College net prices rise for 6th straight year

We’ve written in the past how net price — the price you actually pay for college after financial aid, grants and scholarships — is more important than a college’s published price.

Many colleges have high sticker prices, but end up being affordable because they have generous financial aid policies.

Unfortunately, because the rise in financial aid hasn’t kept up with rising costs, the net price of college has risen for the sixth straight year, Money reports.

College costs rising faster than income & aid

Two annual reports released by the College Board this week show that even after financial aid, the net cost of college has risen — and at a rate faster than inflation, the rise in household incomes, and financial aid, making college less affordable for students and families.

Published prices for tuitions, fees, room and board hit new highs in 2017-18, rising 2.8% at two-year public colleges, 3.1% for in-state students at four-year public colleges, and 3.5% at private colleges.

Over the past decade, the College Board has reported that published prices have risen between 2.2% and 2.7% each year. Meanwhile, the average annual increase in median family income, when adjusted for inflation, has been just 0.3% a year.

And while more than 70% of full-time students now receive grant aid to help pay for college and financial aid awards are higher than ever, it still hasn’t kept pace with this rise in college costs.

As a result, net prices have risen for eight straight years at public four-year institutions, seven years at public two-year institutions, and six years at private colleges, Money reports.

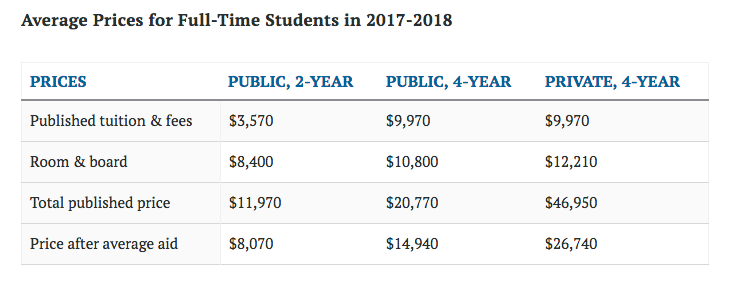

The average net price after financial aid and tax benefits for 2017-18 is $8,070 at two-year public colleges, $14,940 at four-year public colleges and $26,740 at four-year private colleges, the study found.

Net prices at two- and four-year public and four-year private colleges all hit record highs in 2017-18. [Source: Money]

College affordability varies by state

Another reason college has become less affordable is the lack of investment in public education by states. Many states have also been hurt by budget cuts, which have forced them to raise the price of in-state colleges.

In eight states, prices at public colleges increased by 20% or more last year. Students in Louisiana saw a massive increase, with prices at public colleges rising 48%, the report found.

And while some states have attempted to freeze or even lower tuition to address the problem of rising costs, they are overall much higher than they were a decade ago, and state financial aid programs haven’t kept pace.

While states give out about $10 billion per year in state grants, there are large differences between states in terms of how much is allocated to each student.

According to the report, ten states award less than $200 per student in grants each year.

Making college more affordable

It’s discouraging that the net price of college has risen yet again, and financial aid isn’t keeping up with the rise in costs.

As a result, it’s never been more important to prioritize return on investment when choosing a college. It’s crucial to compare costs across colleges and keep in mind the student’s field of study, income after graduation and ability to repay student loans before committing to a particular school or program.

We work with students and families to help them lower their college costs, maximize their financial aid awards and limit their college debt. If you need personalized help figuring out the best way to pay for college, you can call our financial aid counselors at 1-888-234-3907 or send us a message.

college affordability, college costs, financial aid, financial aid counseling, net price