Student loan balances have increased nearly 150% in last decade

Student loan debt has hit $1.4 trillion nationally, and there aren’t many positive signs that it will decrease anytime soon.

Over the last 10 years, student loan balances in the United States have increased more than $833 billion — a jump of nearly 150 percent, CNBC reports.

Record student debt for borrowers

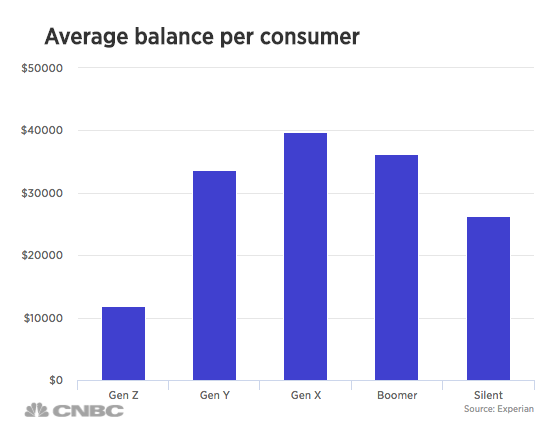

The average student loan borrower’s balance is now a record $34,144, which represents an increase of 62 percent over the past decade.

Student debt is a problem among all generations, with the average borrower now having over $34,000 in student loans. [Image: CNBC]

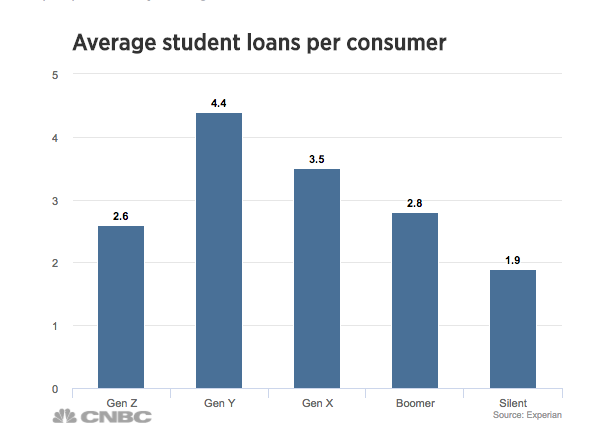

And about 13 percent of the country’s population carries at least one student loan, Experian reports. The average number of loans is 3.7 per person, up from 2.4 per person 10 years ago.

Student loan borrowers now average 3.7 student loans each. Generation Y has the highest average number of loans per borrower, at 4.4. [Image: CNBC]

According to the article, a college education is now the second-largest expense an individual is likely to make in a lifetime, besides purchasing a home.

College worth the cost — but not at any cost

Still, college is worth the investment. You just have to be careful about not putting yourself deeply into debt, particularly if you plan on entering a low-paying field.

As Rod Griffin, director of public education at Experian, puts it,

In most cases, higher education is worth the investment because student loans pay off in the form of higher income over time. However, it’s especially important for young people to understand the terms of their loans.

Unfortunately, the majority of students who borrow money for college don’t fully understand the terms or amounts of their loans or how student debt will affect them down the road.

That’s why it’s crucial to evaluate return on investment when making the decision where to attend college and how to pay for it.

If you need personalized help figuring out how to lower your college costs or reduce your student debt, we can help. Call us at 1-888-234-3907 or message us for a free consultation.