1/3 of colleges greatly underestimate living costs

You’re prepared for college. You know exactly how much you’ll have to pay, have borrowed the appropriate amount, and shouldn’t have any unexpected expenses. Right?

Not so fast, say researchers. If you planned for college costs using your college’s cost of living estimates, there’s a good chance the amount of money you’ve budgeted will fall short — perhaps by thousands of dollars.

Colleges underestimate by over $3,000

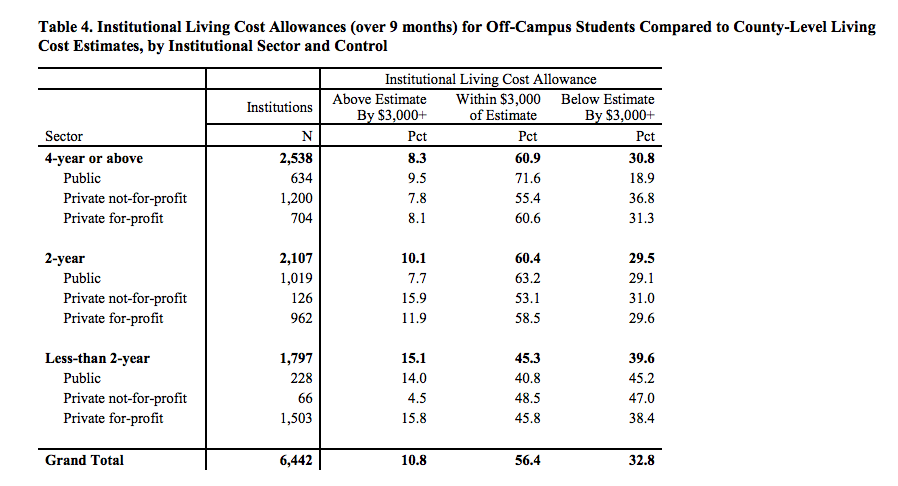

While colleges can tell you how much you’ll spend by living on-campus, they tend to underestimate the real cost of living off campus — and as many of a third of all colleges underestimate the local cost of living by at least $3,000, according to researchers.

About 1/3 of colleges underestimate the local cost of living by $3,000 or more. [Table: Report]

As Sara Goldrick-Rab, professor of higher education policy and sociology at Temple University, told CNBC in a recent article,

It’s easy for colleges to estimate incorrectly. The school is just reading local ads for apartments and doing small surveys of students.

According to CNBC, colleges often neglect to include things like transportation costs, entertainment, laundry and personal care when they come up with their cost of living estimates.

Colleges also tend to underestimate the cost of renting, neglecting to factor in things like renters needing to pay first and last month’s rent, as well as a security deposit, in order to move into an apartment.

Consequences of inaccurate cost estimates

This inaccuracy can make it very difficult for families to plan for college. Student loan interest and origination fees can add up, so you don’t want to overborrow — but you don’t want to be left with a large bill and no way to pay it, either.

It’s also alarming that so many colleges are so far off in their assessments of local cost of living due to the fact that financial aid is based on these estimates.

If a college commits to covering a student’s cost of attendance (COA) through financial aid, but the school estimates its cost of attendance too low, then the student can end up running out of money to cover their college costs.

How to estimate college living costs

The average public college student living off-campus and not with family spent an average of $9,857 on room and board during the 2017-2018 college year, according to the National Center for Education Statistics.

Students at private schools spent an average of $9,940 on room and board, while on-campus students paid about $10,000 on average.

But these numbers can vary widely from college to college. Thus, it’s crucial for students and families to do their own research about the actual cost of living of the area of their college before committing to living off campus — or even, perhaps, before making the decision to attend a certain college.

Here are some tips for planning for and managing unexpected college costs:

- Contact students at the college before your commit to gather real information about living costs. College Confidential allows you to connect with current students, parents and alumni. Reaching out to people via their message boards is a great way to get more accurate information from people who have actually attended the college.

- Use a cost-of-living calculator to get specific information about the cost of rent, utilities, basic goods and entertainment in the city you’ll be living. You can also compare it with the city in which you currently live to get a better feel for how you’ll have to budget.

- Take a tour and do an overnight visit of the college. Speak with students while you’re there, and go around town to check out the apartment complexes, restaurants and hangouts that are popular with students. Take notes of rental costs, general food costs and other expenses.

- If you’re already a student planning on moving off campus, talk to older students who have moved off campus about their experiences and average monthly living costs.

- Check Craigslist, Zillow and student housing sites to get a better feel for the cost of renting in the area.

- If your research seems to show that the college is underestimating living costs and your financial aid package won’t be enough, reach out to the financial aid office. If you explain your situation and the research you’ve done, they may be willing to work with you to improve your financial aid package so that you’re not left making up for unexpected costs.

- Get a part-time job. There are always going to be expenses you haven’t estimated for — health bills, car expenses or extracurricular activities. Making some money during the semester can help offset some of the burden and stress of dealing with these extra expenses.

- When in doubt, overestimate how much you’ll need (within reason). You’re better off having a little extra in the bank than running out of cash before the semester ends.

If you need personalized, one-on-one help figuring out how to manage college costs and maximize your financial aid, we can help. Give us a call at 1-888-234-3907 or send us a message.

college costs, cost of attendance, cost of living, financial aid, paying for college