College costs have risen less than you think

The general consensus among the public is that the cost of college has risen dramatically over the past few decades. We’ve reported how much the rise in college tuition has outpaced gas, cars and any other household item that the government tracks.

According to the government, college tuition and fees have risen a shocking 107 percent since 1992, even after adjusting for inflation.

But according to the New York Times, this figure is misleading because it’s based on colleges’ published prices, rather than what students actually pay.

How the government exaggerates the cost of college

In reality, most families don’t pay the staggering amounts you hear about on the news.

When you look at the net price of college–how much the average family pays after grants, scholarships, and other forms of financial aid–the price is much lower, as is the overall percentage increase.

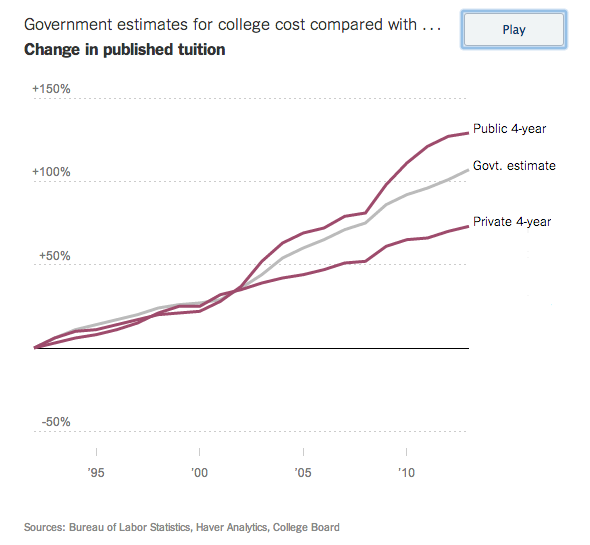

Below is the change in published tuition amounts compared to government estimates.

As you can see, the government estimates are close to the percentage public college tuition has risen in recent years, largely due to budget cuts. The sticker price of private colleges, however, has risen much more slowly.

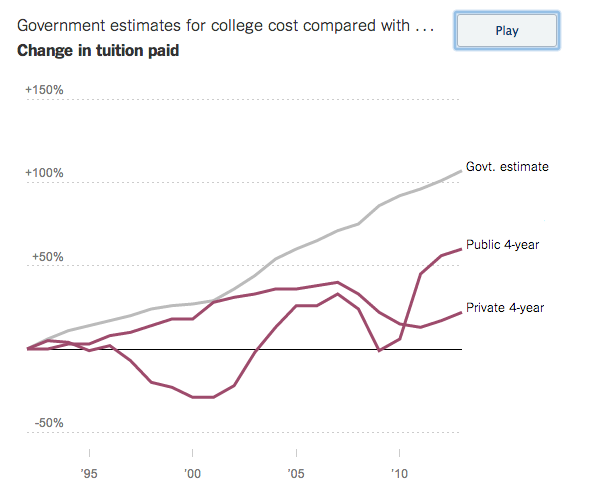

The figure below shows how the change in how much families actually paid for college tuition after financial aid was applied.

It’s clear that the government’s estimate is significantly higher than what students actually paid for college tuition over the past two decades, making the increase appear much more dramatic.

Yes, college costs have risen, but not nearly as dramatically as we’re constantly hearing in the media, since most colleges are also offering more financial aid than ever.

Despite rising costs, college remains a great investment

In fact, after financial aid, the average tuition and fees were $12,460 at private colleges last year and $3,120 for in-state students at public four-year colleges, according to the College Board.

While those costs certainly add up after 4 years, they’re meager compared to the cost of not going to college.

As David Leonhardt writes,

By almost any economic calculation, the country would be better off if college were more affordable for middle- and low-income families.

At the same time, it’s worth remembering that the perception of college costs comes in large part from the high list price of private colleges. The next time you hear somebody describe college as costing $60,000 a year, know that the truth is: It costs $60,000 for affluent students who don’t qualify for financial aid to attend one of the elite colleges that a tiny share of Americans attend (and the figures includes housing and food).

College can be more affordable than it seems

Let’s be clear–the sticker price of most colleges has become out of reach for most families.

But there is a danger in making students and families feel like they’ll never be able to afford a good college, or any college at all.

This is how many high-achieving, low-income students don’t apply to prestigious schools for which they are qualified, even though these colleges offer significant financial aid that could leave them with little to no student debt.

It’s also why regular students end up paying more for college than they should.

We realize that many middle class families are squeezed in the financial aid process, making too much to qualify for financial aid but not enough to pay for college. That’s why we also help families like these reduce their college costs and find schools that may have a high sticker price but are actually more affordable because they offer significant scholarships.

If you’re interested in learning how we can help you make college more affordable, give Rick and Andy a call at 1-888-234-3907 or fill out our contact form.

affording college, college costs, college value, economy, financial aid, financial aid counseling, paying for college