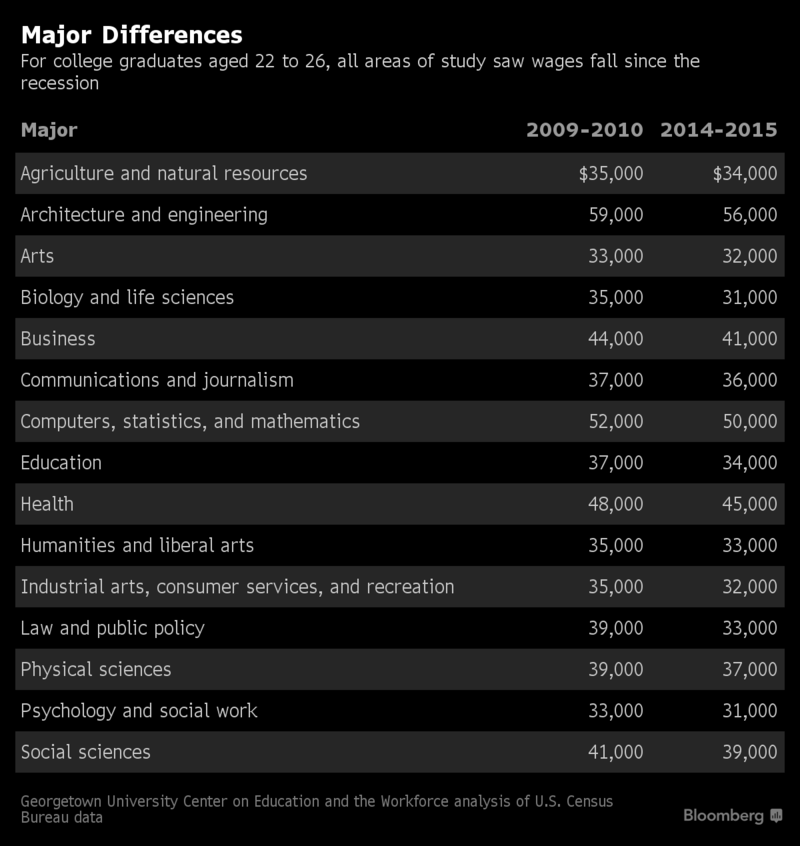

While a Bachelor’s Degree is a prerequisite to most good-paying jobs these days, many college graduates have not seen their incomes increase since the 2007-09 recession, a new study finds.

The biggest factor in whether or not wages increased was a college graduate’s major, the study found.

With private student loan interest rates on the rise, and the high cost of college forcing many students and parents to take on debt to pay for college, student loan refinancing has emerged as an option for borrowers to reduce their interest rates (depending on their credit score) and save money on repayment.

Find out why you should consider refinancing your student loans, and learn about SoFi, one of the best-known student loan refinancing companies.

It’s been widely reported that millennials and recent college graduates are putting off purchasing homes because of high student debt. But New York Gov. Andrew Cuomo has proposed a new program to make it easier for young college graduates to afford homes in our hometown of Upstate New York, the Times-Union reports. College grads incentivized […]

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

Student loan debt isn’t just a problem for millennials. It’s following baby boomers into retirement as well.

The government has collected about $1.1 billion from Social Security recipients of all ages to go toward unpaid student loans since 2001, including $171 million in 2015, the Government Accountability Office said in December.

Good news for student loan borrowers burdened with debt: the U.S. is on pace to forgive at least $108 billion in student debt over the next 10-20 years, according to a report from the Government Accountability Office.

It just keeps getting worse. Student debt has topped $1.4 trillion, nearly more than all of the credit card and car loan debt in the U.S., according to NBC 12. And that number is growing by the second, leading many borrowers to question whether college was worth the cost. Student loan debt a widespread problem The problem is […]

Many of the statistics on student debt in America are shocking — and it’s only getting worse.

National student debt has surpassed $1.3 trillion and is growing by the second.

With the average college student graduating with over $37,000 in student debt in 2016, the trend will only continue.

As new college graduates look for jobs and prepare to start the next phase of their lives, many consider moving for career or financial reasons.

With most graduates carrying student debt, finding a place to live where they can build a career and repay their loans is extremely important.

While 401(K) contributions have traditionally been a benefit companies used to lure talented employees, innovative companies are beginning to offer a new benefit that their millennial employees need even more: help paying their student loans. A recent article in The Hechinger Report discussed the rise of employee benefit programs aimed at helping employees pay student debt. […]