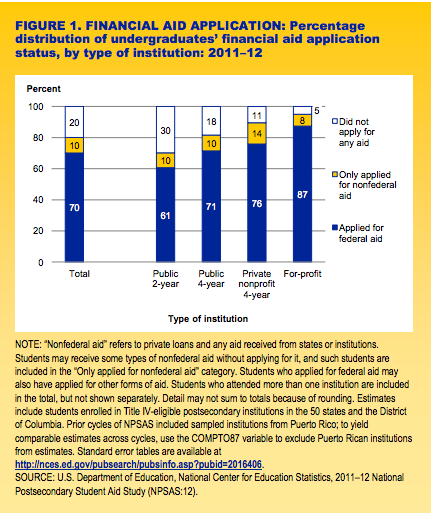

We write often about the importance of applying for financial aid, even if you don’t think you’re qualified to receive it.

But a new study from the National Center for Education Statistics (NCES) found that 1 in 5 students don’t apply for financial aid at all.

Millennials may hear their parents reminisce about putting themselves through college by working a summer job and part-time during the school year, but those days are long gone, NPR reports.

NPR broke down the costs of attending college in 1981-82 and how much students would have to work in order to cover their expenses that year. They then compared this to how much students would need to work to pay for college today with a minimum wage part-time or summer job, and the results are striking.

Getting into college is exciting–receiving the envelope and imagining your future. But not all colleges are created equal.

For-profit colleges, in particular, have been criticized for being dishonest about graduate employment statistics and leaving students with lots of student debt. Some have even gone bankrupt after being fined or sued for misleading students.

To help students better understand the risks, NerdWallet and USA Today College put together a list of 5 things to consider before choosing to attend a for-profit college.

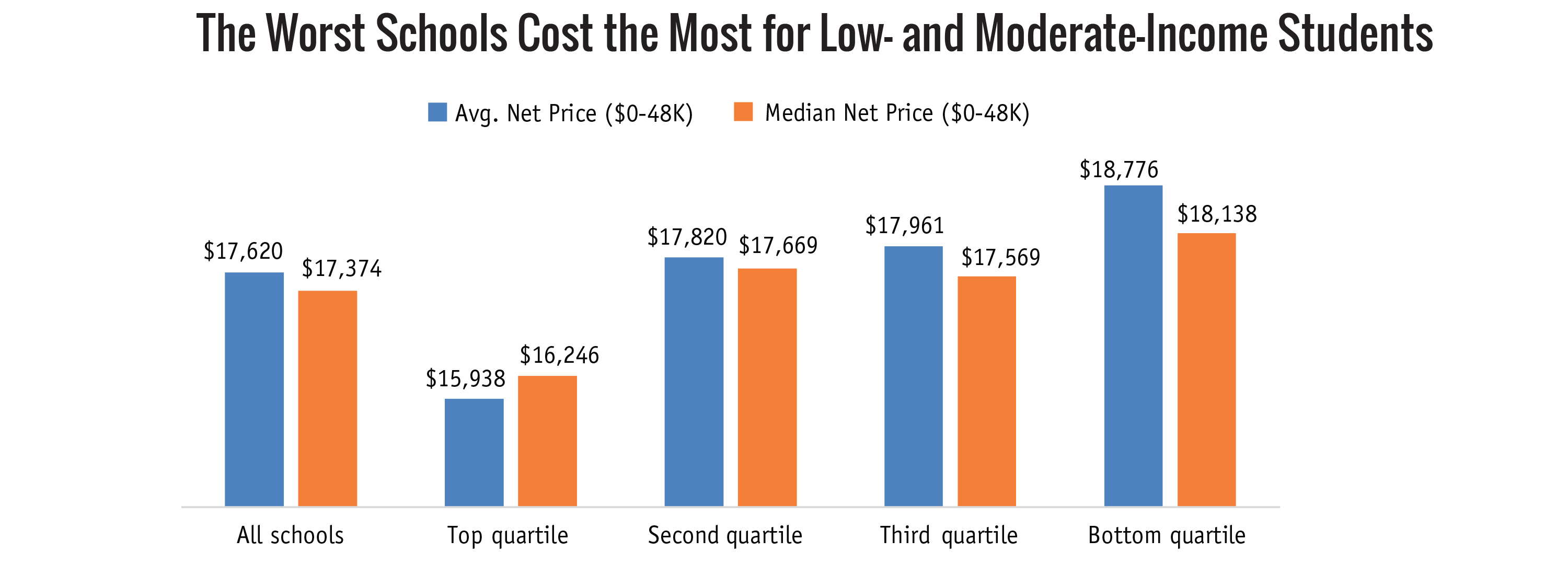

Many students and families assume that the more expensive a college is, the more prestigious and the higher its quality.

