Good news for student loan borrowers burdened with debt: the U.S. is on pace to forgive at least $108 billion in student debt over the next 10-20 years, according to a report from the Government Accountability Office.

It just keeps getting worse. Student debt has topped $1.4 trillion, nearly more than all of the credit card and car loan debt in the U.S., according to NBC 12. And that number is growing by the second, leading many borrowers to question whether college was worth the cost. Student loan debt a widespread problem The problem is […]

With the cost of college continuing to rise, many graduates are questioning whether their own degrees were worth the investment, according to the Hechinger Report.

Half of college graduates surveyed in a recent Gallup Poll said they weren’t sure whether their degree was worth the money.

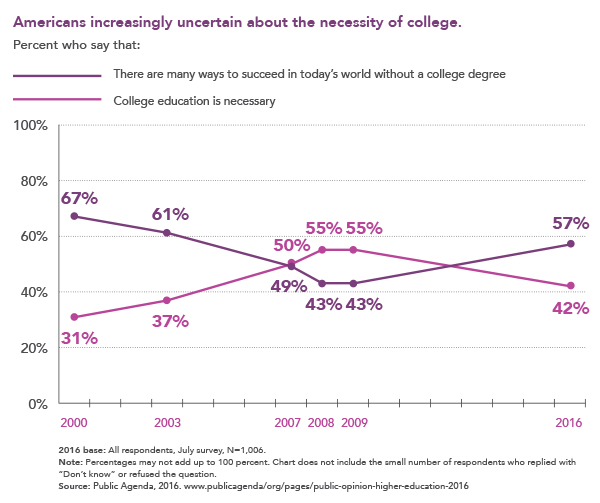

And nearly half of graduates surveyed in August by Public Agenda said a higher education is no longer necessarily a good investment — particularly because of how much debt many students take on in order to pay for their college degree.

Many of the statistics on student debt in America are shocking — and it’s only getting worse.

National student debt has surpassed $1.3 trillion and is growing by the second.

With the average college student graduating with over $37,000 in student debt in 2016, the trend will only continue.

Food (and of course, beverages) tend to make up a large portion of college students’ budgets.

But given the high cost of college, students don’t always have a lot of money to pay for meals — especially if they’re not on a campus meal plan that’s automatically added to their college bill.

The video above from NBC News explains how college students on a budget can save money on food costs without feeling deprived.

The FAFSA is available now at fafsa.gov for students attending college in 2017-18. Because of its earlier availability (it usually isn’t available until January 1), the Department of Federal Student Aid is allowing families to use tax information from 2015 to complete the form.

To make it easier to complete the FAFSA, you can use the IRS Data Retrieval Tool to automatically fill in all of your tax information. This will allow you to submit the form sooner and maximize your chances of receiving financial aid for college.

The Free Application for Federal Student Aid (FAFSA) is now available at https://fafsa.ed.gov.

This application may be used for students attending college in the 2017-18 school year. In order to be eligible for federal financial aid, students and parents must complete the FAFSA.

As we’ve written before, there’s more to rising college expenses than just increasing tuition costs–off-campus housing costs are also skyrocketing, adding to students’ financial burdens even more and forcing them to take on more student debt. And unfortunately, attending a higher-ranked college often means paying more for housing, a new study has found. Elite colleges […]

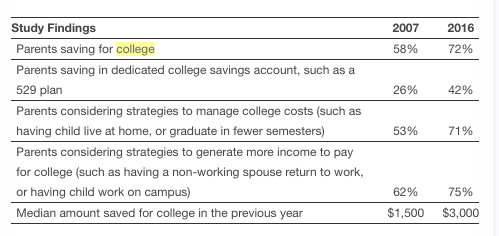

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

While most of the focus on rising college costs has been related to tuition, there’s another factor that’s driving college students into debt: high off-campus housing costs.

A recent article from USA Today outlined the impact rising off-campus housing costs are having on students.