Seniors’ social security checks garnished to repay student debt

Student loan debt isn’t just a problem for millennials. It’s following baby boomers into retirement as well.

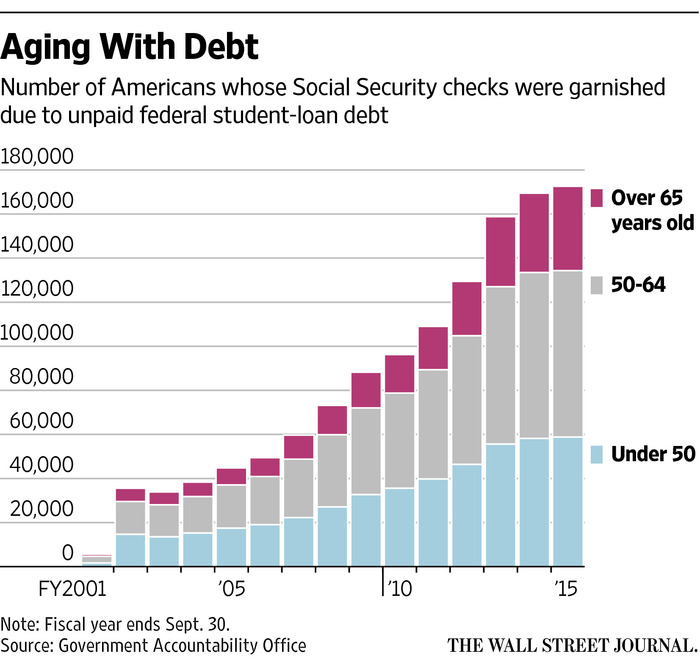

The government has collected about $1.1 billion from Social Security recipients to go toward unpaid student loans since 2001, including $171 million in 2015, the Government Accountability Office said in December, The Wall Street Journal reports.

Retirees left in poverty after losing benefits to student loans

Most people who had their benefits taken for student loan debt in 2015 were age 50 or older and receiving disability benefits, with the average borrower losing about $140 a month. About 38,000 borrowers were 65 or older.

This practice highlights a part of the student debt problem that often goes unnoticed, and leaves those with the least ability to pay forced into poverty because of student loan debt.

Overall, about seven million Americans age 50 and older owed about $205 billion in federal student debt in 2015. About 1 in 3 were in default, putting them at risk of having their social security benefits garnished when they retire.

More retirees losing benefits to student loan debt

Most of the baby boomers retiring with student debt took out the loans years ago to pay for their own college educations, but many also took on debt in the form of Parent PLUS loans to pay for their children’s college.

These loans have higher interest rates than federal student loans taken out by students.

While many baby boomers are putting off retirement in order to repay these student loans, many have been unable to avoid falling into default.

Since the government is the primary student loan lender, it also has the ability to garnish Social Security retirement checks, most disability checks, and federal workers’ wages to collect unpaid student debt.

As student loan debt has increased, more workers are being forced to give up their wages to the government to cover their loans, with about 173,000 people giving up parts of their Social Security checks in 2015 versus about 36,000 in 2002.

But consumer advocates and some politicians argue that the government’s tactics have become too aggressive and target indigent borrowers who do not have the ability to repay their loans.

And since most Social Security recipients rely on their checks as their primary source of income, garnishing their wages for student loans can put them deeper into poverty.

Seniors have few options for repaying student debt

It’s extremely unfortunate that borrowers are put in these difficult situations. And many of them don’t have the same protections or repayment options as current borrowers have, making it even more difficult to repay their student loans.

Even those on an income-based repayment plan will struggle to repay the balance because their payments will likely only cover the interest on their loan.

And Parent PLUS loans, in particular, are notoriously difficult to repay because of their high interest rates and fewer repayment options.

That’s one reason we advise parents who need additional funding for their child’s education to explore other options, such as private loans through credit unions, and do their best to reduce college costs before taking out Parent PLUS loans.

Whether you’re close to graduating college, graduated years ago, or have taken out student debt for your child, we can help you figure out the best repayment plan for your situation and help you determine if refinancing might be right for you.

To learn how we can help you reduce your student loan debt, call us for a free consultation at 1-888-234-3907 or send us a message and we’ll get back to you ASAP.

parent plus loans, plus loans, seniors, student debt, student loan debt, student loan default, student loan refinancing, wage garnishment