted class ever, but, as has been the case for the past 20 years, the record has been broken by this year’s class.

Sen. Elizabeth Warren (D-MA) says student loan interest rates are ‘crushing’ former students, and something needs to be done. She introduced a plan in March that would let student loan borrowers refinance their loans at lower interest rates. And last week, she filed the bill with the support of 27 co-sponsors. Plan would let borrowers refinance […]

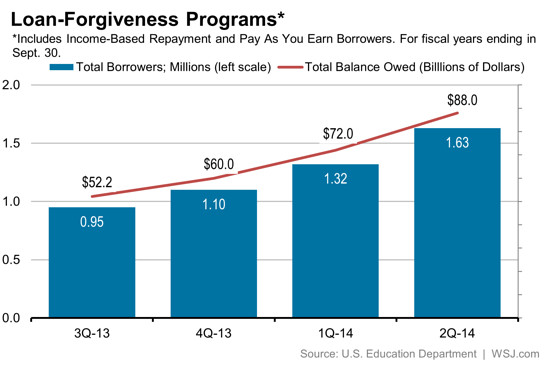

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.

What’s keeping millennials up at night? It’s not just Netflix–it’s student debt.

NPR’s Morning Edition recently asked young adults, members of the millennial generation, what their biggest concerns were.

The results were telling: almost two-thirds responded that college debt was their biggest worry.

Good news (finally!) for young college graduates.

According to a survey released on April 16, employers said they plan to increase the number of college graduates they hire this year by nearly 9 percent.

Hechinger Report recently published a great opinion piece from Karen Gross on the ‘flawed conversation’ regarding the cost of higher education. She says that too much public focus is placed on the hard costs of college, and not enough on the repercussions of taking out student debt and alternative repayment options for students. We couldn’t agree more with her claims. […]