College tuition hikes are (finally) slowing down

It seems there’s a light at the end of the college cost tunnel.

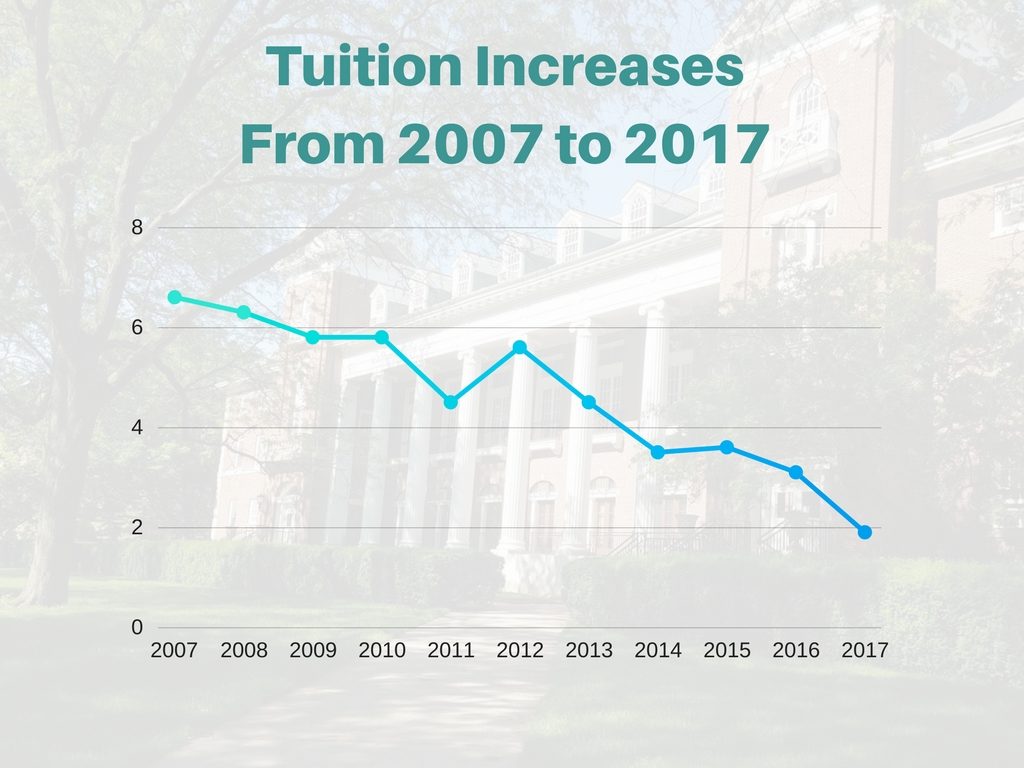

While college costs are higher than they’ve ever been (and continuing to rise), the yearly tuition increases are, finally, slowing down, according to new data from the Labor Department.

The department found that over the past 12 months, tuition costs rose by just 1.9 percent–the lowest rate since before 2007, StudentLoanHero notes.

College tuition rose by only 1.8% last year, the lowest increase in a decade. [StudentLoanHero]

Since 2007, the cost of college tuition has increased by as much as 6.7 percent per year, far outpacing the rate of inflation. Six of the past 10 years saw increases of at least 5% each year.

But the increases have slowed since 2015, and this year’s was the lowest–hopefully starting a new trend in the right direction for college tuition.

Unfortunately, other college costs are continuing to rise quickly, including college fees and room and board.

Why college tuition isn’t rising as fast

One reason for the slower increases is increased competition for students, StudentLoanHero writes.

And as more families understand the importance of maximizing the return on their college investment, colleges have begun to realize that they can’t keep raising prices exponentially. As costs have risen, state colleges have seen increased demand for students looking for a more affordable college option.

StudentLoanHero also acknowledges that some trades that do not require college have become more appealing in this era of high college costs. Enrollment in colleges fell by 1.4 percent in 2016, according to the Lumina Foundation.

College still a worthy investment

In 2016-17, the average cost (including tuition, fees, room and board) of one year at 4-year private college was $45,370, and the average cost of a public college for an in-state student was $20,070, according to The College Board.

Despite the high price, college remains a worthwhile investment for most students–assuming you don’t take on more debt than you’ll be able to repay when you graduate.

But as we’ve written before, most people don’t pay full price for college. Even if you have a higher-than-average income, you can still be eligible for financial aid and scholarships.

We’re hoping the slowdown in increases continues and helps address the issue of rising student debt, which is now at over $1.4 trillion nationally.

With college being such a large investment, it’s crucial to make sure you’re spending your college dollar wisely and maximizing your financial aid package.

If you need personalized help figuring out how to make college more affordable or reduce your student debt, call us at 1-888-234-3907 or send us a message.