10 Common FAFSA Mistakes & How To Avoid Them

Now that the Free Application For Federal Student Aid (FAFSA) is available in October, it’s important to make sure you’re filling it out as early as possible.

But filling it out correctly is even more important. If you make a mistake on your FAFSA, you could miss out on financial aid.

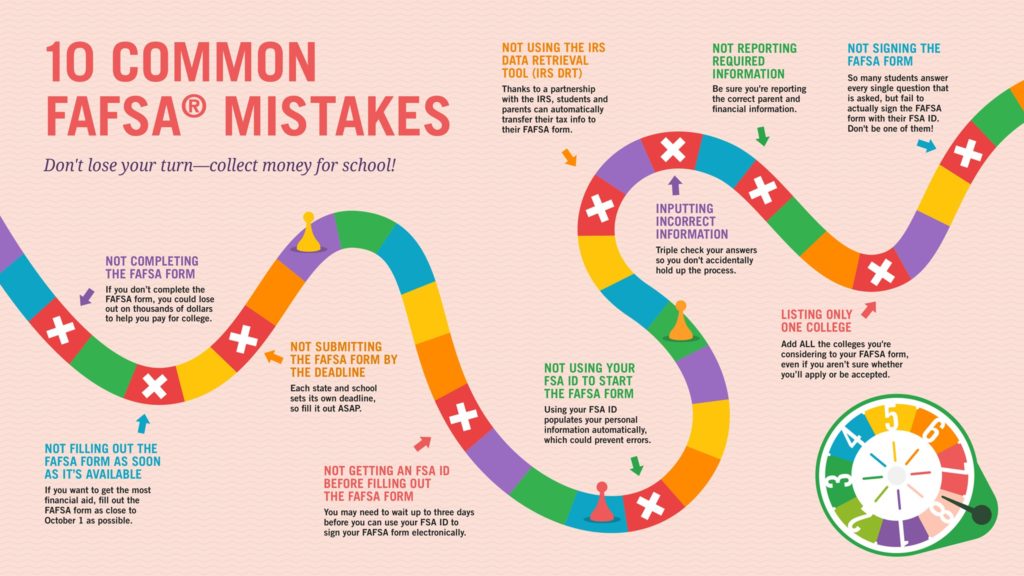

Check out the top 10 common FAFSA mistakes from the Office of Federal Student Aid to make sure you don’t miss out on free money for college.

Don’t make these FAFSA errors

1. Not completing the FAFSA form. It should go without saying, but nearly 40% of college-bound students didn’t complete the FAFSA last year, even though many of them would have been eligible for financial aid. These students left millions, if not billions, of free money for college on the table.

Even if you think your income is too high or you won’t receive aid for other reasons, there are many factors that determine financial aid, and it’s definitely worth seeing filling it out to see if you qualify. Many colleges and states also require that you complete the FAFSA to receive other scholarships as well (including merit-based scholarships), so it’s very important to complete it. A recent study showed that 71% of undergraduate students receive financial aid, so your chances of receiving aid are high if you fill it out on time.

2. Not getting an FSA ID before filling out the FAFSA. The FSA ID is a username and password that you use to sign into your account on the Federal Student Aid website. Both the student and one parent need to create an FSA ID, which is used every year when you fill out the FAFSA. You may need to wait up to three days before you can use your FSA ID to sign the FAFSA electronically, so it’s important to create one ASAP to avoid delays — here’s how to do it.

4. Not filling out the FAFSA ASAP. The sooner you fill out your FAFSA, the better your chances of receiving the most financial aid possible. The FAFSA becomes available every year on October 1, and families who have a child attending college the following year should complete it as early as possible. Remember, you don’t need to wait for this year’s tax information to come in — you can use information from last year and update the form later if necessary.

5. Not submitting the FAFSA by the deadline. Every state and college has its own deadline, and some are as early as February. You must meet the deadlines to be eligible to receive scholarships, and the sooner, the better. Scholarship funds are limited, so submit it ASAP to get the most aid possible.

6. Not using the IRS Data Retrieval Tool. The IRS Data Retrieval Tool allows you to instantly transfer last year’s tax information directly into your FAFSA. It can be used by both students and parents, and it’s the best way to ensure all of your information is accurate and up to date. Our blog post outlines how to transfer your information directly into the FAFSA, saving you time and stress.

7. Inputting incorrect information. If the information on your FAFSA is inaccurate, you may lose out on financial aid or not receive the correct amount. It may also result in processing delays that can inhibit your ability to receive financial aid and scholarships. Be sure to triple-check your form to make sure everything is correct.

8. Not reporting required information. Be sure to fill out all required information for both the student and parent. If the student doesn’t live with both parents or has a non-traditional guardian, refer to this site for information on who should fill out the FAFSA.

9. Listing only one college. It’s important to list all colleges you’re considering regardless of whether you believe you’ll be accepted or even apply. This ensures that these colleges receive all of your information so that they can develop your financial aid package if you are accepted. The vast majority of colleges practice need-blind admissions, which means they do not consider a student’s financial need when deciding whether to admit a student, so filling out the FAFSA should not affect your chances of being accepted to the college of your choice. You can add up to 10 schools at first. If you want more than 10 schools to receive your FAFSA, you’ll have to remove some schools and add the new schools, then submit again.

10. Not signing the FAFSA form. This is a common mistake that can result in delays and issues processing your FAFSA. Once you’ve filled out all of the required information, both the student and one parent must sign the FAFSA using their FSA ID.

We help students and families secure the most financial aid possible for college. If you’re interested in getting personalized help from one of our advisors, give us a call at 1-888-234-3907 or send us a message.

fafsa, fafsa mistakes, financial aid, financial aid counseling, scholarships