More people are behind on student loans than any other debt

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

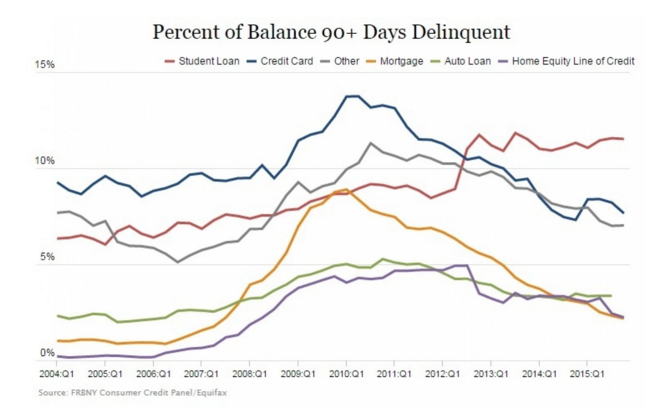

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

The report showed that about 11.5 percent of the $1.23 trillion in outstanding student loans was classified as severely delinquent (more than 90 days past due) at the end of 2015.

By comparison, 7.7 percent of the $733 billion in total credit card debt is severely past due. Car loans, mortgages, and other forms of debt had much lower delinquency rates.

Why student loan delinquency is higher

One reason for this, according to The Washington Post, is that since student loans (unlike all other forms of debt) can’t be discharged in bankruptcy, delinquent and defaulted loans can appear for longer periods of time, keeping delinquency rates up.

However, unlike with other forms of debt, student loan borrowers have many repayment options to help them avoid falling behind on their loans.

Income-driven plans, such as Income-Based Repayment and the Pay As You Earn plans are designed to make repayment easier–yet a significant portion of borrowers are still falling behind.

Even though enrollment in income-based student loan repayment plans has risen nearly doubled to 4.2 million people in the 12 months ending September 2015, according to the Department of Education, there’s still a wide gap between the number of eligible borrowers and the number taking advantage of it.

Avoid falling behind on your student loans

Falling behind on your student loans can negatively affect your credit and make it harder to get other types of loans.

It’s crucial to get on a student loan repayment plan that makes it easier to afford your student loan payments and avoid falling into delinquency or default.

If you’re already delinquent or in default on your student loans, there are still ways to get back on track and get out of default.

We can help you get on the best repayment plan for your situation and get out of default if you’re falling behind on your payments. Call us at 1-888-234-3907 or contact us here for a free consultation.

student debt, student loan debt, student loan default, student loan delinquency, student loan repayment, student loans