This leads some families to overpay for college under the assumption that there is a positive correlation between price and education quality.

But a recent report from Third Way found that that’s not the case.

In fact, they found the lowest-ranked colleges charged low- and moderate-income students more than higher-ranked schools.

As new college graduates look for jobs and prepare to start the next phase of their lives, many consider moving for career or financial reasons.

With most graduates carrying student debt, finding a place to live where they can build a career and repay their loans is extremely important.

While 401(K) contributions have traditionally been a benefit companies used to lure talented employees, innovative companies are beginning to offer a new benefit that their millennial employees need even more: help paying their student loans. A recent article in The Hechinger Report discussed the rise of employee benefit programs aimed at helping employees pay student debt. […]

We often discuss the dangers of taking on more student debt than you’ll be able to repay. A recent Boston Globe article highlights the difficulty many students, particularly those who are low-income, have with repaying their student loans after graduation. Comparing college net price to graduate salaries In the interactive graphic below, you can see […]

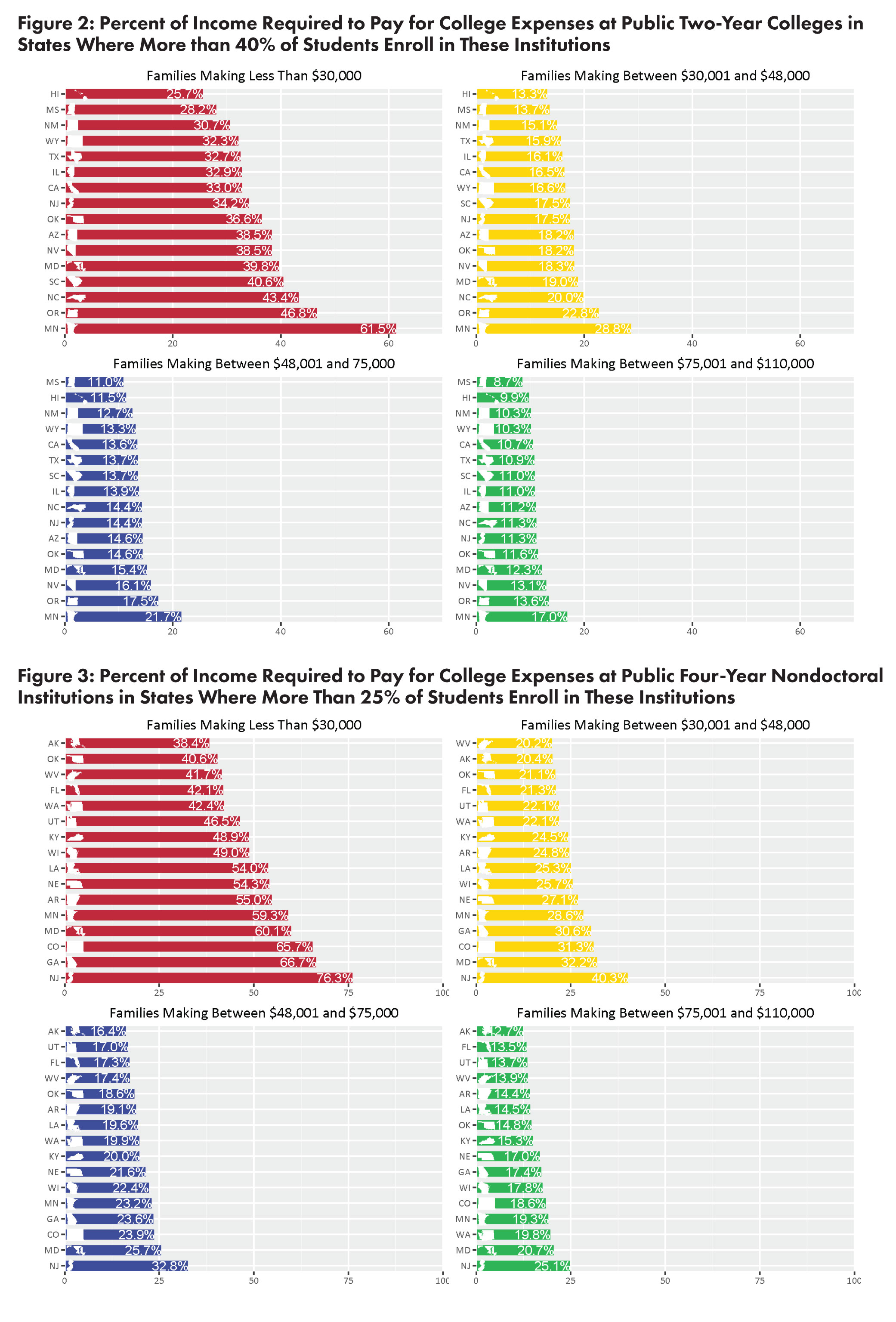

We’ve written previously about how college overall has gotten more expensive, and even though financial aid has reached record levels, it still hasn’t been enough to make up the difference for most families, particularly low-income ones. And a new study from the Institute for Research on Higher Education at the University of Pennsylvania confirms that college […]

