Class of 2014 graduates with record student loan debt

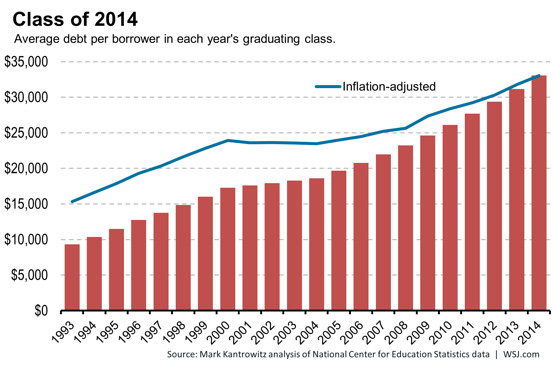

It’s official: the class of 2014 is the most indebted college class ever.

According to an analysis by Mark Kantrowitz published in the Wall Street Journal, the average 2014 college graduate has $33,000 in student loans, more than any previous class.

Another year, another record broken

Just a year ago, we were talking about how the class of 2013 was the most indebted class ever, but, as has been the case for the past 20 years, the record has been broken with by this year’s class.  This year’s figure is up from around $31,000 in 2013 and under $10,000 in 1993. And most likely, the class of 2014’s record will be broken by the class of 2015.

This year’s figure is up from around $31,000 in 2013 and under $10,000 in 1993. And most likely, the class of 2014’s record will be broken by the class of 2015.

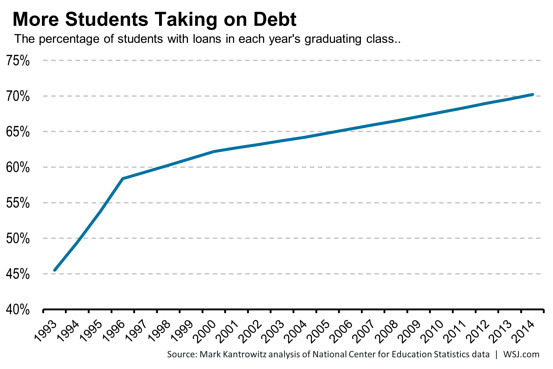

And not only is average student debt on the rise; more students are accumulating it. Since 1993, the percentage of students taking out loans for college has risen from around 46% to 70%.

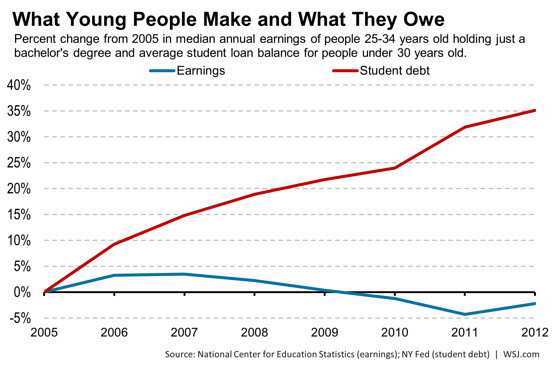

College debt rising, but salaries going down

Unfortunately, students are taking out more and more debt, while their ability to repay the loans is decreasing. That’s because student loan debt and earnings are moving in opposite directions.

According to the NY Fed, from 2005 to 2012, average student loan debt has jumped 35%, adjusting for inflation. The median salary, however, has actually dropped by 2.2%.

Luckily for 2014 graduates, more employers expecting to hire college graduates this year than in years past, which would, hopefully, make it easier for them to find a job and manage their monthly payments.

But with wages still not keeping up with debt, it’s likely that this trend will continue for the foreseeable future.

College is worth it, but excessive debt is not

With college costs and student debt rising faster than inflation in recent years, some people have begun to question whether a college degree is worth the cost.

All of the data still proves it is–college graduates make more money, have lower unemployment rates and are less likely to be in poverty. But this doesn’t mean that students can take out unlimited amounts of money and still expect to see a positive return.

According to Kantrowitz, students must consider future earnings when determining how much debt to take out to pay for college.

A good rule of thumb is that undergraduate and graduate students should borrow no more for their entire education than their expected salary at graduation.

Student loan debt will likely continue to increase

While we’ll probably see another student debt record broken next year (and, perhaps, for several years after that), it may help that Congress lowered interest rates on new student loans to 3.86% last year.

But, as we’ve discussed, student loan reform can only do so much.

According to Anya Kamenetz in a report for Third Way, the cost of college tuition has increased faster than the consumer price index in every single year since 1978.

Costs at private not-for-profit colleges have tripled over the last 40 years, with the average jumping to $30,094 last year. Source: Quartz

In fact, colleges have increased their prices more than any other sector of the economy except health care, which is another sector that highly subsidized by the government.

Unless colleges lower their costs, we won’t even begin to solve the student debt problem.

Even law schools have begun to lower tuition, and it’s time that colleges start to do the same.

If they don’t, they risk pricing lower-income students out of the market, as well as saddling borrowers with loans that follow them for decades, prevent them from starting a family, buying a house or pursuing other milestones that have a positive impact on the economy.

college debt, repayment, student debt, student loan repayment, student loans