We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

Good news for student loan borrowers burdened with debt: the U.S. is on pace to forgive at least $108 billion in student debt over the next 10-20 years, according to a report from the Government Accountability Office.

It just keeps getting worse. Student debt has topped $1.4 trillion, nearly more than all of the credit card and car loan debt in the U.S., according to NBC 12. And that number is growing by the second, leading many borrowers to question whether college was worth the cost. Student loan debt a widespread problem The problem is […]

Many of the statistics on student debt in America are shocking — and it’s only getting worse.

National student debt has surpassed $1.3 trillion and is growing by the second.

With the average college student graduating with over $37,000 in student debt in 2016, the trend will only continue.

We often discuss the dangers of taking on more student debt than you’ll be able to repay. A recent Boston Globe article highlights the difficulty many students, particularly those who are low-income, have with repaying their student loans after graduation. Comparing college net price to graduate salaries In the interactive graphic below, you can see […]

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

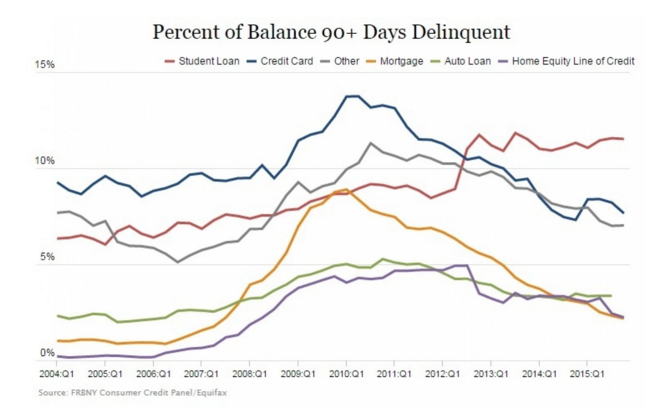

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

What would you do if you could have all of your student loans paid off?

A lot, most students say, including taking a punch from boxer Mike Tyson.

With the national student debt now at $1.3 trillion, and thousands of borrowers in default, some borrowers are going to great lengths to avoid paying back their debt–including moving to a whole other country. Hiding from student debt collectors abroad An interesting new article from VICE takes a look at the many Americans who have moved […]

Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.