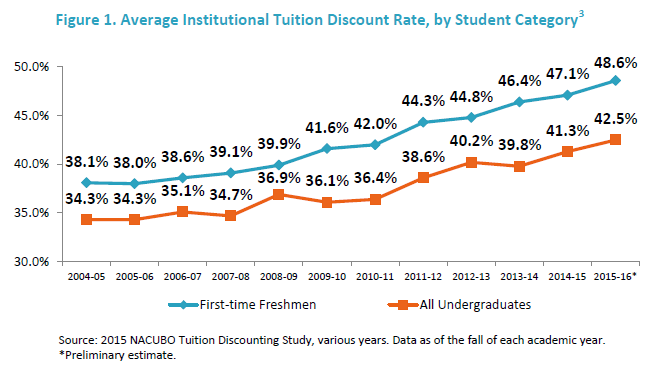

While it’s no secret that college costs are rising, financial aid has been increasing too, providing more opportunities for students to take advantage of discounts at expensive private colleges, MONEY reports. According to The National Association of College and University Business Officers’ annual survey of tuition discount rates, the average freshman student at a private college only […]

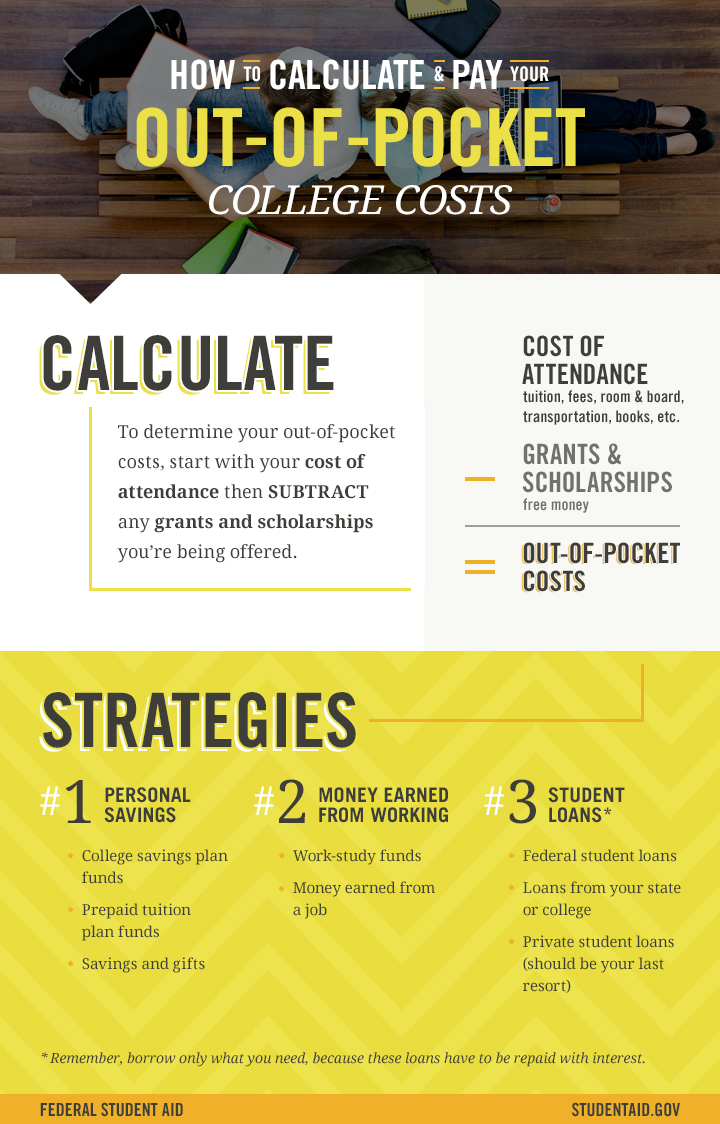

In order to compare financial aid awards from different colleges, you need to be able to understand the different out-of-pocket costs for each college–the total cost you’ll have to pay after grants and scholarships are applied.